Your How to work out contribution per unit images are ready in this website. How to work out contribution per unit are a topic that is being searched for and liked by netizens now. You can Download the How to work out contribution per unit files here. Get all free images.

If you’re looking for how to work out contribution per unit images information linked to the how to work out contribution per unit interest, you have pay a visit to the right blog. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

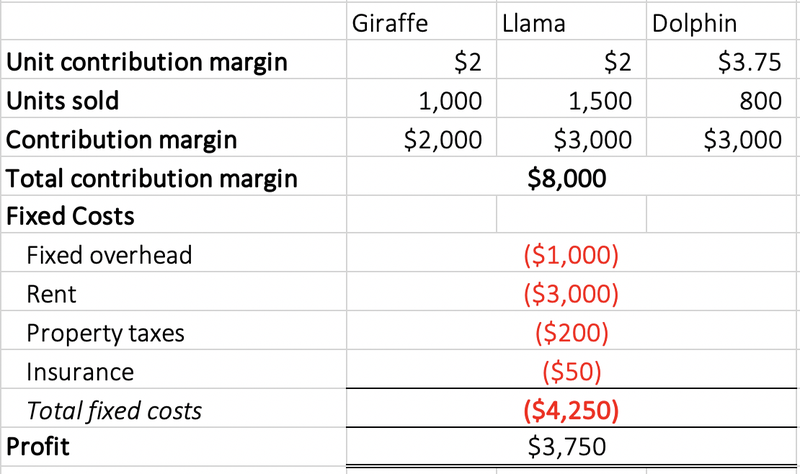

How To Work Out Contribution Per Unit. Contribution per unit describes how the sale of one unit affects a companys net income. Contribution Margin Per Unit Sales Price Per Unit Contribution Margin Ratio Sales volume is still an important facet of contribution margin to keep in mind but the ratio allows you to quickly compare your products. Contribution per unit x number of units sold. In a throughput accounting context a very similar calculation is performed but this time it is not contribution per unit of scarce resource which is.

