Your No work performed certified payroll form images are available in this site. No work performed certified payroll form are a topic that is being searched for and liked by netizens now. You can Download the No work performed certified payroll form files here. Download all royalty-free images.

If you’re searching for no work performed certified payroll form pictures information linked to the no work performed certified payroll form keyword, you have visit the right blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

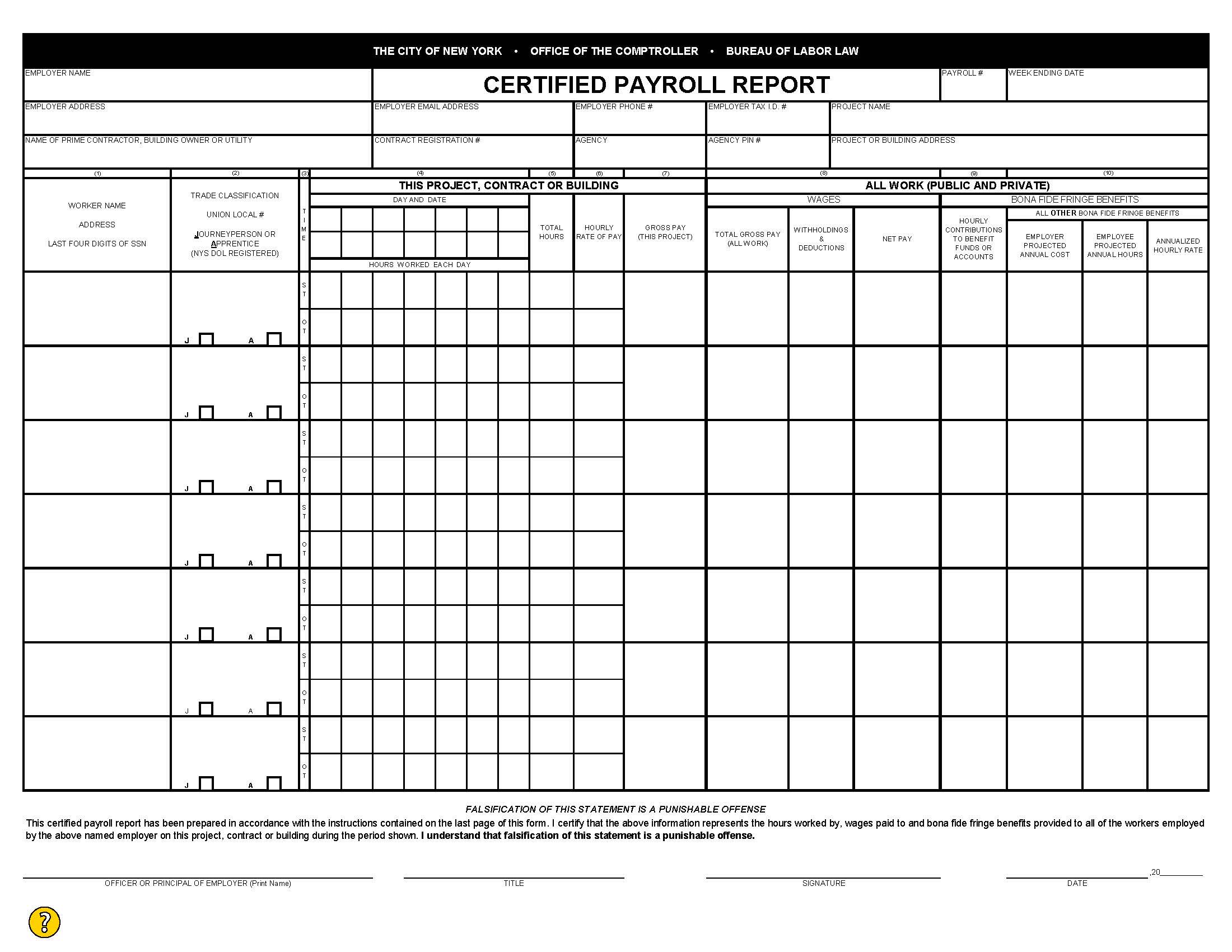

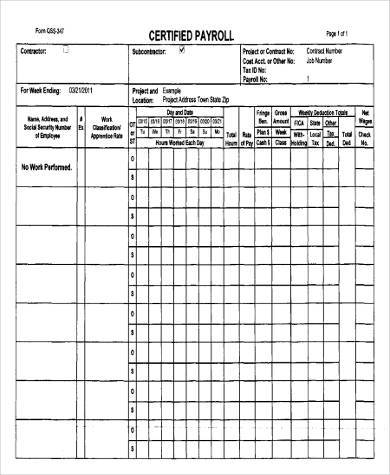

No Work Performed Certified Payroll Form. Employers annual federal unemployment futa tax return instructions and prior-year forms are complete schedule a form 940. When there is a temporary break in work a No Work Performed payroll must be submitted. Gsa form gsa-618d date statement to be submitted when work is performed personally name of signatory party title of signatory party name of firm submitting statement type of contractor nature of work prime subcontractor name of building where. Certified payroll reports are due no later than 35 days after starting work on each contract and at each successive 35 day interval thereafter.

Free 8 Sample Certified Payroll Forms In Pdf From sampletemplates.com

Free 8 Sample Certified Payroll Forms In Pdf From sampletemplates.com

