Your Work related car expense images are available in this site. Work related car expense are a topic that is being searched for and liked by netizens today. You can Download the Work related car expense files here. Download all free photos.

If you’re searching for work related car expense pictures information related to the work related car expense topic, you have visit the ideal blog. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

Work Related Car Expense. This is for tax years after December 2017. In principle travel directly between home and place of work and the return trip are considered to be not deductible but there are exceptions Travel between home and work. You need to work out if you are able to claim a deduction for work-related car expenses before using the calculator. Work-related car expenses These are expenses incurred whilst performing your work duties for a car you either owned leased or hired under a hire-purchase agreement.

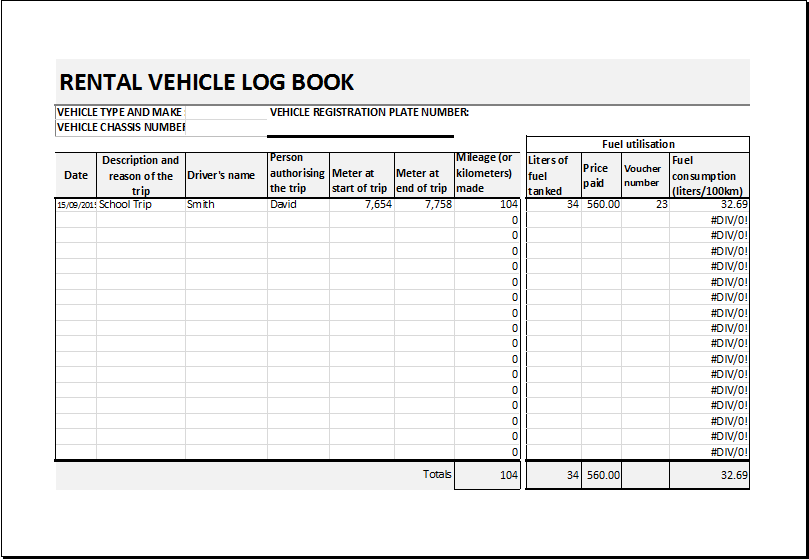

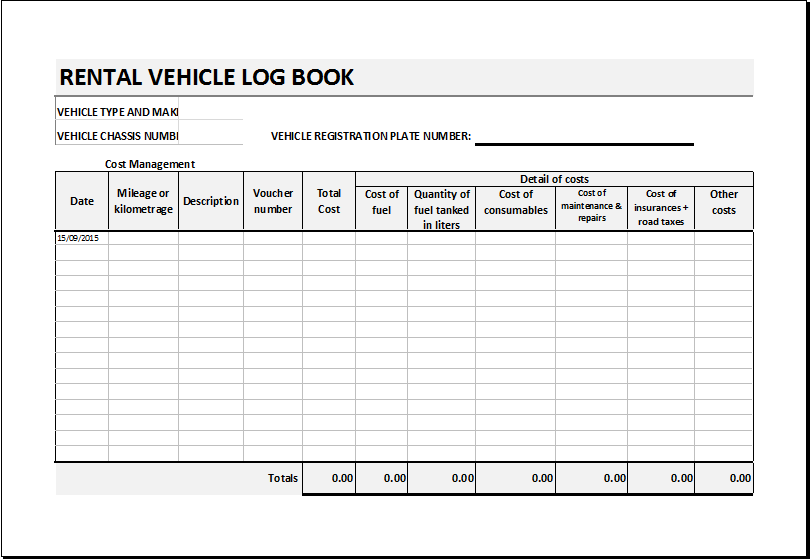

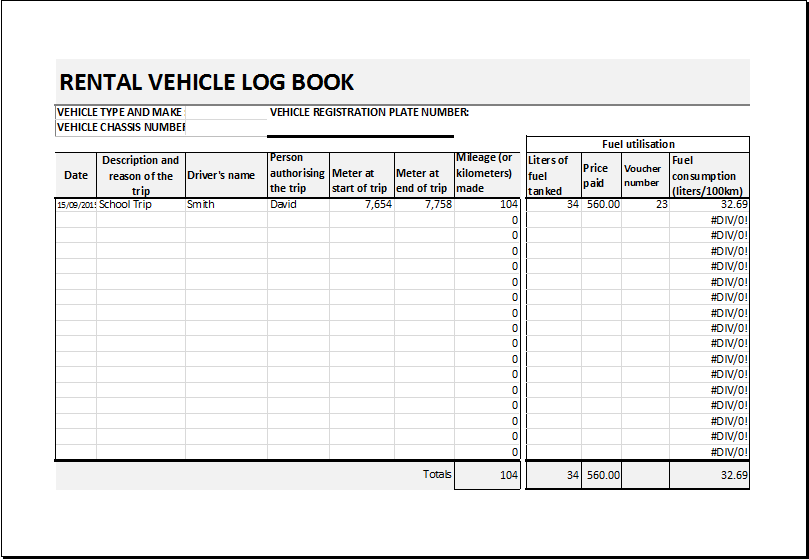

Rental Vehicle Log Book Template For Excel Excel Templates From xltemplates.org

Rental Vehicle Log Book Template For Excel Excel Templates From xltemplates.org

Attend work-related conferences or meetings away from your regular place of. You can claim car expenses from the ATO only if you use your own vehicle to perform your work-related duties. For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses. You cannot claim at this item any expenses relating to motorcycles and vehicles with a carrying capacity of one tonne or more or nine or more passengers such as utility trucks and panel vans. Revise your tax claiming practices. You can use your actual expenses which include parking fees and tolls vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine maintenance and depreciation.

