Your Work test age 67 legislation images are ready. Work test age 67 legislation are a topic that is being searched for and liked by netizens now. You can Download the Work test age 67 legislation files here. Download all free photos.

If you’re looking for work test age 67 legislation images information connected with to the work test age 67 legislation interest, you have visit the right blog. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Work Test Age 67 Legislation. From 1 July 2020 for those under the age of 67 years it is now possible to make personal contributions without needing to satisfy a work test. Prohibitions on age discrimination 4. They will mean that members aged 65 and 66 will no longer have to meet the work test. The work test must be met priorto the contribution being made to the superannuation fund.

Pdf Motivated To Be Socially Mindful Explaining Age Differences In The Effect Of Employees Contact Quality With Coworkers On Their Coworker Support From researchgate.net

Pdf Motivated To Be Socially Mindful Explaining Age Differences In The Effect Of Employees Contact Quality With Coworkers On Their Coworker Support From researchgate.net

Prohibitions on age discrimination 4. From 1 July 2020 the recent change in legislation has allowed making contributions to super easier for anyone aged 65 or 66 years of age as there now is no requirement to meet the work test. See below for further details. Your age if you are 67 years or older when you make the contribution 65 years or older in 201920 and earlier income years you may need to meet a work test or work test exemption. Age discrimination in other areas 8. But once an individual reaches 67 years of age the work test must be met prior to the contribution being made.

From 1 July 2020 for those under the age of 67 years it is now possible to make personal contributions without needing to satisfy a work test.

You need to be sure the following contributions can be accepted if your member is at or above the relevant age threshold for. Individuals age 65 and 66 will be able to make up to three years of non-concessional superannuation contributions under the bring forward rule. Yes this is because a person who has triggered the bring forward rule for non-concessional contributions in a financial year and has since reached age 65 is required to satisfy the work test in later financial years that they may want to contribute up to their brought forward non-concessional contributions cap. You need to be sure the following contributions can be accepted if your member is at or above the relevant age threshold for. Age 67-74 and have met the work test or age 67 74 and meet the requirements for the work test exemption. Other discrimination issues 9.

Source: ec.europa.eu

Source: ec.europa.eu

Yes this is because a person who has triggered the bring forward rule for non-concessional contributions in a financial year and has since reached age 65 is required to satisfy the work test in later financial years that they may want to contribute up to their brought forward non-concessional contributions cap. Age discrimination in work 5. Your age if you are 67 years or older when you make the contribution 65 years or older in 201920 and earlier income years you may need to meet a work test or work test exemption. Once you reached age 67 you were still required to meet the work test or use the one-off work test exemption. The work test exemption provides a one-year relief from the work test for recent retirees.

