Your How does a buyout work images are available in this site. How does a buyout work are a topic that is being searched for and liked by netizens today. You can Get the How does a buyout work files here. Get all royalty-free photos and vectors.

If you’re looking for how does a buyout work pictures information connected with to the how does a buyout work topic, you have come to the ideal site. Our website always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

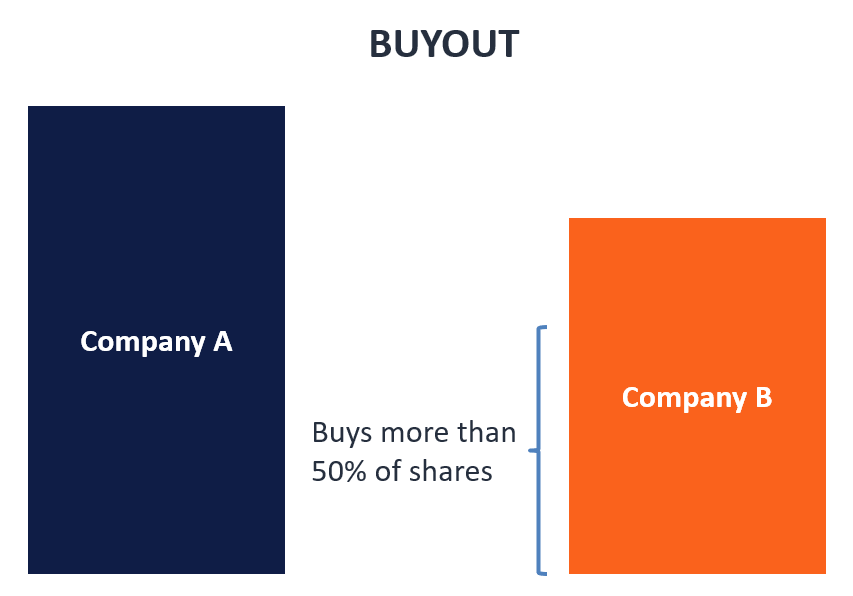

How Does A Buyout Work. This amount may also be called the buyout amount or purchase option price. If it is an all-stock deal the shares will be replaced by shares of the company doing the buying. This is typically done by purchasing shares of the company. If you have good credit and want to keep more of your stuff this is a good.

Missing Assignment Buyout Program Assignments Student Writing Algebra From pinterest.com

Missing Assignment Buyout Program Assignments Student Writing Algebra From pinterest.com

For a buyout to work you will need to give an offer and have someone accept. Contents show If the buyout is an all-cash deal shares of your stock will disappear from your portfolio at some point following the deals official closing date and be replaced by the cash value of the shares specified in the buyout. Buyouts are a common method for reducing the number and cost of employees. Buying your leased car saves the. If it is an all-stock deal the shares will be replaced by shares of the company doing the buying. Using the earlier example youd need to have 100000.

Are lease buyouts worth it.

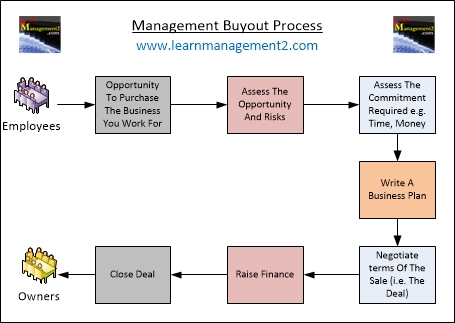

How Does a Buyout Work. One divorcing spouse will buy the home from the selling spouse using a refinanced loans. In its simplest form an MBO involves a companys management team combining resources to acquire all or part of the company they manage. Getting a business valuation is an important step to understanding how much your business is worth as much as you love your management team you dont want to be underselling. Buyouts are common in the corporate world. Buying your leased car saves the.

