Your Work opportunity tax credit questionnaire images are ready. Work opportunity tax credit questionnaire are a topic that is being searched for and liked by netizens today. You can Get the Work opportunity tax credit questionnaire files here. Find and Download all royalty-free images.

If you’re searching for work opportunity tax credit questionnaire images information connected with to the work opportunity tax credit questionnaire keyword, you have come to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. Employers may meet their business needs and claim a tax credit if they. This questionnaire will assist KS Staffing. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file.

R D Tax Credit Carryforward Adp From adp.com

R D Tax Credit Carryforward Adp From adp.com

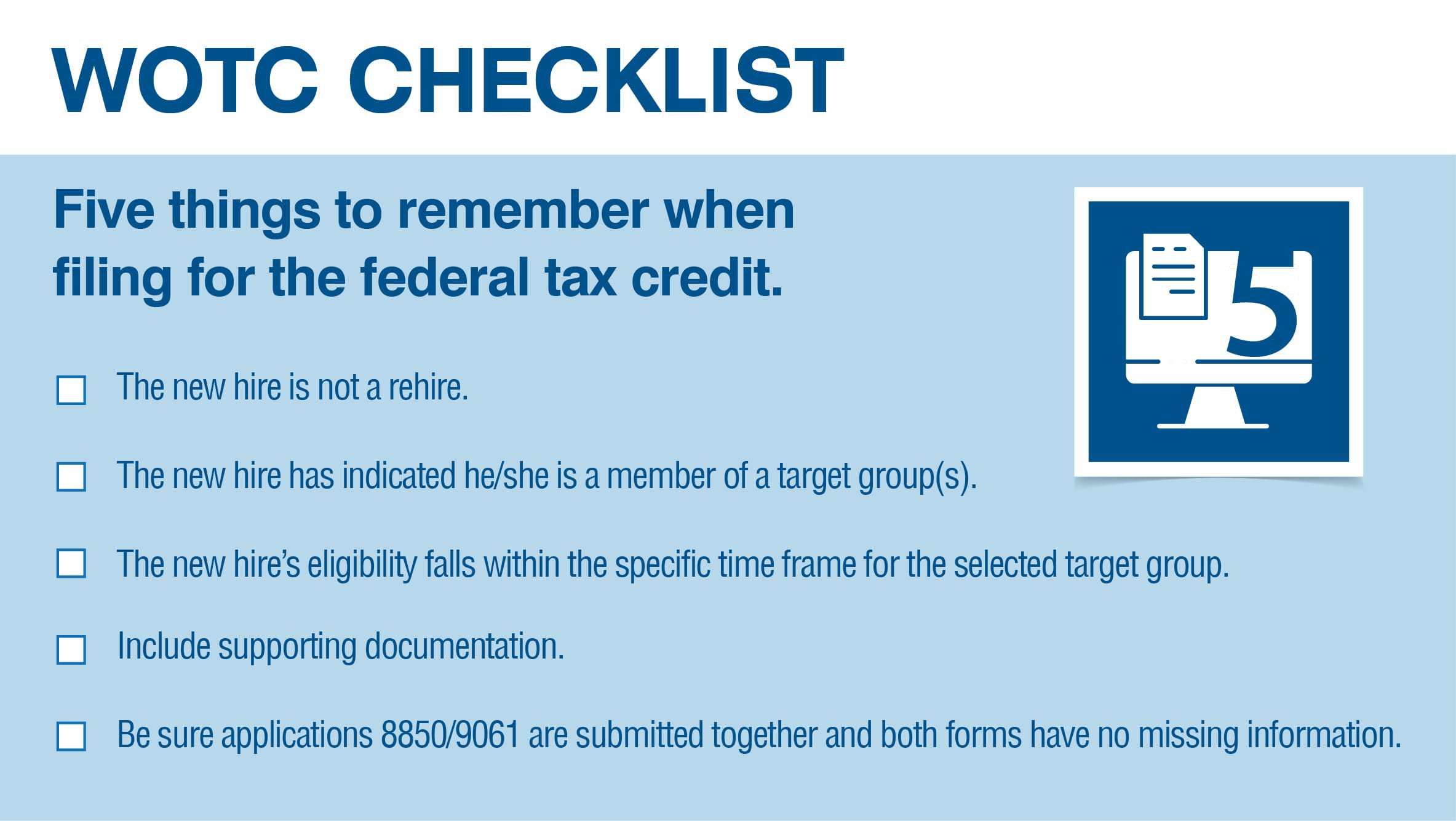

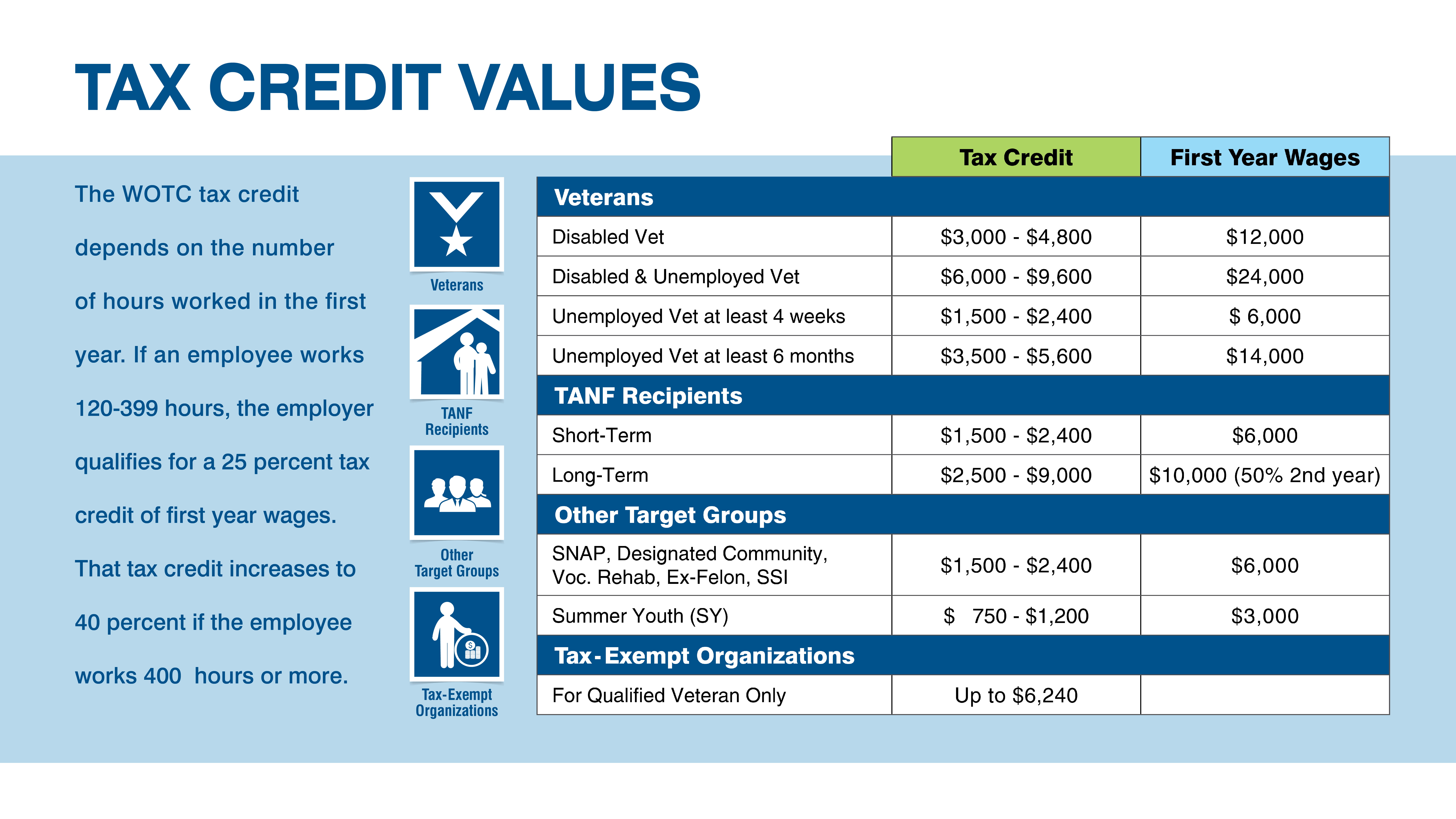

WOTC Screening Our WOTC tax credit screening can add bottom. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. WOTC Work Opportunity Tax Credit Questionnaire K S Staffing Solutions Inc. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American. The Work Opportunity Tax Credit WOTC can help you get a job. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

WORK OPPORTUNITY TAX CREDIT QUESTIONNAIRE.