Begin the sequence with Initial or 1. Speed up your businesss document. BUREAU OF LABOR AND INDUSTRIES PAYROLLCERTIFIED STATEMENT FORM WH-38 WAGE AND HOUR DIVISION FOR USE IN COMPLYING WITH ORS 279C845 PRIME CONTRACTOR SUBCONTRACTOR PAYROLL NO_____ FINAL PAYROLL Business Name DBA. If you need additional guidance contact the awarding agency offering the contract. Certified payroll reports are due no later than 35 days after starting work on each contract and at each successive 35 day interval thereafter. When there is a temporary break in work a No Work Performed payroll must be submitted.

All payroll certifications must be signed by an officer of the company.

Speed up your businesss document. This must include whatever payrolls the contractor has paid out at the time of the report. Certified Payroll Form Samples - 9 Free Documents in Word PDF Payroll is the total amount of compensation given to an employee for a given duration of time and a set date. Create this form in 5 minutes. Employers annual federal unemployment futa tax return instructions and prior-year forms are complete schedule a form 940. Get access to thousands of forms.

Source: certified-payroll-form.pdffiller.com

Source: certified-payroll-form.pdffiller.com

If you need additional guidance contact the awarding agency offering the contract. CCB Registration Number. Certified payroll no work performed - 618d Us. As a general rule payrolls should be. Therefore theres no one universal certified payroll report for all cases.

