Your How to work out operating profit images are ready in this website. How to work out operating profit are a topic that is being searched for and liked by netizens now. You can Download the How to work out operating profit files here. Find and Download all royalty-free vectors.

If you’re looking for how to work out operating profit images information related to the how to work out operating profit topic, you have visit the ideal blog. Our site always provides you with hints for seeing the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

How To Work Out Operating Profit. This is primarily due to uncertainty over which specific cost categories to include in the operating profit equation. Deduct the increase in receivables or add any decrease. Operating Profit Total Sales Cost of Sales Office and Administration Expenses Selling and Distribution Expenses. Why Is Operating Profit Margin Ratio Important.

The term has no statutory definition here and is not outlined in the UKs Generally Accepted Accounting Practice GAAP guidelines ie. Another reason is because there are two methods to work out this metric. How to Calculate Operating Profit in Business - 2021 - MasterClass Business owners can calculate one of three measures of profitability. Add back depreciation and amortisation. Calculate the increase or decrease in receivables. Firstly determine the revenue earned by the company from the core business operations.

For operating variance subtract projected operating profit from actual operating profit which equals revenue minus all COGS and operating expenses.

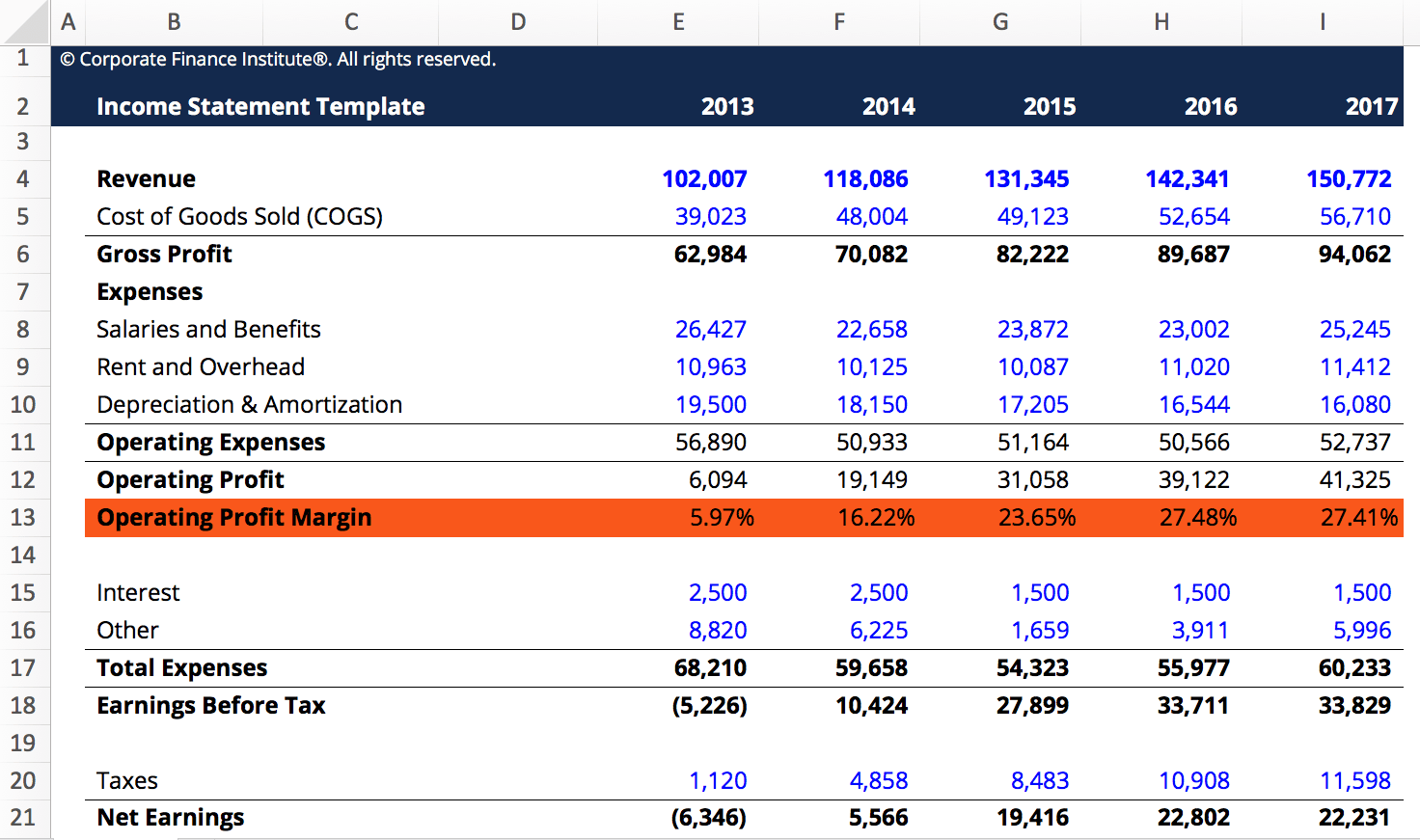

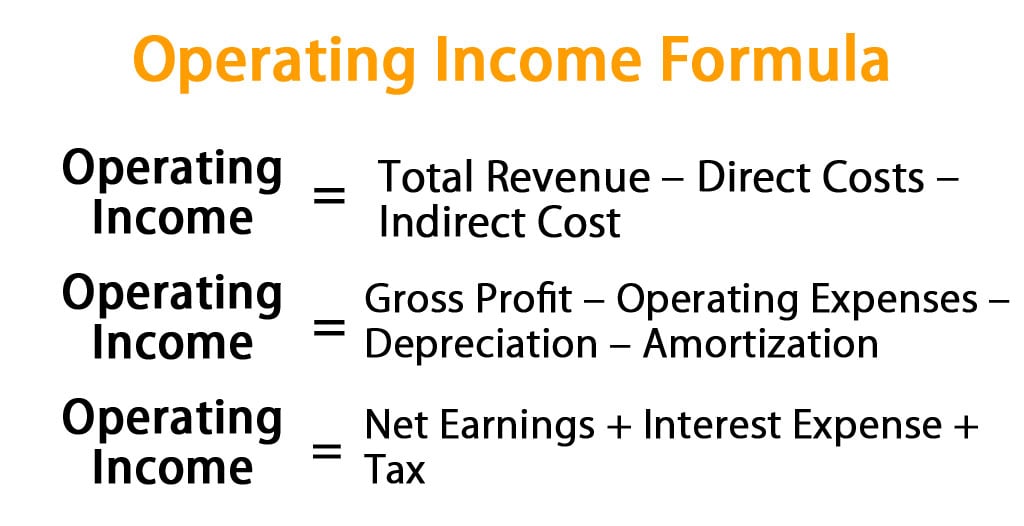

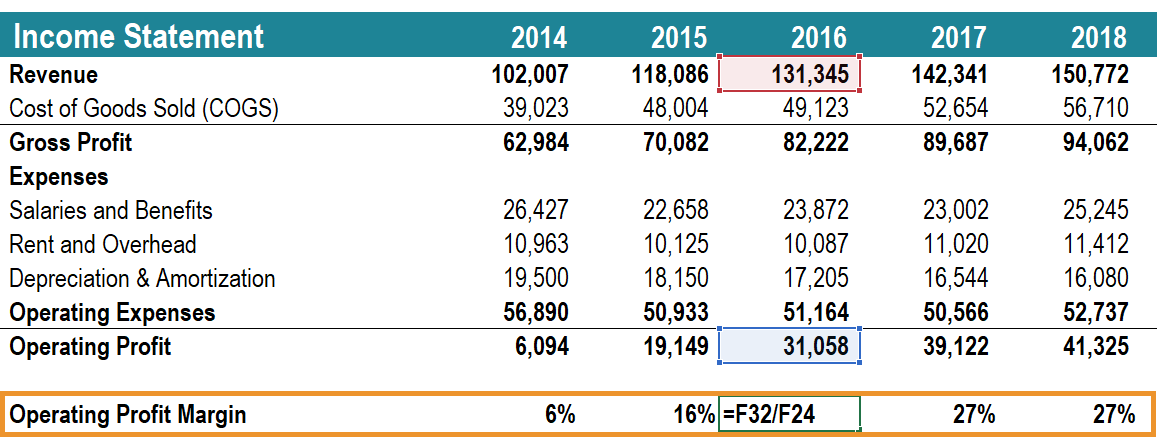

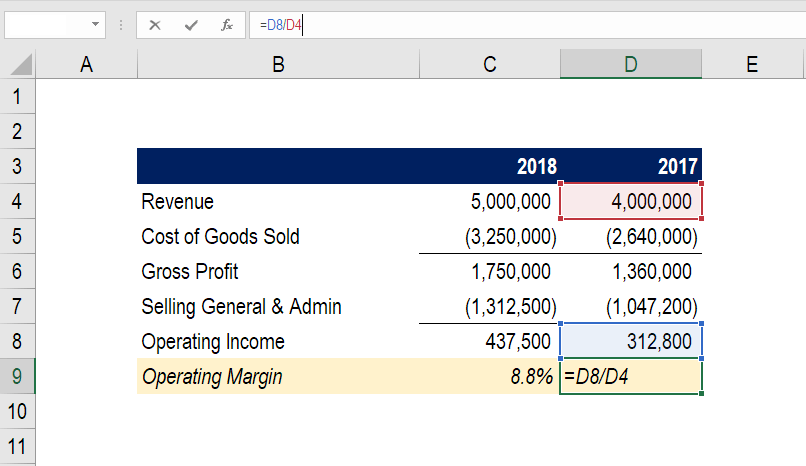

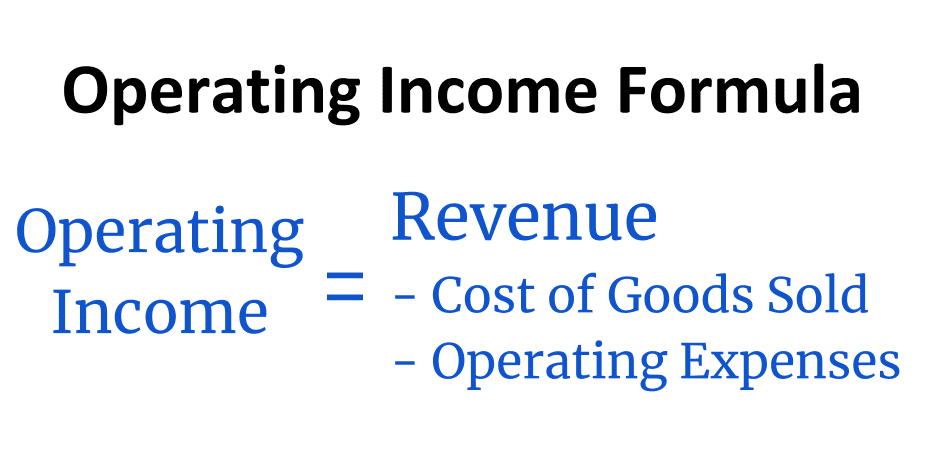

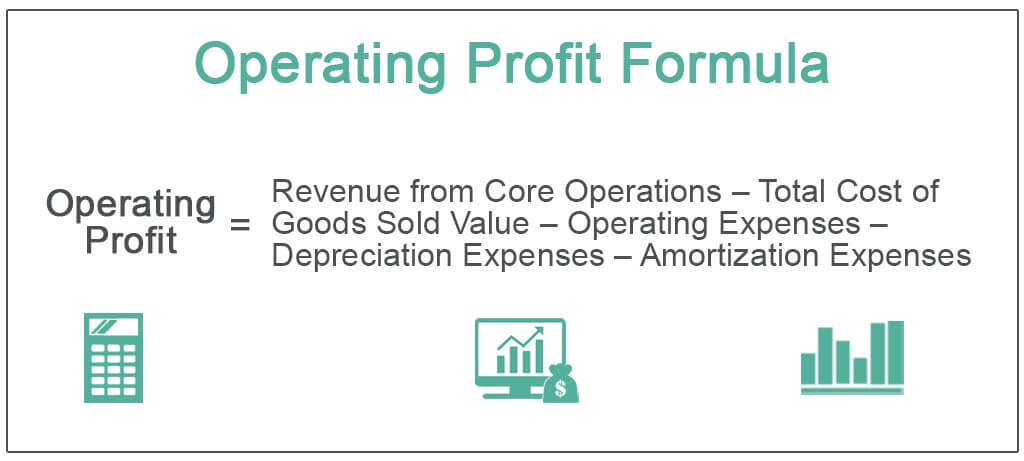

Gross profit net profit and operating profit. The formula for calculating operating profit is as follows. The operating profit formula sometimes creates more confusion than rival profit metrics such as net profit. Net profit sales - direct cost of sales operating expenses How to calculate profit margin. Operating profit revenue - operating expenses - cost of goods sold - other day-to-day expenses depreciation amortization etc To use this formula to calculate the operating profit of a business you can use the following steps. Operating profit tells you how much money youre clearing from your core business and what your cash flow situation is.

Source: investopedia.com

Source: investopedia.com

The equation for operating profit can be derived by using the following steps. For this all the amount. Net profit sales - direct cost of sales operating expenses How to calculate profit margin. Operating profit is calculated by subtracting all COGS depreciation and amortization and all relevant operating expenses from total revenues. Add back depreciation and amortisation.

