Your Why taxing the rich doesn t work images are available. Why taxing the rich doesn t work are a topic that is being searched for and liked by netizens today. You can Find and Download the Why taxing the rich doesn t work files here. Download all royalty-free images.

If you’re searching for why taxing the rich doesn t work images information connected with to the why taxing the rich doesn t work interest, you have pay a visit to the right site. Our site always gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Why Taxing The Rich Doesn T Work. The problem for politicians at that point will be that taxing the wealthy wont do very much to combat inflation. It is an insufficient way to redistribute wealth as the state cannot be trusted to adequately disperse these funds into the communities that need them. Taxing the rich is much easier said than done. A quick history lesson can teach us that.

Be More Productive And Creative With The 90 20 Rule The 90 20 Rule Is Quite Simple Spend 90 Minutes Focused On A Sp Flow State Brain Function Something To Do From pinterest.com

Be More Productive And Creative With The 90 20 Rule The 90 20 Rule Is Quite Simple Spend 90 Minutes Focused On A Sp Flow State Brain Function Something To Do From pinterest.com

So often that many Americans start to believe them. Rich people and mega corporations dont pay taxes. Even if the full 40 trillion could be paid for in new taxes it would still significantly worsen the federal budget outlook. 1 The rich deserve what they earn because of hard work and initiative. It is an insufficient way to redistribute wealth as the state cannot be trusted to adequately disperse these funds into the communities that need them. London-based academics have analysed 50 years of growth income and employment data covering 18 countries.

The top 1 of all taxpayers those making over 500000 annually pay 40 of all income tax as it is today.

Theyre passed along to consumers in the form of higher prices says Giovanetti. We still have thousands of bridges to fix and our education system is not working optimally to put it mildly. Regardless of the estimate used taxing the rich and large corporations cannot even close CBOs projected 155 trillion budget deficits by 2029 which are based on current policy much less finance new spending. The real issue is how do we balance the budget. Rich people and mega corporations dont pay taxes. With more years of evidence now available the turn toward laissez-faire economics in the late 20th century including sharp declines in tax rates on the rich appears mostly to have helped the.

Source: nytimes.com

Source: nytimes.com

Answer 1 of 22. Theyre arguing two things–that redistribution from rich to poor through the tax system cant do all that much more to reduce inequality. Even if the full 40 trillion could be paid for in new taxes it would still significantly worsen the federal budget outlook. Well maybe on a global scale if you compare me to all the peasant farmers in Asia and Africa like any upper middle class American Id look pretty rich. A study claims that taxing the richest less doesnt strengthen economies and worsens inequality.

