Your Working capital cycle formulas images are available in this site. Working capital cycle formulas are a topic that is being searched for and liked by netizens today. You can Get the Working capital cycle formulas files here. Find and Download all royalty-free vectors.

If you’re searching for working capital cycle formulas pictures information linked to the working capital cycle formulas keyword, you have come to the ideal site. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

Working Capital Cycle Formulas. A company having a working capital ratio of less than 1 may not be good as it indicates poor cash flow of the company. I raw materials days. Accounts Receivable Inventory Accounts Payable Other. To calculate the working capital or liquid funds of business below mentioned formula can be used Working Capital Formula Current Assets Net of Depreciation Current Liabilities Explanation The following steps should be applied to calculate the working capital of.

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work From pinterest.com

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work From pinterest.com

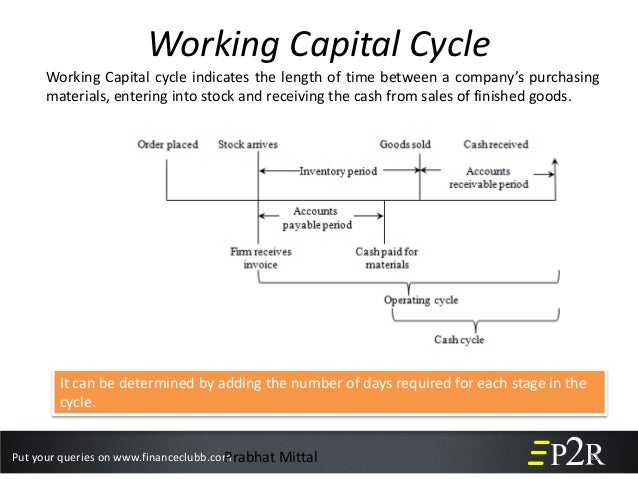

Using the example above the working capital cycle for the manufacturer is 26 days. Working Capital Formula Working Capital formula is defined under. This is calculated by dividing Current Assets by Current Liabilities. 56 Inventory Days 30 Receivable Days 60 Payable Days 26 days working capital cycle. This number is how many days the business is out of pocket before receiving full payment and is whats known as a positive cycle. The continuing flow from cash to suppliers to inventory to accounts receivable and back into cash is called the working capital cycle or operating cycle.

Let us see how to calculate working capital cycle of a company from the above-mentioned formula.

80 inventory days 21 receivable days 90 payable days a working capital cycle totalling 11 days So what does this mean. Most often this ratio is calculated at year-end when annual reports are available. Working Capital Cycle formula For most businesses the Working Capital Cycle formula is as follows. In the manufacturing sector inventory days has three components. Inventory Days Receivable Days - Payable Days Working Capital Cycle in Days You can read more in our article about how to work out your working capital cycle. Lets put them into the formula.

Source: pinterest.com

Source: pinterest.com

A ratio above 1 means current assets exceed liabilities and generally the higher. A company having a working capital ratio of less than 1 may not be good as it indicates poor cash flow of the company. Or you can even say it as Working Capital Cycle Formula APP ACP PPP Or you can even calculate it as Working Capital Cycle Calculation. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. For example a manufacturing business will have more phases than a retailer.

Source: pinterest.com

Source: pinterest.com

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow. The continuing flow from cash to suppliers to inventory to accounts receivable and back into cash is called the working capital cycle or operating cycle. 56 Inventory Days 30 Receivable Days 60 Payable Days 26 days working capital cycle. Lets put them into the formula. Inventory Days Receivable Days - Payable Days Working Capital Cycle in Days You can read more in our article about how to work out your working capital cycle.

Source: pinterest.com

Source: pinterest.com

Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. I raw materials days. Working Capital Formula Working Capital formula is defined under. Inventory Days Receivable Days Payable Days. Lets put them into the formula.

Source: in.pinterest.com

Source: in.pinterest.com

If the value of ration is lower than 1 then it indicates the negative value of it. In other words the term operating cycle refers to the length of time which begins with the acquisition of raw materials of a firm and ends with the final realisation of cash from debtors. For example a manufacturing business will have more phases than a retailer. This number is how many days the business is out of pocket before receiving full payment and is whats known as a positive cycle. Inventory Days Receivable Days Payable Days.

Source: in.pinterest.com

Source: in.pinterest.com

Lets put them into the formula. I raw materials days. This is calculated by dividing Current Assets by Current Liabilities. Accounts Receivable Inventory Accounts Payable Other. The working capital cycle formula is.

Source: in.pinterest.com

Source: in.pinterest.com

Working Capital Cycle Formula Average Payable Period Average Collection Period Payables Payment Period. For example a manufacturing business will have more phases than a retailer. Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. The working capital cycle formula is. This number is how many days the business is out of pocket before receiving full payment and is whats known as a positive cycle.