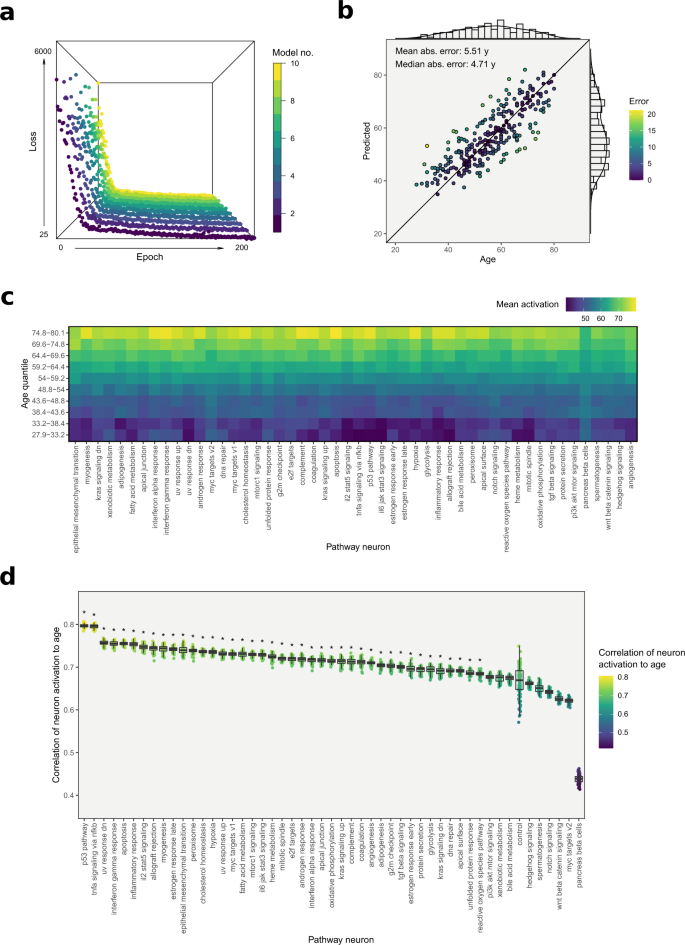

Source: nature.com

Source: nature.com

Currently only individuals under age 65 can contribute without needing to meet the work test. Recently the Federal Budget 2021 contained a proposal to remove the work test requirement for those. From 1 July 2022 people aged 67 to 74 will no longer be required to meet the work test when making or receiving non-concessional or. The Regulations implement the first two elements of the announced budget measure increasing the age at which the work test starts to apply from 65 years to 67 years and the age limit for spouse contributions from 69 years to 74 years. See below for further details.

Source: ec.europa.eu

Source: ec.europa.eu

Yes this is because a person who has triggered the bring forward rule for non-concessional contributions in a financial year and has since reached age 65 is required to satisfy the work test in later financial years that they may want to contribute up to their brought forward non-concessional contributions cap. For example a government co-contribution can always be accepted because they. The new laws if passed are to take effect from 1 July 2020. The work test requires that you have worked at least 40 hours over a consecutive 30 day period in the financial year the contribution is made. They will mean that members aged 65 and 66 will no longer have to meet the work test.