Operating profit tells you how much money youre clearing from your core business and what your cash flow situation is. Or Operating Margin 170000 510000 100 13 100 3333. The cost of goods sold. How to calculate operating profit Revenue. Operating expenses include a companys expenses beyond direct production costs such things as salaries and benefits rent and related overhead expenses research and development costs etc.

Source: investopedia.com

Source: investopedia.com

Gross profit sales - direct cost of sales. Catherine Erdly Founder of The Resilient Retail Club says. The remaining balance after deducting these costsexpenses from the companys operating revenue can be used for. Calculate the increase or decrease in inventory. AS A Level IB.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

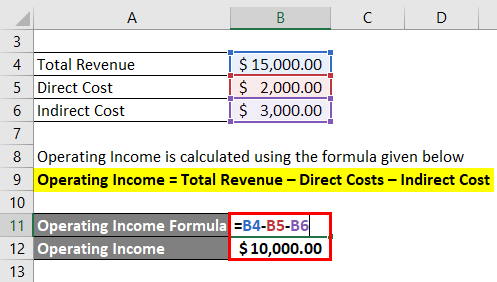

How to Calculate Operating Profit in Business - 2021 - MasterClass Business owners can calculate one of three measures of profitability. Gross profit sales - direct cost of sales. Operating profit margin operating income revenue Example of operation profit margin calculation Your business took 600000 in sales revenue last year and had operating expenses of 500000. Deduct the increase in receivables or add any decrease. Operating income Total Revenue Direct Costs Indirect Costs.

Source: educba.com

Source: educba.com

This is primarily due to uncertainty over which specific cost categories to include in the operating profit equation. Operating expenses include a companys expenses beyond direct production costs such things as salaries and benefits rent and related overhead expenses research and development costs etc. For this all the amount. Gross profit sales - direct cost of sales. There are three formulas to calculate income from operations.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Add back depreciation and amortisation. The profit margin essentially tells. Operating Profit is calculated using the formula given below. The formula for calculating operating profit is as follows. To calculate operating profit subtract operating expenses from gross profit.

Source: business-literacy.com

Source: business-literacy.com

The calculation of operating profit and operating profit margin is explained in this short revision videoalevelbusiness businessrevision aqabusiness tut. The remaining balance after deducting these costsexpenses from the companys operating revenue can be used for. Another reason is because there are two methods to work out this metric. How to Calculate Operating Profit in Business - 2021 - MasterClass Business owners can calculate one of three measures of profitability. AQA Edexcel OCR IB Eduqas WJEC.