Source: youtube.com

Source: youtube.com

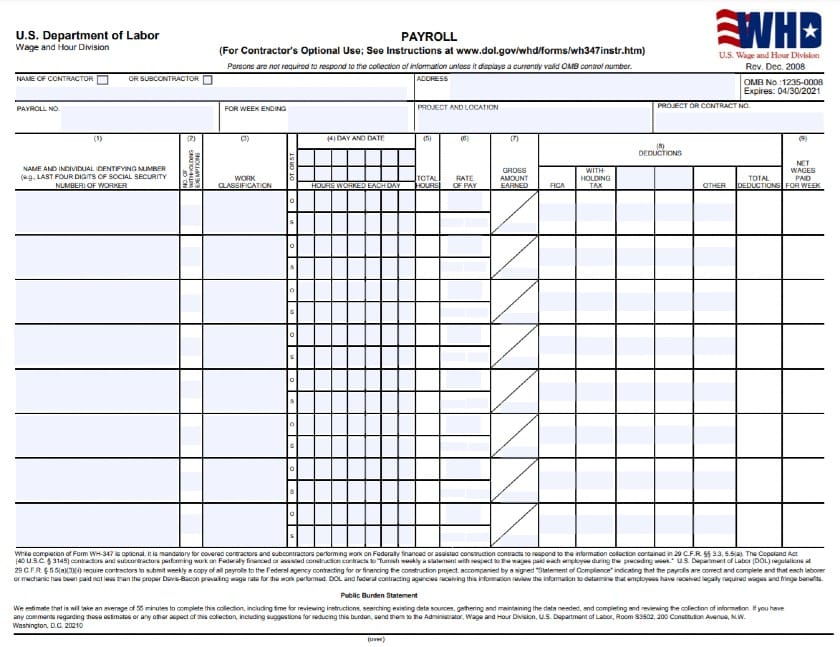

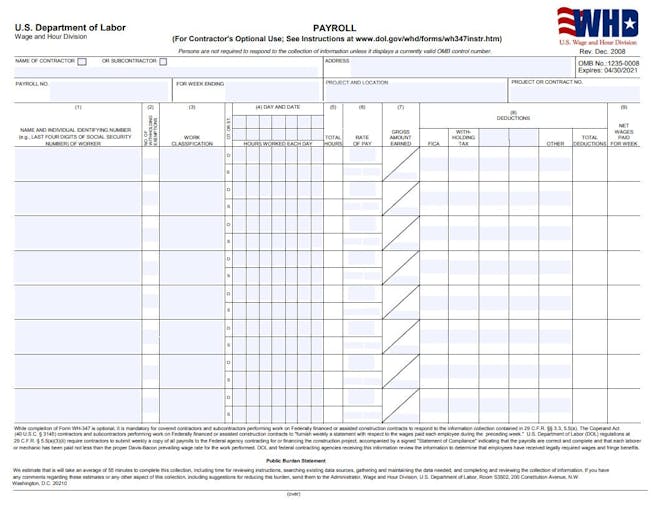

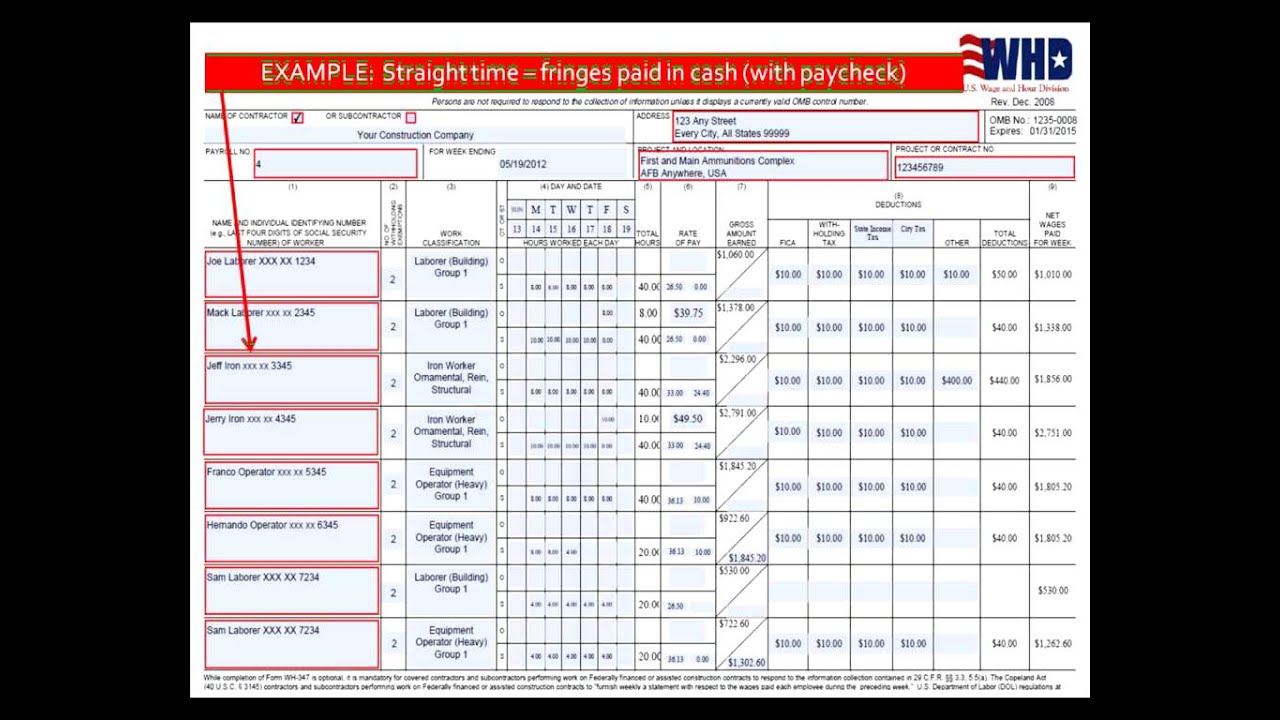

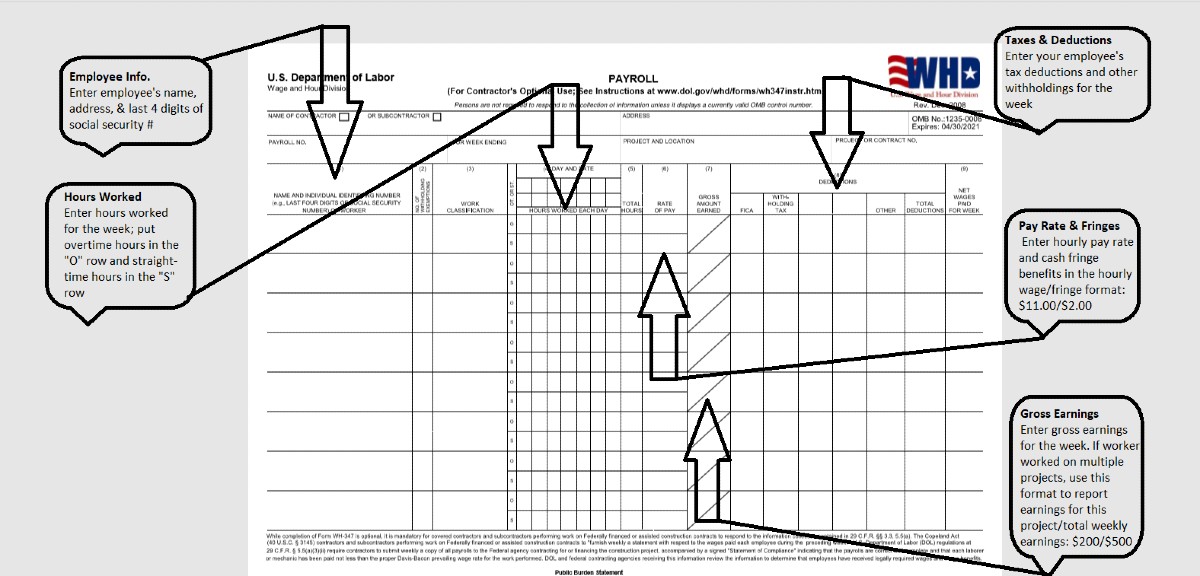

How to create an eSignature for the new york city certified payroll form. Speed up your businesss document. It must then be submitted by the contractor for each week in place of a certified payroll where no work is preformed until the final certified payroll is submitted. Form WH-347has been made available for the convenience of contractors and subcontractors required by their Federal or Federally-aided construction-type contracts and subcontracts to submit weekly payrolls. The weekly WH-347 certified payroll form is a 2 part form is not a complex form and does not ask for any information that you as a business owner do not already need to keep for wage payment tax purposes and information about the project.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

It must then be submitted by the contractor for each week in place of a certified payroll where no work is preformed until the final certified payroll is submitted. Gsa form gsa-618d date statement to be submitted when work is performed personally name of signatory party title of signatory party name of firm submitting statement type of contractor nature of work prime subcontractor name of building where. Number each weekly payroll report sequentially. If you need additional guidance contact the awarding agency offering the contract. Certified payroll forms nj.

Source: clockshark.com

Source: clockshark.com

The weekly WH-347 certified payroll form is a 2 part form is not a complex form and does not ask for any information that you as a business owner do not already need to keep for wage payment tax purposes and information about the project. As a general rule payrolls should be. Number each weekly payroll report sequentially. However contractors may also use their own payrolls provided it has all the required information from the WH-347. The US Department of Labor for example uses Form WH-347.