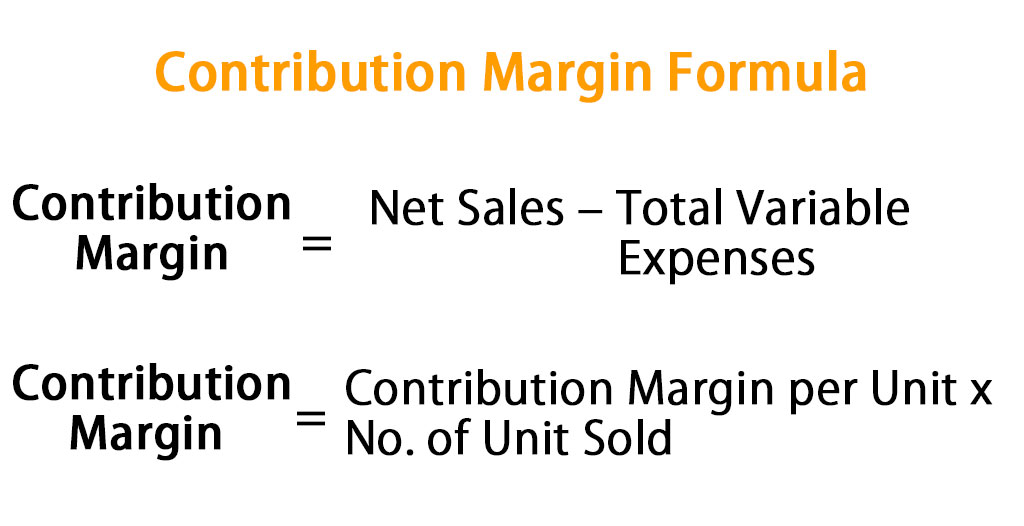

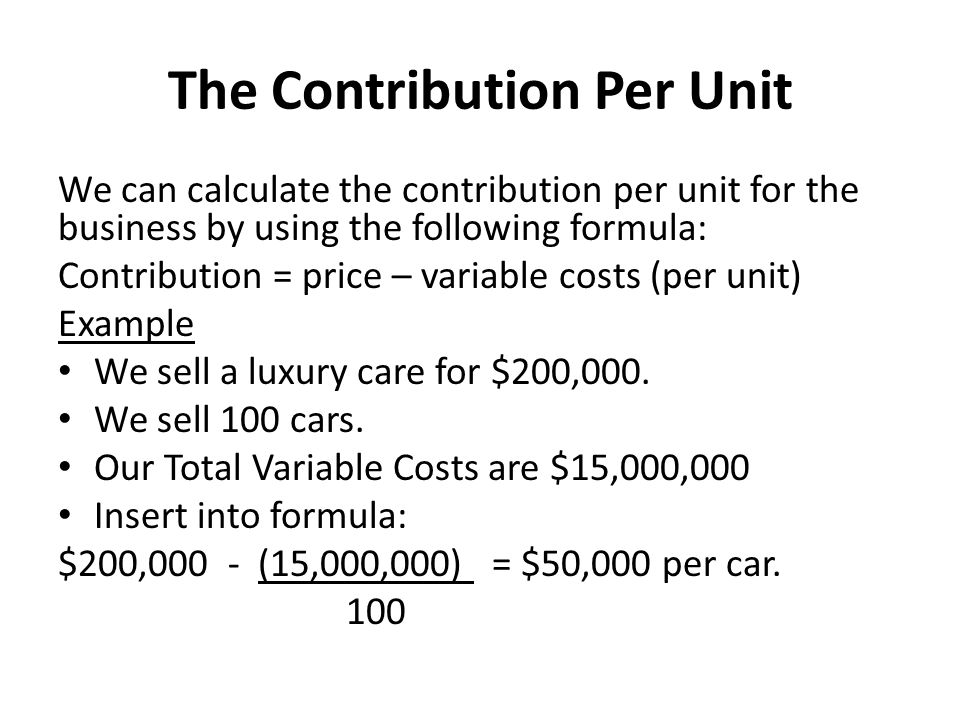

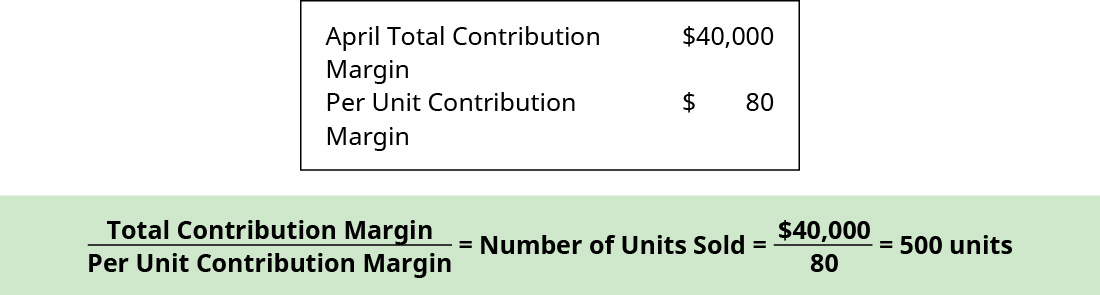

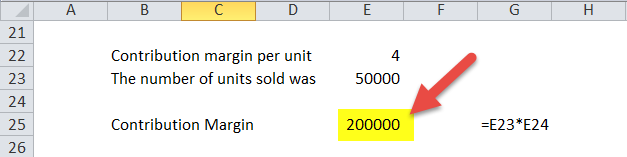

Contribution per unit selling price per unit less variable costs per unit. Contribution per unit is also known as contribution margin per unit. For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit The contribution would be Margin per Unit Number of Units Sold The contribution ratio would be margin Sales You can download this template here Contribution Margin Ratio Excel Template Contribution Margin Video. This is useful if you want to know how much your total. Contribution Margin Per Unit Sales Price Per Unit Contribution Margin Ratio Sales volume is still an important facet of contribution margin to keep in mind but the ratio allows you to quickly compare your products.