Questions and answers about the Work Opportunity Tax Credit program. Below you will find the steps to complete the WOTC both ways. A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. How the Tax Credit Surveys are Used. There are two sets of frequently asked questions for WOTC customers.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. 1 level 1 Hollowpoint38 3y. Below you will find the steps to complete the WOTC both ways. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

Source: michigan.gov

Source: michigan.gov

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Work Opportunity Tax Credit. Employers may meet their business needs and claim a tax credit if they. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

This questionnaire will assist KS Staffing. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. WOTC Target Groups include. Is participating in the WOTC program offered by the government. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

Source: adp.com

Source: adp.com

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. There are two sets of frequently asked questions for WOTC customers. This tax credit may give the employer the incentive to hire you for the job. The employee must meet requirements based on the hours they work and whether they are members of a qualifying category of worker. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment.

Source: smallbusiness.chron.com

Source: smallbusiness.chron.com

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility. Employers may meet their business needs and claim a tax credit if they. HireIQ MyCredit E-Sig Screening Solutions. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

Source: smallbusiness.chron.com

Source: smallbusiness.chron.com

The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. Questions and answers about the Work Opportunity Tax Credit program. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. It is legal and you can google it.

The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers for hiring individuals from specific target groups who have consistently faced significant barriers to employment. Is participating in the WOTC program offered by the government. WOTC Screening Our WOTC tax credit screening can add bottom. 2 level 1 rednail64 3y rAskHR 1 level 1 bonbonbeach 3y Are you really asking if a government form is legal.

Source: cmswotc.com

Source: cmswotc.com

Companies are eligible for tax credit as part of this program and hence it works as an incentive for companies to follow the program. Questions and answers about the Work Opportunity Tax Credit program. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. WOTC helps targeted employees move. Companies are eligible for tax credit as part of this program and hence it works as an incentive for companies to follow the program.

Source: michigan.gov

Source: michigan.gov

The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow. 1 level 1 Hollowpoint38 3y. There are two sets of frequently asked questions for WOTC customers. Employers may meet their business needs and claim a tax credit if they. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees.

Source: thebalancesmb.com

Source: thebalancesmb.com

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. This government program offers participating companies between 2400 9600 per new qualifying hire. The employee must meet requirements based on the hours they work and whether they are members of a qualifying category of worker. What is the Work Opportunity Tax Credit Questionnaire. Completing Your WOTC Questionnaire Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Source: avionteboldsupport.zendesk.com

Source: avionteboldsupport.zendesk.com

Below you will find the steps to complete the WOTC both ways. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file. Questions and answers about the Work Opportunity Tax Credit program. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service.

Source: wotcplanet.com

Source: wotcplanet.com

The data is only used if you are hired. WOTC helps targeted employees move. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees.

Source: cdle.colorado.gov

Source: cdle.colorado.gov

It is legal and you can google it. The data is only used if you are hired. WORK OPPORTUNITY TAX CREDIT QUESTIONNAIRE. This questionnaire will assist KS Staffing. Below you will find the steps to complete the WOTC both ways.

Source: workforce.equifax.com

Source: workforce.equifax.com

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. Is participating in the WOTC program offered by the government. 2 level 1 rednail64 3y rAskHR 1 level 1 bonbonbeach 3y Are you really asking if a government form is legal. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Source: workforce.equifax.com

Source: workforce.equifax.com

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Work Opportunity Tax Credit. What is the Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Source: michigan.gov

Source: michigan.gov

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. The data is only used if you are hired. WOTC screening is the process employers use to determine if a potential hire qualifies to be included in the calculations for the employers tax credit. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American.

Source: formswift.com

Source: formswift.com

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. These are the target groups of job seekers who can qualify an employer for the WOTC. This government program offers participating companies between 2400 9600 per new qualifying hire. Is participating in the WOTC program offered by the government. This tax credit may give the employer the incentive to hire you for the job.

Source: workforce.equifax.com

Source: workforce.equifax.com

WOTC screening is the process employers use to determine if a potential hire qualifies to be included in the calculations for the employers tax credit. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American. WOTC helps targeted employees move. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title work opportunity tax credit questionnaire by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.