Source: prepnuggets.com

Source: prepnuggets.com

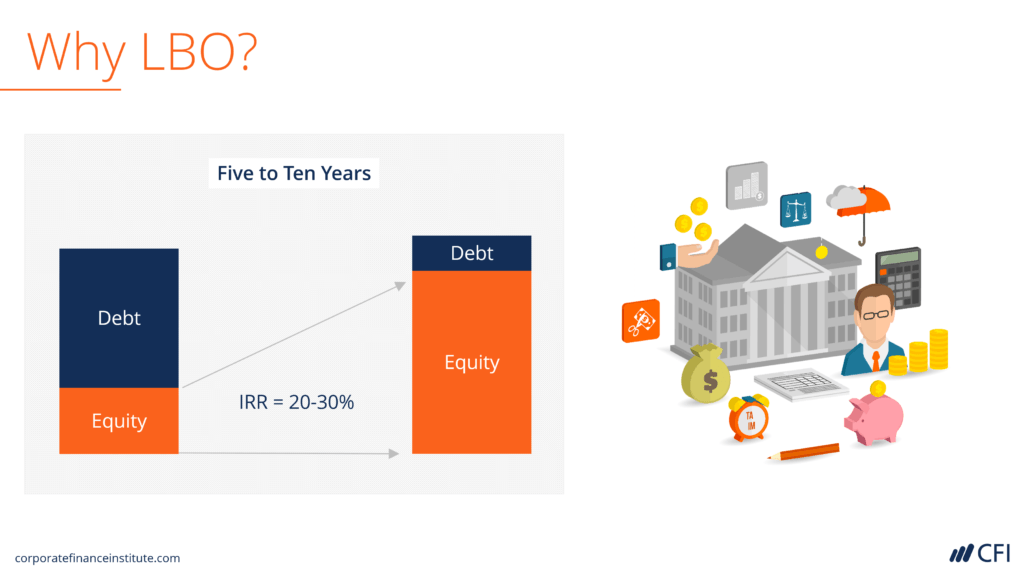

A leveraged buyout LBO is the acquisition of another company using a significant amount of borrowed money bonds or loans to meet the cost of acquisition. The assets of the company being. Transactions are financed using debt secured by both the buyers and the targets assets. Contents show If the buyout is an all-cash deal shares of your stock will disappear from your portfolio at some point following the deals official closing date and be replaced by the cash value of the shares specified in the buyout. How does a share buyout work.

Source: streetofwalls.com

Source: streetofwalls.com

Getting a business valuation is an important step to understanding how much your business is worth as much as you love your management team you dont want to be underselling. Transactions are financed using debt secured by both the buyers and the targets assets. How does a company buyout work. For a buyout to work you will need to give an offer and have someone accept. That being said buyout structures can change.

Source: streetofwalls.com

Source: streetofwalls.com

What is a management buyout. How Does A House Buyout Work. But depending on how the deal is being. An employee buyout just like the name implies works by offering an employee something in return for leaving the job – often a generous retirement or severance package. Buyouts are common in the corporate world.

Source: pinterest.com

Source: pinterest.com

An employee buyout just like the name implies works by offering an employee something in return for leaving the job – often a generous retirement or severance package. If your company is. A sale price is agreed between the seller and the management team. How Does A House Buyout Work. The management buyout process works as follows.

Source: streetofwalls.com

Source: streetofwalls.com

A leveraged buyout allows a buyer to acquire a company using a small amount of equity. How does a lease buyout work. For a buyout to work you will need to give an offer and have someone accept. A mortgage buyout is when one owner of a property pays the other owners share of the propertys equity so that the co-owner can be released from the mortgage and removed from the deed as owner. As explained above the buyout is spread out over a period of twice the remaining length of the contract.

Source: evs-translations.com

Source: evs-translations.com

How does a real estate buyout work. A mortgage buyout is when one owner of a property pays the other owners share of the propertys equity so that the co-owner can be released from the mortgage and removed from the deed as owner. This is how it works. How does a real estate buyout work. With a house buyout you have two main options.

Source: pinterest.com

Source: pinterest.com

A leveraged buyout allows a buyer to acquire a company using a small amount of equity. Leveraged buyouts are also used by management teams looking to acquire a company. How Does a Buyout Work. If you have good credit and want to keep more of your stuff this is a good. Paying the remaining balance and equity in full in cash or refinancing your mortgage and using the equity to buy out your ex-spouse.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

A management buyout MBO is a corporate finance transaction where the management team of an operating company acquires the business by borrowing money to buy out the current owner s. But depending on how the deal is being. As explained above the buyout is spread out over a period of twice the remaining length of the contract. If you have good credit and want to keep more of your stuff this is a good. Most of the time the management team takes full control and ownership using their expertise to grow the company and drive it forward.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If your company is. With a house buyout you have two main options. If you opt for a lease buyout when your lease is up the price will be based on the cars residual value the purchase amount set at lease signing based on the predicted value of the vehicle at the end of the lease. There are several ways through which employees can become the owners of their company but the ESOP is the main source of employee ownership in the US. What Is a Secondary Buyout and How Does It Work.