The selling price per unit is 100.

Calculating Total Contribution Contribution per Unit - YouTube. Contribution Sales Variable Marginal Cost. Total contribution can also be calculated as. The formula for contribution margin dollars-per-unit is. Contribution per limited factor is contributionlimiting factor per unit of production which is either material or kg or labour in hours In this case is the material so you will need to divide by the amount of material used per unit The lemon is 3040075 kg and ginger is 7040175kg. Moreover how do you calculate contribution per unit.

Source: tutor2u.net

Source: tutor2u.net

Thus the calculation of contribution per unit is. Write down the unit contribution margin. Thus the calculation of contribution per unit is. Multilingual Desktop Publishing. To calculate the contribution per unit summarize all revenue for the product in question and subtract all variable expenses from these revenues to arrive at the total contribution margin and then divide by the number of units produced or sold to arrive at the contribution per unit.

Contribution per unit describes how the sale of one unit affects a companys net income. Contribution per unit selling price per unit less variable costs per unit. It gives you another lense through which you can view your financial information and make informed decisions. The formula for contribution margin dollars-per-unit is. Contribution total sales less total variable costs.

Source: youtube.com

Source: youtube.com

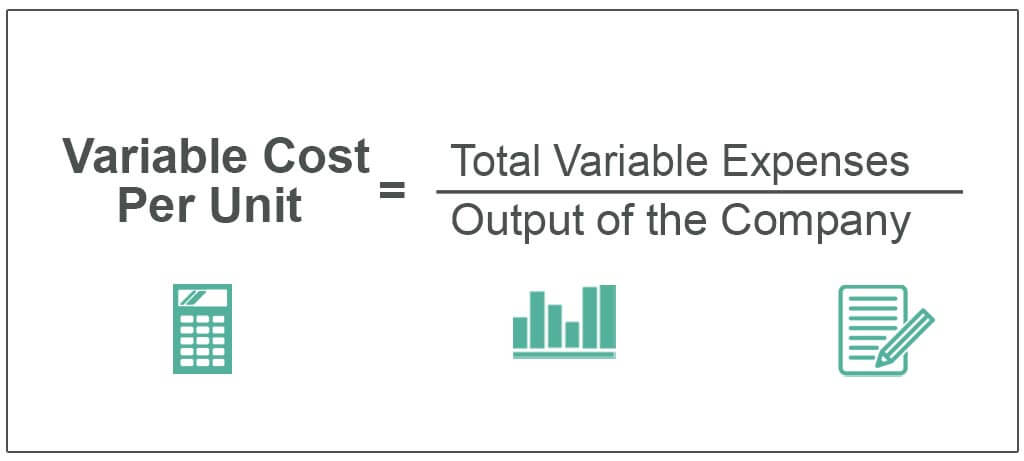

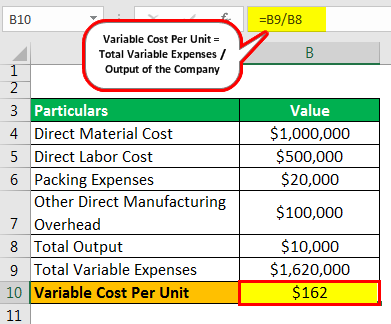

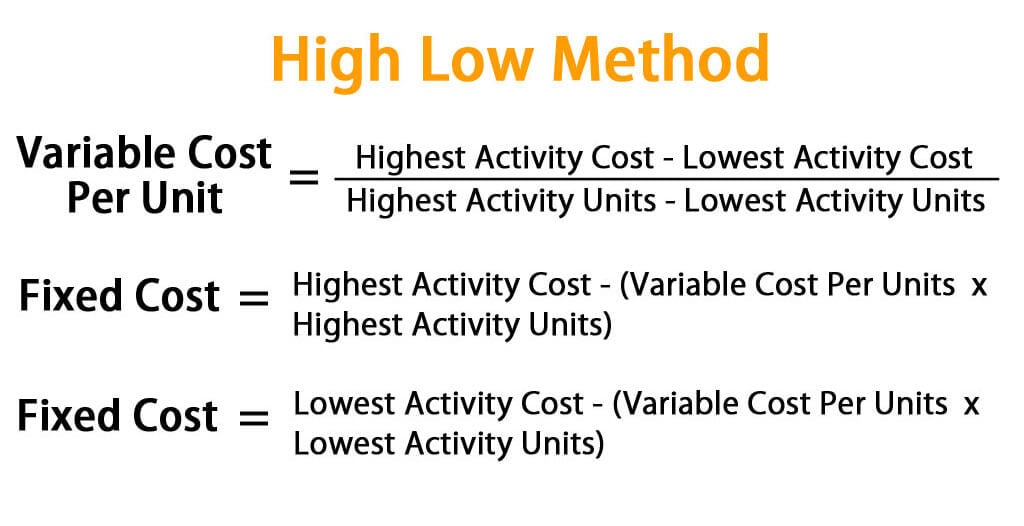

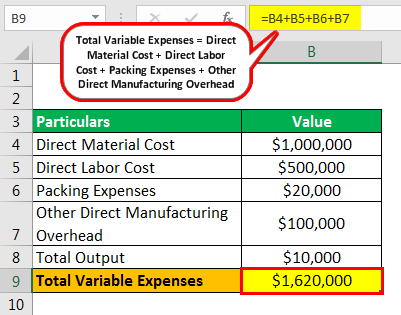

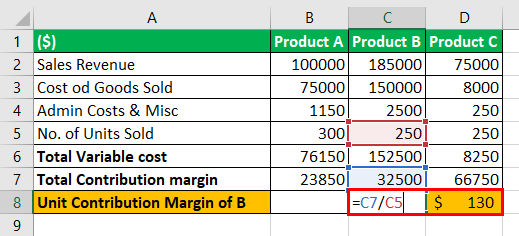

Calculate contribution per unit of output of each product Contribution is simply selling price less variable costs. Calculating Total Contribution Contribution per Unit - YouTube. Contribution Margin Per Unit Sales Price Per Unit Contribution Margin Ratio Sales volume is still an important facet of contribution margin to keep in mind but the ratio allows you to quickly compare your products. Contribution per unit Selling price per unit Variable costs per unit Once the contribution per unit is found the. The formula for the calculation of the Variable Cost Per Unit is as follows.