You need to work out if you are able to claim a deduction for work-related car expenses before using the calculator.

The 12 per cent of the original value method. You can claim work-related expenses you incurred as an employee for a car you. The ATO recommends two ways of calculating your work related car expense deductions. ATO has enhanced technology that will make this more efficient than ever to do. In principle travel directly between home and place of work and the return trip are considered to be not deductible but there are exceptions Travel between home and work. And remember work related refers to the can list above.

Source: pinterest.com

Source: pinterest.com

Still not every work-related drive will qualify. Cents per kilometer method A change has been made to this method. Attending meetings or conferences Collecting supplies or delivering items. If you use someone elses car for workrelated purposes you can only claim a deduction for actual expenses such as fuel in the work-related travel expense section of your tax return. Work-related travel expenses is an umbrella term used to identify any expenditure that incurs due to transport travel purchases or accommodation because of your job requirements.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Currently the following four methods are available to individual taxpayers for calculating their work-related car expense deductions. You can claim work-related expenses you incurred as an employee for a car you. ATO has increased the scrutiny of work related car expenses in 2018. To separate the wheat from the chaff and make sure youre super-clear on what you can claim heres a. To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity.

Source: pinterest.com

Source: pinterest.com

Claiming Work-Related Car Expenses If you use your own car in performing your work-related duties including a car you lease or hire under a hire-purchase agreement you may be able to claim a deduction for car expenses using either. The ATO recommends two ways of calculating your work related car expense deductions. Cents per kilometer method A change has been made to this method. Still not every work-related drive will qualify. You need to work out if you are able to claim a deduction for work-related car expenses before using the calculator.

Source: smallbusiness.chron.com

Source: smallbusiness.chron.com

Trips between two separate workplaces such as two franchise locations for a fast food restaurant chain owner. Work Related Car Deductions. Attend work-related conferences or meetings away from your regular place of. The 12 per cent of the original value method. For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses.

Source: hu.pinterest.com

Source: hu.pinterest.com

Perform your work duties for example if you travel from your regular place of work to meet with a client. Work-related car expenses Work-related car expenses are expenses that you incurred whilst performing your work duties for a car you either owned leased or hired under a hire-purchase agreement. 4 Methods of claiming work-related car expenses are as below. To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity. You can claim at this item your work-related expenses for using a car that you owned leased or hired under a hire-purchase agreement.

Source: sk.pinterest.com

Source: sk.pinterest.com

To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity. Currently the following four methods are available to individual taxpayers for calculating their work-related car expense deductions. A work-related car expense claim is a tax deduction in relation to a car which is used for business or income producing purposes. Cents per KM method. Find out more about how to do it and what expenses you can and cant claim.

Source: dolmanbateman.com.au

Source: dolmanbateman.com.au

If you use someone elses car for workrelated purposes you can only claim a deduction for actual expenses such as fuel in the work-related travel expense section of your tax return. You have two options for deducting car and truck expenses. The ATO recommends two ways of calculating your work related car expense deductions. Revise your tax claiming practices. Work-related car expenses These are expenses incurred whilst performing your work duties for a car you either owned leased or hired under a hire-purchase agreement.

Source: blog.taxact.com

Source: blog.taxact.com

Examples of work-related car expenses where you may be able to claim a deduction can include. To separate the wheat from the chaff and make sure youre super-clear on what you can claim heres a. As of 2016 financial year only 2 methods can be used for claiming work related car expenses. You can claim work-related expenses you incurred as an employee for a car you. To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity.

Source: investopedia.com

Source: investopedia.com

To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity. Examples of work-related car expenses where you may be able to claim a deduction can include. Find out more about how to do it and what expenses you can and cant claim. Work-related car expenses These are expenses incurred whilst performing your work duties for a car you either owned leased or hired under a hire-purchase agreement. Cars owned or leased by someone else may include a spouse family member or.

Source: financialsamurai.com

Source: financialsamurai.com

Claiming Work-Related Car Expenses If you use your own car in performing your work-related duties including a car you lease or hire under a hire-purchase agreement you may be able to claim a deduction for car expenses using either. Revise your tax claiming practices. Employees cant deduct this cost even if their employer doesnt reimburse the employee for using their own car. As of January 1 2020 the standard mileage reimbursement for work-related driving is 575 cents per business mile driven. A work-related car expense claim is a tax deduction in relation to a car which is used for business or income producing purposes.