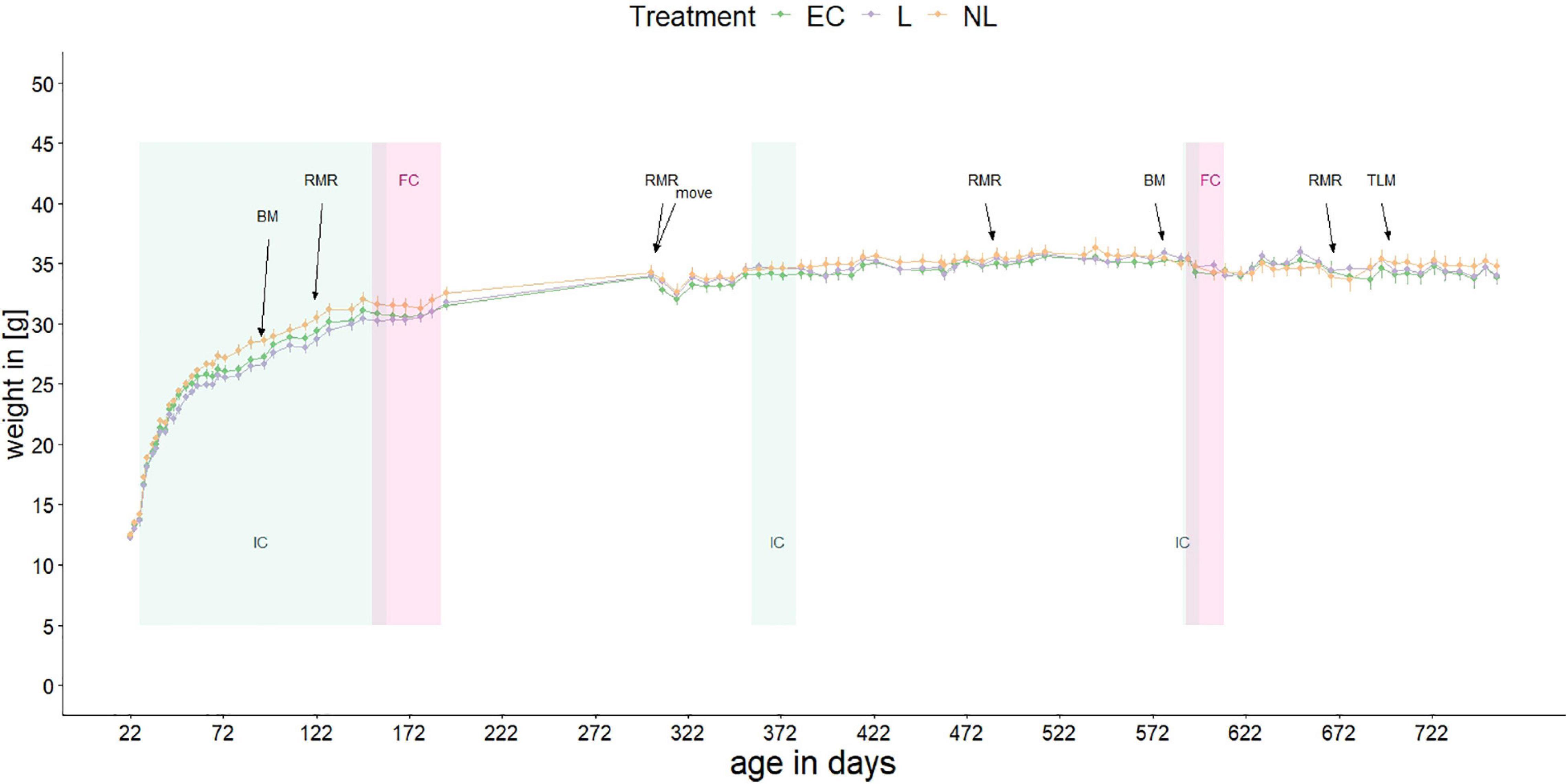

Source: frontiersin.org

Source: frontiersin.org

Age discrimination in relation to goods services and facilities 6. For example a government co-contribution can always be accepted because they. In July 2020 the start age for the work test increased from 65 to 67. On Friday 2952020 the The Superannuation Legislation Amendment 2020 Measures No 1 Regulations 2020 was registered amending the SIS Regulations to allow people aged 65 and 66 ie under age 67 to make voluntary superannuation contributions both concessional and non-concessional without meeting the work test. In the financial year a person reaches the age of 67 personal contributions can be made prior to reaching 67 years old.

Source: link.springer.com

Source: link.springer.com

The work test exemption provides a one-year relief from the work test for recent retirees. Your age if you are 67 years or older when you make the contribution 65 years or older in 201920 and earlier income years you may need to meet a work test or work test exemption. Learn about eligibility and requirements. Still need more information. The new age limit meant that from 1 July 2020 if you were aged under 67 you could make personal or non-concessional contributions into your super account without needing to meet a work test requirement.