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. The contribution margin is when you deduct all connected variable costs from your products price which results in the incremental profit earned for each unit. In the previous watch example if the company produced 200 watches in August the contribution margin per unit would be 20. Contribution total sales less total variable costs. In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

This will give you the total contribution margin for all units. Contribution total sales less total variable costs. For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. Contribution is the difference between sales and variable costs of production. It gives you another lense through which you can view your financial information and make informed decisions.

Source: ifinancebox.com

Source: ifinancebox.com

Thus the calculation of contribution per unit is. Actual Unit Sold Budgeted Unit Sales x Standard Contribution Per Unit Explanation Sales Volume Variance quantifies the effect of a change in the level of. To determine the ratio. In a throughput accounting context a very similar calculation is performed but this time it is not contribution per unit of scarce resource which is. Moreover how do you calculate contribution per unit.

Calculate contribution per unit of output of each product Contribution is simply selling price less variable costs. Contribution is the difference between sales and variable costs of production. Contribution per unit selling price per unit less variable costs per unit. Contribution per unit Selling price per unit Variable costs per unit Once the contribution per unit is found the. Contribution Margin Per Unit Sales Price Per Unit Contribution Margin Ratio Sales volume is still an important facet of contribution margin to keep in mind but the ratio allows you to quickly compare your products.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

Image Localization Editing. Thus the calculation of contribution per unit is. Total revenue variable costs of units sold. Contribution total sales less total variable costs. Contribution can be represented as.