Source: nytimes.com

Source: nytimes.com

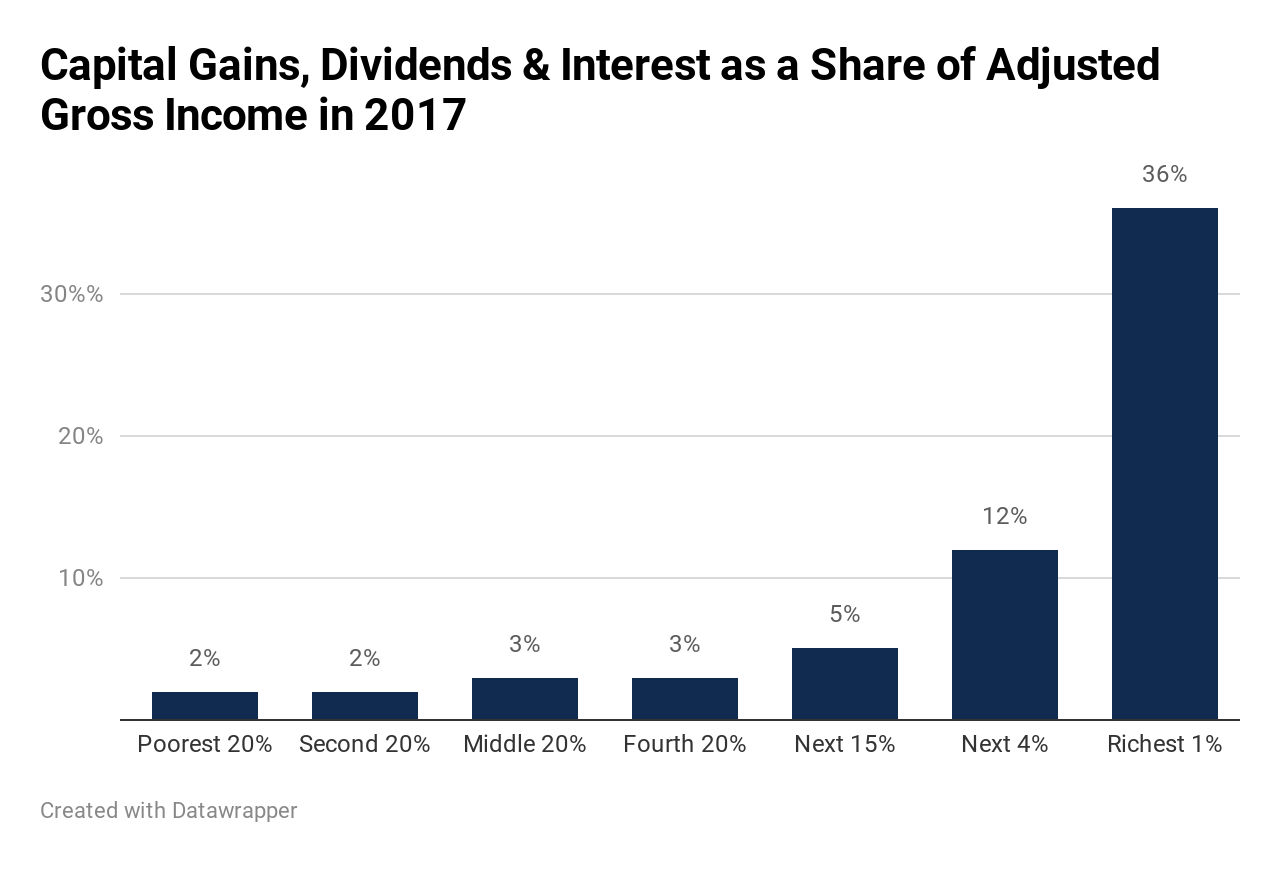

This may account for why taxing the rich is inexplicably for Progressives not popular with voters. The real issue is how do we balance the budget. 1 The rich deserve what they earn because of hard work and initiative. Instead the bulk of billionaires income stems from capital such as investments like stocks and bonds which enjoy a. With more years of evidence now available the turn toward laissez-faire economics in the late 20th century including sharp declines in tax rates on the rich appears mostly to have helped the.

Source: econofact.org

Source: econofact.org

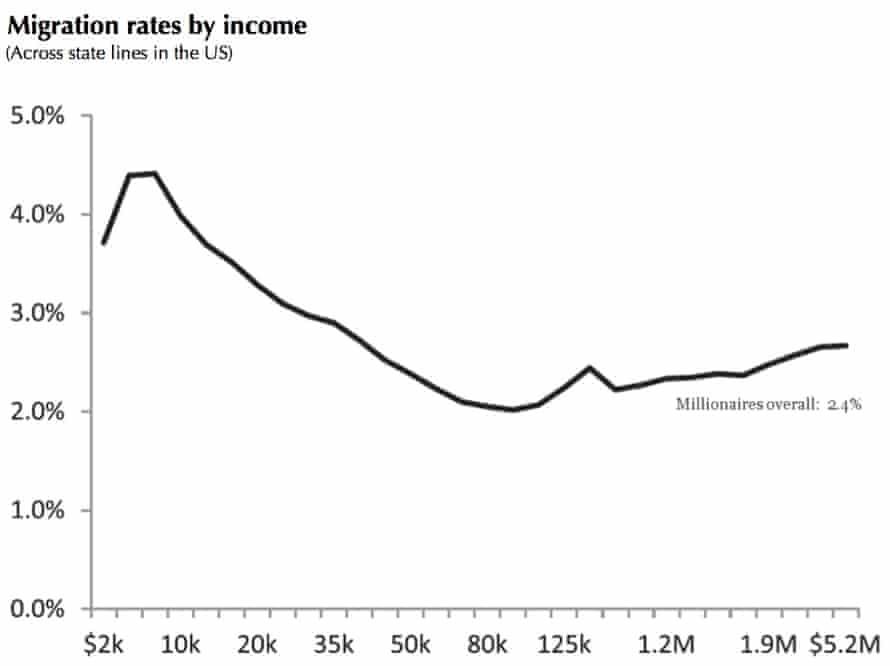

According to the report rich people respond to over-taxation in a variety of different ways and the outcomes not surprisingly have the effect of reducing revenues to governments. If we are looking for ways to close the wage gap we wont find it in additional taxes to the rich. London-based academics have analysed 50 years of growth income and employment data covering 18 countries. Ill break them down for you below. The real issue is how do we balance the budget.

Source: ro.pinterest.com

Source: ro.pinterest.com

But the facts and common sense reveal good reasons NOT to NOT tax the rich. Billionaires have seen their wealth. According to the report rich people respond to over-taxation in a variety of different ways and the outcomes not surprisingly have the effect of reducing revenues to governments. Theyre arguing two things–that redistribution from rich to poor through the tax system cant do all that much more to reduce inequality. We still have poverty.

Source: nsjonline.com

Source: nsjonline.com

Now 200000 is more than 18000 so doesnt taxing the rich at least leave the federal. Ill add that if inefficient changes in the tax code are re introduced Tax the Rich. The rich pay lower tax rates than the middle class because most of their income doesnt come from wages unlike most workers. Progressive candidates wasted no time in denouncing the recent round of tax cuts in their campaigns as a giveaway to the rich. Theres no union for taxpayers who fall in the top two brackets.

Source: pinterest.com

Source: pinterest.com

This is because the underlying budget deficit is. Let me say up front that I have an above-average income but I am not rich. They use other peoples money to create assets that dont exist and then bet on them to fail. Ill add that if inefficient changes in the tax code are re introduced Tax the Rich. If we are looking for ways to close the wage gap we wont find it in additional taxes to the rich.