Source: in.pinterest.com

Source: in.pinterest.com

Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. Inventory Days Receivable Days Payable Days. Using the example above the working capital cycle for the manufacturer is 26 days. Current assets Assets converted to cash value within a normal operating cycle Current liabilities. Working Capital Current Assets Current Liabilities where.

Source: cz.pinterest.com

Source: cz.pinterest.com

Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. Using the example above the working capital cycle for the manufacturer is 26 days. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. The formula for Working Capital is as follows. 56 Inventory Days 30 Receivable Days 60 Payable Days 26 days working capital cycle.

Source: pinterest.com

Source: pinterest.com

Working Capital Current Assets Current Liabilities. In case if the cycle is long the capital gets typically stuck without earning returns in the operational period. Inventory Days Receivable Days - Payable Days Working Capital Cycle in Days You can read more in our article about how to work out your working capital cycle. The higher the number of days the longer it takes for that company to convert to revenue. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue.

Source: in.pinterest.com

Source: in.pinterest.com

Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. In the manufacturing sector inventory days has three components. Working capital currently available assets current Liabilities The ratio is a sign of whether a firm has sufficient short-term assets to fulfil the short-term debt possessed on them. Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. To calculate the working capital or liquid funds of business below mentioned formula can be used Working Capital Formula Current Assets Net of Depreciation Current Liabilities Explanation The following steps should be applied to calculate the working capital of.

Source: in.pinterest.com

Source: in.pinterest.com

It shows how long cash is tied up in the companies working capital. For example a manufacturing business will have more phases than a retailer. Cash operating cycle Inventory days Receivables days Payables days. The working capital cycle formula is. If the value of ration is lower than 1 then it indicates the negative value of it.

Source: in.pinterest.com

Source: in.pinterest.com

What makes a liability current is that it is due within a year. A company having a working capital ratio of less than 1 may not be good as it indicates poor cash flow of the company. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow. A ratio above 1 means current assets exceed liabilities and generally the higher. It shows how long cash is tied up in the companies working capital.

Source: in.pinterest.com

Source: in.pinterest.com

80 inventory days 21 receivable days 90 payable days a working capital cycle totalling 11 days So what does this mean. In other words the term operating cycle refers to the length of time which begins with the acquisition of raw materials of a firm and ends with the final realisation of cash from debtors. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. The working capital cycle formula is. The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales.

Source: in.pinterest.com

Source: in.pinterest.com

The formula for Working Capital is as follows. The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales. As we mentioned before the working capital cycle formula tells you how many days it takes for your business to turn your working capital into cash. Inventory Days Receivable Days - Payable Days Working Capital Cycle in Days You can read more in our article about how to work out your working capital cycle. Working Capital Cycle Formula Average Payable Period Average Collection Period Payables Payment Period.

Source: pinterest.com

Source: pinterest.com

Using the example above the working capital cycle for the manufacturer is 26 days. Most often this ratio is calculated at year-end when annual reports are available. For example a manufacturing business will have more phases than a retailer. In case if the cycle is long the capital gets typically stuck without earning returns in the operational period. In the manufacturing sector inventory days has three components.

Source: pinterest.com

Source: pinterest.com

The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. A company having a working capital ratio of less than 1 may not be good as it indicates poor cash flow of the company. Cash short term investments short term debt Working capital requirements are an investment WC Requirement AR Inventory AP Other In order to reduce working capital requirements. 56 Inventory Days 30 Receivable Days 60 Payable Days 26 days working capital cycle. To calculate the working capital or liquid funds of business below mentioned formula can be used Working Capital Formula Current Assets Net of Depreciation Current Liabilities Explanation The following steps should be applied to calculate the working capital of.

Source: br.pinterest.com

Source: br.pinterest.com

The working capital cycle formula is. Let us see how to calculate working capital cycle of a company from the above-mentioned formula. Working capital currently available assets current Liabilities The ratio is a sign of whether a firm has sufficient short-term assets to fulfil the short-term debt possessed on them. Working Capital Current Assets Current Liabilities. Or you can even say it as Working Capital Cycle Formula APP ACP PPP Or you can even calculate it as Working Capital Cycle Calculation.

Source: pinterest.com

Source: pinterest.com

Let us see how to calculate working capital cycle of a company from the above-mentioned formula. Inventory Days Receivable Days - Payable Days Working Capital Cycle in Days The Working Capital Cycle formula may vary depending on different types of business. The working capital cycle formula is. Lets put them into the formula. If the value of ration is lower than 1 then it indicates the negative value of it.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title working capital cycle formulas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.