Source: investopedia.com

Source: investopedia.com

Operating profit revenue - operating expenses - cost of goods sold - other day-to-day expenses depreciation amortization etc To use this formula to calculate the operating profit of a business you can use the following steps. Operating Profit and Operating Profit Margin. Operating profit margin 600000 -. Gross profit net profit and operating profit. To calculate gross profit variance you would subtract your projected gross profit from your actual gross profit which equals periodic sales minus costs of goods sold.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Add all income together to get the gross revenue this will give you the revenue part of the formula. This is primarily due to uncertainty over which specific cost categories to include in the operating profit equation. One measure of the money that it takes for a business to operatethink rent staff salaries travel expensesis the businesss operating cost which is an essential component of a businesss bottom line. How to Calculate Operating Profit in Business - 2021 - MasterClass Business owners can calculate one of three measures of profitability. Calculate the after-tax operating profit.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

For Year One sales were 1 million and the gross profit was 250000 – resulting in a gross profit margin of 25 percent 250000 1. Operating profit tells you how much money youre clearing from your core business and what your cash flow situation is. To calculate operating profit subtract operating expenses from gross profit. The profit margin essentially tells. For this all the amount.

Source: wallstreetprep.com

Source: wallstreetprep.com

For this all the amount. Gross profit sales - direct cost of sales. Operating income Total Revenue Direct Costs Indirect Costs. Add back depreciation and amortisation. Add all income together to get the gross revenue this will give you the revenue part of the formula.

Source: stockanalysis.com

Source: stockanalysis.com

Use the calculations below to work out both your gross profit and your net profit. Firstly determine the revenue earned by the company from the core business operations. How to calculate operating profit Revenue. Use the calculations below to work out both your gross profit and your net profit. A companys financial health isnt just about money coming in.

Changes in current assets. Operating profit tells you how much money youre clearing from your core business and what your cash flow situation is. Operating profit operating revenue - cost of goods sold COGS - operating expenses - depreciation - amortization Example of operating profit The concept of operating profit is easier to understand with an example of how it works. Add back depreciation and amortisation. How to calculate operating profit Revenue.

Source: educba.com

Source: educba.com

After that the cost of the goods sold by the company during that period is calculated by. How to Calculate Operating Profit in Business - 2021 - MasterClass Business owners can calculate one of three measures of profitability. Operating expenses include a companys expenses beyond direct production costs such things as salaries and benefits rent and related overhead expenses research and development costs etc. Use the calculations below to work out both your gross profit and your net profit. Add all income together to get the gross revenue this will give you the revenue part of the formula.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The calculation of operating profit and operating profit margin is explained in this short revision video. Calculate the increase or decrease in receivables. Deduct the increase in receivables or add any decrease. Operating profit margin operating income revenue Example of operation profit margin calculation Your business took 600000 in sales revenue last year and had operating expenses of 500000. Calculate the increase or decrease in inventory.

It can be used to compare a company with its competitors or similar companies. Operating profit tells you how much money youre clearing from your core business and what your cash flow situation is. The operating profit margin ratio is a useful indicator of a companys financial health. Also called earnings before interest and taxes EBIT operating profit is defined as the profits earned from a companys core business after subtracting the cost of goods sold COGS operating costs and any depreciation expenses. A companys financial health isnt just about money coming in.

Firstly determine the revenue earned by the company from the core business operations. It can be used to compare a company with its competitors or similar companies. Net profit sales - direct cost of sales operating expenses How to calculate profit margin. AQA Edexcel OCR IB Eduqas WJEC. How to calculate operating profit Revenue.

Source: educba.com

Source: educba.com

Operating Profit Total Sales Cost of Sales Office and Administration Expenses Selling and Distribution Expenses. Firstly determine the revenue earned by the company from the core business operations. Add all income together to get the gross revenue this will give you the revenue part of the formula. After that the cost of the goods sold by the company during that period is calculated by. Its also about money going out.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to work out operating profit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.