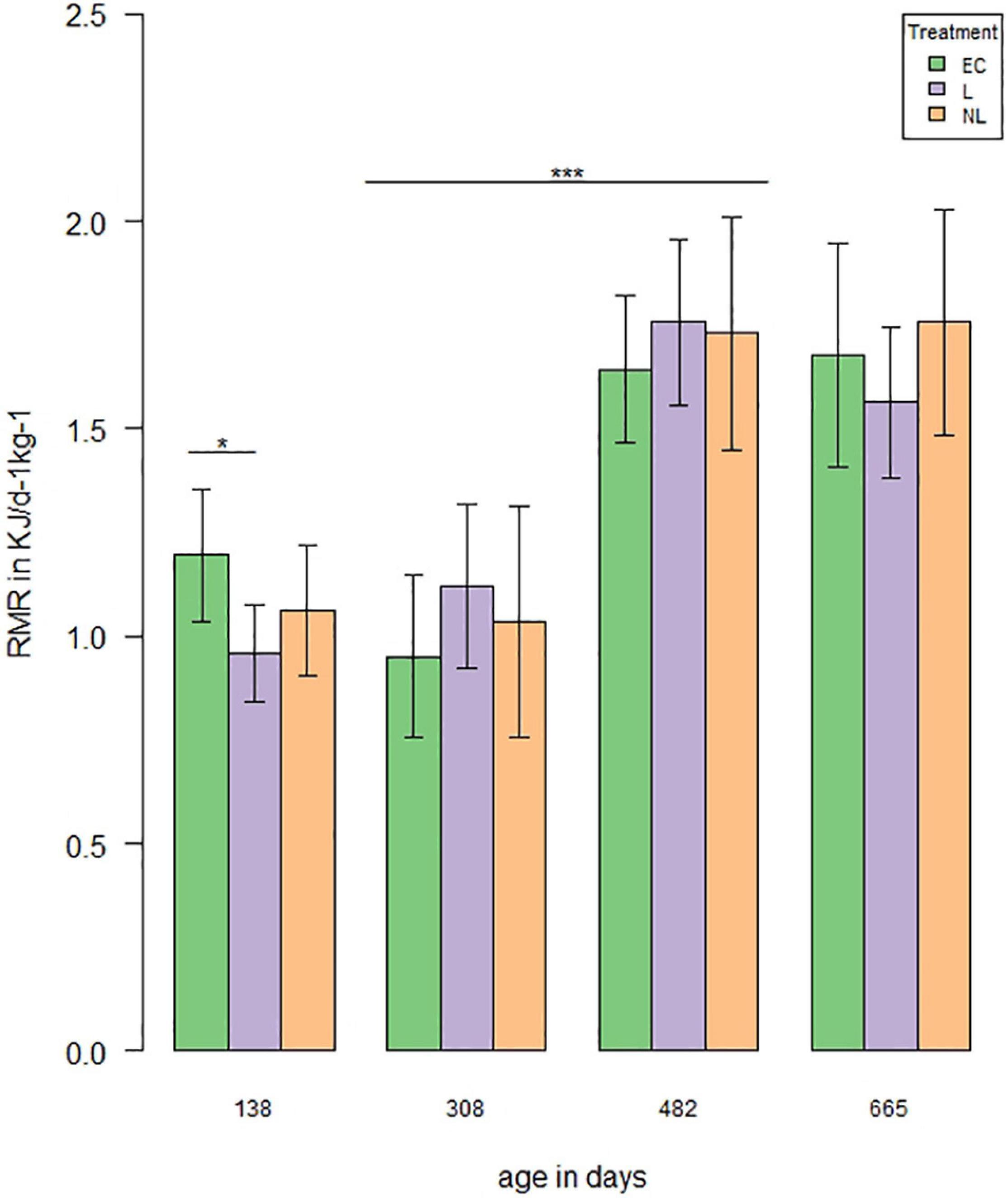

Source: frontiersin.org

Source: frontiersin.org

The work test exemption can only be applied once. It is available if. The age at which the work test starts to apply for voluntary concessional and non-concessional contributions is to be increased from 65 to 67. Work test exemption for recent retirees aged 67 to 74 01 Jul 2021 Technical resource Individuals aged between 67 and 74 who have recently retired may be eligible to make additional voluntary contributions to their super. The new laws if passed are to take effect from 1 July 2020.

Source: frontiersin.org

Source: frontiersin.org

Currently only individuals under age 65 can contribute without needing to meet the work test. Read more about the work test and work. The cut-off age for spouse contributions is to be increased from 70 to 75. Recently the Federal Budget 2021 contained a proposal to remove the work test requirement for those. Still need more information.

Source: link.springer.com

Source: link.springer.com

However a work test must be met at any time during the financial year prior to the contribution. From 1 July 2020 the recent change in legislation has allowed making contributions to super easier for anyone aged 65 or 66 years of age as there now is no requirement to meet the work test. Recently the Federal Budget 2021 contained a proposal to remove the work test requirement for those. Prohibitions on age discrimination 4. See below for further details.

The new laws if passed are to take effect from 1 July 2020. The work test for voluntary concessional and non-concessional contributions will be pushed out to 67 and the age limit for spouse contributions lifted to 74 from 1 July 2020 after enabling regulations were registered late last week. On 1 July 2020 the federal government introduced a one-year exemption from the work test for those aged over 67 with a super balance of under 300000. However a work test must be met at any time during the financial year prior to the contribution. The new laws if passed are to take effect from 1 July 2020.