Source: pinterest.com

Source: pinterest.com

As a general rule payrolls should be. No labor or services will be performed on and no materials will be furnished or delivered to any Lot by or on behalf of Borrower prior to recording the Deed of Trust covering that Lot which could give rise to a Lien on the Lot with priority equal to or greater than the Liens and security interests of the Deed of Trust or. If you need additional guidance contact the awarding agency offering the contract. No work performed certified payroll form - form 2013 federal. Number each weekly payroll report sequentially.

Source: youtube.com

Source: youtube.com

A Payroll Department is responsible for calculating a salarys wages tracking the number of hours of work and calculating withholding tax and deductions with the use of Payroll Forms. Weeks where no work is performed onsite still require submitting a certified payroll report form with NO WORK PERFORMED written across the payroll OR use the alternative option of submitting a No Work Report Form. A Payroll Department is responsible for calculating a salarys wages tracking the number of hours of work and calculating withholding tax and deductions with the use of Payroll Forms. Keeping payroll records and submitting Certified Payroll Records if requested. Payroll Week Ending Date.

Source: comptroller.nyc.gov

Source: comptroller.nyc.gov

As a general rule payrolls should be. If you need additional guidance contact the awarding agency offering the contract. Payroll Week Ending Date. Therefore theres no one universal certified payroll report for all cases. Keeping payroll records and submitting Certified Payroll Records if requested.