Source: pinterest.com

Source: pinterest.com

If you opt for a lease buyout when your lease is up the price will be based on the cars residual value the purchase amount set at lease signing based on the predicted value of the vehicle at the end of the lease. What is a management buyout. An MBO transaction is a type of leveraged buyout LBO and can sometimes be referred to as a leveraged management buyout LMBO. The team still takes a caphit and the caphit by year is calculated as follows. Contents show If the buyout is an all-cash deal shares of your stock will disappear from your portfolio at some point following the deals official closing date and be replaced by the cash value of the shares specified in the buyout.

Source: pinterest.com

Source: pinterest.com

Most of the time the management team takes full control and ownership using their expertise to grow the company and drive it forward. How does a real estate buyout work. How does a lease buyout work. Introduction A leverage buyout or LBO is what happens when the controlling interest in a company is acquired by a financial sponsor. A mortgage buyout is when one owner of a property pays the other owners share of the propertys equity so that the co-owner can be released from the mortgage and removed from the deed as owner.

Source: ar.pinterest.com

Source: ar.pinterest.com

How Does A House Buyout Work. An employee buyout just like the name implies works by offering an employee something in return for leaving the job – often a generous retirement or severance package. Buyouts are a common method for reducing the number and cost of employees. A leveraged buyout allows a buyer to acquire a company using a small amount of equity. Introduction A leverage buyout or LBO is what happens when the controlling interest in a company is acquired by a financial sponsor.

Source: pinterest.com

Source: pinterest.com

There are two general ways to have this happen. Even if a company isnt publicly traded an investment firm may purchase a controlling interest in it. A management buyout MBO is a corporate finance transaction where the management team of an operating company acquires the business by borrowing money to buy out the current owner s. Transactions are financed using debt secured by both the buyers and the targets assets. The announcement When a company announces that its being acquired or bought out it almost always will be at a premium to the stocks recent trading price.

Source: pinterest.com

Source: pinterest.com

Risk factors and opportunities for growth are evaluated. Most of the time the management team takes full control and ownership using their expertise to grow the company and drive it forward. There are several ways through which employees can become the owners of their company but the ESOP is the main source of employee ownership in the US. The announcement When a company announces that its being acquired or bought out it almost always will be at a premium to the stocks recent trading price. There are two general ways to have this happen.

Source: pinterest.com

Source: pinterest.com

If your company is. Multiply the remaining salary excluding signing bonuses by the buyout amount as determined by age to obtain the total buyout cost. In an employee buyout the employer offers some or all of their employees the opportunity to receive a large severance package in return. Transactions are financed using debt secured by both the buyers and the targets assets. Leveraged buyouts are also used by management teams looking to acquire a company.

Source: learnmanagement2.com

Source: learnmanagement2.com

How Does a Buyout Work. Getting a business valuation is an important step to understanding how much your business is worth as much as you love your management team you dont want to be underselling. A management buyout or MBO is when existing managers acquire a large part or all of the companys assets. The announcement When a company announces that its being acquired or bought out it almost always will be at a premium to the stocks recent trading price. How Does a Buyout Work.

Source: streetofwalls.com

Source: streetofwalls.com

An MBO transaction is a type of leveraged buyout LBO and can sometimes be referred to as a leveraged management buyout LMBO. One divorcing spouse will buy the home from the selling spouse using a refinanced loans. If your company is. Even if a company isnt publicly traded an investment firm may purchase a controlling interest in it. A leveraged buyout LBO is the acquisition of another company using a significant amount of borrowed money bonds or loans to meet the cost of acquisition.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If your company is. There are several ways through which employees can become the owners of their company but the ESOP is the main source of employee ownership in the US. The assets of the company being. Are lease buyouts worth it. This is how it works.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does a buyout work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.