Source: educba.com

Source: educba.com

The contribution margin is when you deduct all connected variable costs from your products price which results in the incremental profit earned for each unit. Firstly a business must work out the contribution this is calculated as. For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. Contribution Margin Ratio Net Sales Revenue -Variable Costs Sales Revenue Sample Calculation of Contribution Margin. The formula for contribution margin dollars-per-unit is.

Source: fool.com

Source: fool.com

To determine the ratio. In this revision video on breakeven analysis we explain the key concept of contribution and how it can be used to calculate the breakeven outputalevelbusi. Revenue Variable costs Contribution Margin Yes its a formula as most accounting based measures are but it can be kept quite simple. The contribution margin per unit is simply the contribution margin divided by the number of items a company made in a period of time. Contribution and Contribution per Unit.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit The contribution would be Margin per Unit Number of Units Sold The contribution ratio would be margin Sales You can download this template here Contribution Margin Ratio Excel Template Contribution Margin Video. Contribution and Contribution per Unit. In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production. Revenue Variable costs Contribution Margin Yes its a formula as most accounting based measures are but it can be kept quite simple. Contribution is the difference between sales and variable costs of production.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

Contribution per unit describes how the sale of one unit affects a companys net income. Thus the calculation of contribution per unit is. In the previous watch example if the company produced 200 watches in August the contribution margin per unit would be 20. Contribution can be represented as. You are free to use this image on your website templates etc Please provide us with an attribution link.

Source: slideplayer.com

Source: slideplayer.com

In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production. In a throughput accounting context a very similar calculation is performed but this time it is not contribution per unit of scarce resource which is. The formula for the calculation of the Variable Cost Per Unit is as follows. You are free to use this image on your website templates etc Please provide us with an attribution link. Contribution per unit Selling price per unit Variable costs per unit Once the contribution per unit is found the.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production. The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit The contribution would be Margin per Unit Number of Units Sold The contribution ratio would be margin Sales You can download this template here Contribution Margin Ratio Excel Template Contribution Margin Video. Contribution per unit x number of units sold. Contribution total sales less total variable costs. Contribution Margin Fixed Costs Net Income.

Source: opentextbc.ca

Source: opentextbc.ca

Contribution can be represented as. The formula for the calculation of the Variable Cost Per Unit is as follows. Contribution Margin Per Unit Sales Price Per Unit Contribution Margin Ratio Sales volume is still an important facet of contribution margin to keep in mind but the ratio allows you to quickly compare your products. In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production. Calculate contribution per unit of output of each product Contribution is simply selling price less variable costs.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Contribution Margin Ratio Net Sales Revenue -Variable Costs Sales Revenue Sample Calculation of Contribution Margin. Contribution Margin Ratio Net Sales Revenue -Variable Costs Sales Revenue Sample Calculation of Contribution Margin. The contribution margin per unit is simply the contribution margin divided by the number of items a company made in a period of time. The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit The contribution would be Margin per Unit Number of Units Sold The contribution ratio would be margin Sales You can download this template here Contribution Margin Ratio Excel Template Contribution Margin Video. Total revenue variable costs of units sold.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Multilingual Desktop Publishing. The formula for contribution margin dollars-per-unit is. Contribution per unit describes how the sale of one unit affects a companys net income. The contribution margin ratio per unit formula would be Selling price per unit Variable cost per unit The contribution would be Margin per Unit Number of Units Sold The contribution ratio would be margin Sales You can download this template here Contribution Margin Ratio Excel Template Contribution Margin Video. Contribution total sales less total variable costs.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

In key factor analysis the contribution per unit is first calculated for each product then a contribution per unit of scarce resource is calculated by working out how much of the scarce resource each unit requires in its production. Contribution total sales less total variable costs. Firstly a business must work out the contribution this is calculated as. Multiply the unit contribution margin by the the number of units produced. In the previous watch example if the company produced 200 watches in August the contribution margin per unit would be 20.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to work out contribution per unit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.