Source: thelancet.com

Source: thelancet.com

From 1 July 2020 older super members will be able to make contributions into their super account without having to meet the requirements of the work test. From 1 July 2020 for those under the age of 67 years it is now possible to make personal contributions without needing to satisfy a work test. Under the former rules once you reached 67 years but not 75 years you needed to have worked at least 40 hours within 30 consecutive days in a financial year before your super fund could accept after. Still need more information. Learn about eligibility and requirements.

Source: ec.europa.eu

Source: ec.europa.eu

For example a government co-contribution can always be accepted because they. The Regulations implement the first two elements of the announced budget measure increasing the age at which the work test starts to apply from 65 years to 67 years and the age limit for spouse contributions from 69 years to 74 years. Age 67-74 and have met the work test or age 67 74 and meet the requirements for the work test exemption. This is an increase to the previous requirement of needing to be under age 65 and designed to progressively align the work test with the eligibility age for the age pension currently legislated to increase from age 66 to age 67 for both men and women by 1 July 2023. What is the work test.

Source: nature.com

Source: nature.com

If the new regulations pass from 1 July 2020 people age 65 and 66 would be able to make contributions without. In July 2020 the start age for the work test increased from 65 to 67. Your age if you are 67 years or older when you make the contribution 65 years or older in 201920 and earlier income years you may need to meet a work test or work test exemption. Removal of work test to age 67. Still need more information.

Source: ec.europa.eu

Source: ec.europa.eu

The work test exemption provides a one-year relief from the work test for recent retirees. In the financial year a person reaches the age of 67 personal contributions can be made prior to reaching 67 years old. Read more about the work test and work. Still need more information. This is an increase to the previous requirement of needing to be under age 65 and designed to progressively align the work test with the eligibility age for the age pension currently legislated to increase from age 66 to age 67 for both men and women by 1 July 2023.

Source: ec.europa.eu

Source: ec.europa.eu

However a work test must be met at any time during the financial year prior to the contribution. From 1 July 2020 older super members will be able to make contributions into their super account without having to meet the requirements of the work test. In July 2020 the start age for the work test increased from 65 to 67. The work test requires that you have worked at least 40 hours over a consecutive 30 day period in the financial year the contribution is made. The age at which the work test starts to apply for voluntary concessional and non-concessional contributions is to be increased from 65 to 67.

Source: researchgate.net

Source: researchgate.net

Prohibitions on age discrimination 4. Age discrimination in work 5. This is known as the work test. The work test exemption allows people aged 67 to 74 with a total super balance below 300000 on 30 June of the previous financial year to make voluntary super contributions for a period of 12 months from the end of the financial year in which they last met the work test. Age discrimination in other areas 8.

Source: ec.europa.eu

Source: ec.europa.eu

In the financial year a person reaches the age of 67 personal contributions can be made prior to reaching 67 years old. Age discrimination in other areas 8. You need to be sure the following contributions can be accepted if your member is at or above the relevant age threshold for. The work test must be met priorto the contribution being made to the superannuation fund. A member is age 67 or more at the time of contribution and is also gainfully employed for at least 40 hours in no more than 30 consecutive days in the financial year.

Source: mdpi.com

Source: mdpi.com

Individuals age 65 and 66 will be able to make up to three years of non-concessional superannuation contributions under the bring forward rule. For example a government co-contribution can always be accepted because they. On 1 July 2020 the federal government introduced a one-year exemption from the work test for those aged over 67 with a super balance of under 300000. Work test exemption for recent retirees aged 67 to 74 01 Jul 2021 Technical resource Individuals aged between 67 and 74 who have recently retired may be eligible to make additional voluntary contributions to their super. The work test requires that an individual is gainfully employed for at least 40 hours in 30 consecutive days in the financial year in which the contribution is made.

Source: researchgate.net

Source: researchgate.net

Age discrimination in relation to goods services and facilities 6. Removal of work test to age 67. In the financial year a person reaches the age of 67 personal contributions can be made prior to reaching 67 years old. Individuals age 65 and 66 will be able to make up to three years of non-concessional superannuation contributions under the bring forward rule. Learn about eligibility and requirements.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title work test age 67 legislation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.