Source: dfas.mil

Source: dfas.mil

When there is a temporary break in work a No Work Performed payroll must be submitted. Get access to thousands of forms. When there is a temporary break in work a No Work Performed payroll must be submitted. There is no need to pay for Certified Payroll Professional CPP - you or your representative can manage that process. Find out how easily you can conclude the file with SignNows templates and tools.

Source: sampletemplates.com

Source: sampletemplates.com

All payroll certifications must be signed by an officer of the company. Davis-Bacon Certified Payroll Guidance 1. If someone other than an officer is. If the contract lasts more than 70 days succeeding wage certification reports are due at 35 day intervals eg 35 70 105 and 140 days from the time. Faxing is not accepted.

Source: sampleforms.com

Source: sampleforms.com

2008 While completion of Form WH-347 is optional it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 CFR. The US Department of Labor for example uses Form WH-347. Microsoft Word - BLANK STATEMENT OF NON PERFORMANCE Author. How to Complete Form WH-347. 2008 While completion of Form WH-347 is optional it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 CFR.

No labor or services will be performed on and no materials will be furnished or delivered to any Lot by or on behalf of Borrower prior to recording the Deed of Trust covering that Lot which could give rise to a Lien on the Lot with priority equal to or greater than the Liens and security interests of the Deed of Trust or. No work performed certified payroll form. Find out how easily you can conclude the file with SignNows templates and tools. Payroll submissions must be mailed or dropped off at the General Contractors office. Certified payroll forms nj.

Source: certified-payroll-form.pdffiller.com

Source: certified-payroll-form.pdffiller.com

A Payroll Department is responsible for calculating a salarys wages tracking the number of hours of work and calculating withholding tax and deductions with the use of Payroll Forms. If you need additional guidance contact the awarding agency offering the contract. No labor or services will be performed on and no materials will be furnished or delivered to any Lot by or on behalf of Borrower prior to recording the Deed of Trust covering that Lot which could give rise to a Lien on the Lot with priority equal to or greater than the Liens and security interests of the Deed of Trust or. CCB Registration Number. Number each weekly payroll report sequentially.

However contractors may also use their own payrolls provided it has all the required information from the WH-347. If the contract lasts more than 70 days succeeding wage certification reports are due at 35 day intervals eg 35 70 105 and 140 days from the time. When there is a temporary break in work a No Work Performed payroll must be submitted. Weeks where no work is performed onsite still require submitting a certified payroll report form with NO WORK PERFORMED written across the payroll OR use the alternative option of submitting a No Work Report Form. No work performed certified payroll form - Page 2 notice 2005 13 form Tax-exempt leasing involving defeasance notice 2005 13 the internal revenue service and the treasury department are aware of types of transactions described below in which a taxpayer enters into a purported sale-leaseback arrangement with a.

This must include whatever payrolls the contractor has paid out at the time of the report. The certified payrolls may be submitted using the standard WH-347 form from the Department of Labor. How to create an eSignature for the new york city certified payroll form. Faxing is not accepted. This must include whatever payrolls the contractor has paid out at the time of the report.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Youll need to know. No Work Week Payroll 5. The weekly WH-347 certified payroll form a 2-part form is not a complex form and does not ask for any information that you as a business owner do not already need to keep for wage payment tax purposes and information about the project. Payroll submissions must be mailed or dropped off at the General Contractors office. Employers annual federal unemployment futa tax return instructions and prior-year forms are complete schedule a form 940.

Source: pinterest.com

Source: pinterest.com

No work performed certified payroll form. Therefore theres no one universal certified payroll report for all cases. This must include whatever payrolls the contractor has paid out at the time of the report. If you answered no then you likely do not have a prevailing wage project. If the contract lasts more than 70 days succeeding wage certification reports are due at 35 day intervals eg 35 70 105 and 140 days from the time.

Gsa form gsa-618d date statement to be submitted when work is performed personally name of signatory party title of signatory party name of firm submitting statement type of contractor nature of work prime subcontractor name of building where. It must then be submitted by the contractor for each week in place of a certified payroll where no work is preformed until the final certified payroll is submitted. However contractors may also use their own payrolls provided it has all the required information from the WH-347. The certified payrolls may be submitted using the standard WH-347 form from the Department of Labor. Begin the sequence with Initial or 1.

Fill Now Certified payroll no work performed - 618d. No work performed certified payroll form. How to Complete Form WH-347. Certified payroll no work performed - 618d Us. Use professional pre-built templates to fill in and sign documents online faster.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title no work performed certified payroll form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.