Source: pinterest.com

Source: pinterest.com

The reason for this should be familiar to anyone who followed the debates about. Taxing the rich is much easier said than done. Billionaires have seen their wealth. Let me say up front that I have an above-average income but I am not rich. Regardless of the estimate used taxing the rich and large corporations cannot even close CBOs projected 155 trillion budget deficits by 2029 which are based on current policy much less finance new spending.

Source: theguardian.com

Source: theguardian.com

London-based academics have analysed 50 years of growth income and employment data covering 18 countries. So often that many Americans start to believe them. Progressive candidates wasted no time in denouncing the recent round of tax cuts in their campaigns as a giveaway to the rich. 1 The rich deserve what they earn because of hard work and initiative. It may also have to do with the fact that the wealthy arent organized.

Source: pinterest.com

Source: pinterest.com

Taxing the rich means more taxes being paid by people who earn money through ordinary income wages commissions tips salary etc. It is an insufficient way to redistribute wealth as the state cannot be trusted to adequately disperse these funds into the communities that need them. The real issue is how do we balance the budget. According to the report rich people respond to over-taxation in a variety of different ways and the outcomes not surprisingly have the effect of reducing revenues to governments. When youre buying a car.

Source: pinterest.com

Source: pinterest.com

Ill add that if inefficient changes in the tax code are re introduced Tax the Rich. This is because the underlying budget deficit is. A study claims that taxing the richest less doesnt strengthen economies and worsens inequality. Billionaires have seen their wealth. It is an insufficient way to redistribute wealth as the state cannot be trusted to adequately disperse these funds into the communities that need them.

Source: pinterest.com

Source: pinterest.com

The study comes as governments are considering raising taxes to repair the economic damage of COVID-19. 1 The rich deserve what they earn because of hard work and initiative. As Democrats take control of the US House taxing the rich inevitably becomes a focus. Let me say up front that I have an above-average income but I am not rich. Taxing the rich is much easier said than done.

Source: nytimes.com

Source: nytimes.com

The study comes as governments are considering raising taxes to repair the economic damage of COVID-19. This may account for why taxing the rich is inexplicably for Progressives not popular with voters. Even if the full 40 trillion could be paid for in new taxes it would still significantly worsen the federal budget outlook. The study comes as governments are considering raising taxes to repair the economic damage of COVID-19. With more years of evidence now available the turn toward laissez-faire economics in the late 20th century including sharp declines in tax rates on the rich appears mostly to have helped the.

Source: pinterest.com

Source: pinterest.com

The main reason to target the rich is to punish them for their success through class warfare. When youre buying a car. It may also have to do with the fact that the wealthy arent organized. Billionaires have seen their wealth. A quick history lesson can teach us that.

Source: itep.org

Source: itep.org

The reason for this should be familiar to anyone who followed the debates about. Now 200000 is more than 18000 so doesnt taxing the rich at least leave the federal. Ill add that if inefficient changes in the tax code are re introduced Tax the Rich. As Democrats take control of the US House taxing the rich inevitably becomes a focus. When youre buying a car.

Source: reddit.com

Source: reddit.com

It is an insufficient way to redistribute wealth as the state cannot be trusted to adequately disperse these funds into the communities that need them. Progressive candidates wasted no time in denouncing the recent round of tax cuts in their campaigns as a giveaway to the rich. But the facts and common sense reveal good reasons NOT to NOT tax the rich. Well maybe on a global scale if you compare me to all the peasant farmers in Asia and Africa like any upper middle class American Id look pretty rich. London-based academics have analysed 50 years of growth income and employment data covering 18 countries.

Source: pinterest.com

Source: pinterest.com

A study claims that taxing the richest less doesnt strengthen economies and worsens inequality. Theyre arguing two things–that redistribution from rich to poor through the tax system cant do all that much more to reduce inequality. Progressive candidates wasted no time in denouncing the recent round of tax cuts in their campaigns as a giveaway to the rich. A quick history lesson can teach us that. Theyre passed along to consumers in the form of higher prices says Giovanetti.

Source: pinterest.com

Source: pinterest.com

Some increased taxation on the wealthy effectively means that they help to cover some of the money the rest of the country would have paid in taxes. Although this rhetoric often polls well among some key demographics in practice taxation isnt so simple. The rich pay lower tax rates than the middle class because most of their income doesnt come from wages unlike most workers. If we are looking for ways to close the wage gap we wont find it in additional taxes to the rich. Let me say up front that I have an above-average income but I am not rich.

Source: pinterest.com

Source: pinterest.com

Some increased taxation on the wealthy effectively means that they help to cover some of the money the rest of the country would have paid in taxes. A study claims that taxing the richest less doesnt strengthen economies and worsens inequality. The study comes as governments are considering raising taxes to repair the economic damage of COVID-19. According to the report rich people respond to over-taxation in a variety of different ways and the outcomes not surprisingly have the effect of reducing revenues to governments. Now 200000 is more than 18000 so doesnt taxing the rich at least leave the federal.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title why taxing the rich doesn t work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.