Source: move.org

Source: move.org

For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses. ATO has increased the scrutiny of work related car expenses in 2018. This is for tax years after December 2017. If you can show that your actual expenses are more than the standard mileage rate your employer will need to pay the difference. Use ALL the available technology at your disposal to accurately track your car related expenses.

Source: xltemplates.org

Source: xltemplates.org

You can use which ever method has the greater benefit or whichever one is easiest. Cents per KM method. You have two options for deducting car and truck expenses. Calculating work related car expenses. You need to work out if you are able to claim a deduction for work-related car expenses before using the calculator.

Source: smallbusiness.chron.com

Source: smallbusiness.chron.com

A work-related car expense claim is a tax deduction in relation to a car which is used for business or income producing purposes. Trips between two separate workplaces such as two franchise locations for a fast food restaurant chain owner. To keep up with these changes you need to do two things. Attending meetings or conferences. You can claim at this item your work-related expenses for using a car that you owned leased or hired under a hire-purchase agreement.

Source: financialsamurai.com

Source: financialsamurai.com

Attend work-related conferences or meetings away from your regular place of. You can use your actual expenses which include parking fees and tolls vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine maintenance and depreciation. To keep up with these changes you need to do two things. To put it simply a work related car expense is any expense that you incurred while using your car for an income earning activity. Work-related car expenses These are expenses incurred whilst performing your work duties for a car you either owned leased or hired under a hire-purchase agreement.

Source: investopedia.com

Source: investopedia.com

As of 2016 financial year only 2 methods can be used for claiming work related car expenses. Trips between two separate workplaces such as two franchise locations for a fast food restaurant chain owner. To keep up with these changes you need to do two things. ATO has enhanced technology that will make this more efficient than ever to do. You can claim at this item your work-related expenses for using a car that you owned leased or hired under a hire-purchase agreement.

Source: xltemplates.org

Source: xltemplates.org

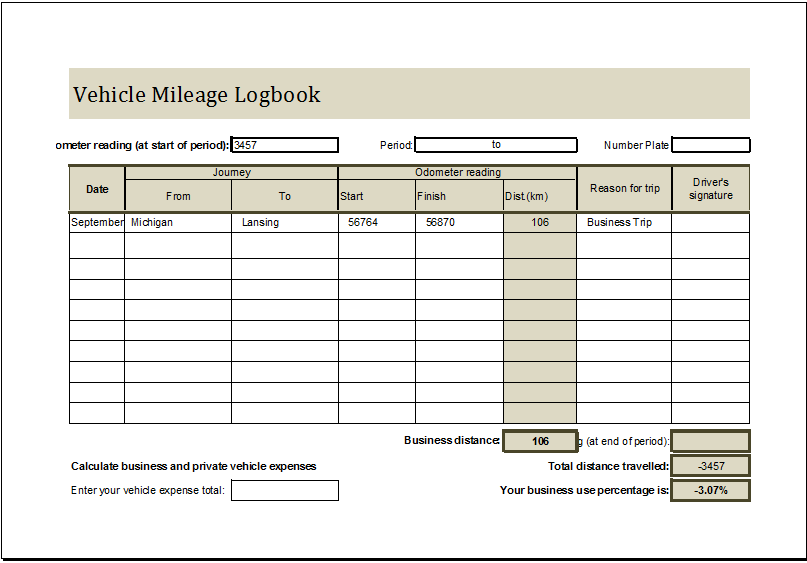

These two methods are the cents per kilometre method and the logbook method. You can use which ever method has the greater benefit or whichever one is easiest. Using a logbook as explained above to calculate the percentage of the vehicles kms that are work-related. In principle travel directly between home and place of work and the return trip are considered to be not deductible but there are exceptions Travel between home and work. Employees cant deduct this cost even if their employer doesnt reimburse the employee for using their own car.

Source: xltemplates.org

Source: xltemplates.org

You can claim car expenses from the ATO only if you use your own vehicle to perform your work-related duties. You cannot claim at this item any expenses relating to motorcycles and vehicles with a carrying capacity of one tonne or more or nine or more passengers such as utility trucks and panel vans. You have two options to calculate the work-related portion under this method. Employees who use their car for work can no longer take an employee business expense deduction as part of their miscellaneous itemized deductions reported on Schedule A. Using a logbook as explained above to calculate the percentage of the vehicles kms that are work-related.

Source: hrblock.com

Source: hrblock.com

Claiming work-related car expenses on your tax return. For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses. 4 Methods of claiming work-related car expenses are as below. You can claim car expenses from the ATO only if you use your own vehicle to perform your work-related duties. What car expenses can you claim.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title work related car expense by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.