Your How does a balloon loan work images are ready. How does a balloon loan work are a topic that is being searched for and liked by netizens today. You can Find and Download the How does a balloon loan work files here. Get all free photos and vectors.

If you’re looking for how does a balloon loan work images information connected with to the how does a balloon loan work topic, you have visit the ideal blog. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

How Does A Balloon Loan Work. A balloon loan allows you to finance a car with monthly payments that are usually lower than the payments youd make with a traditional auto loan. Can you pay off a balloon loan early. Most borrowers make this payment at the end of the loan term. Click to see full answer.

Balloon Loan Calculator Single Or Multiple Extra Payments From financial-calculators.com

Balloon Loan Calculator Single Or Multiple Extra Payments From financial-calculators.com

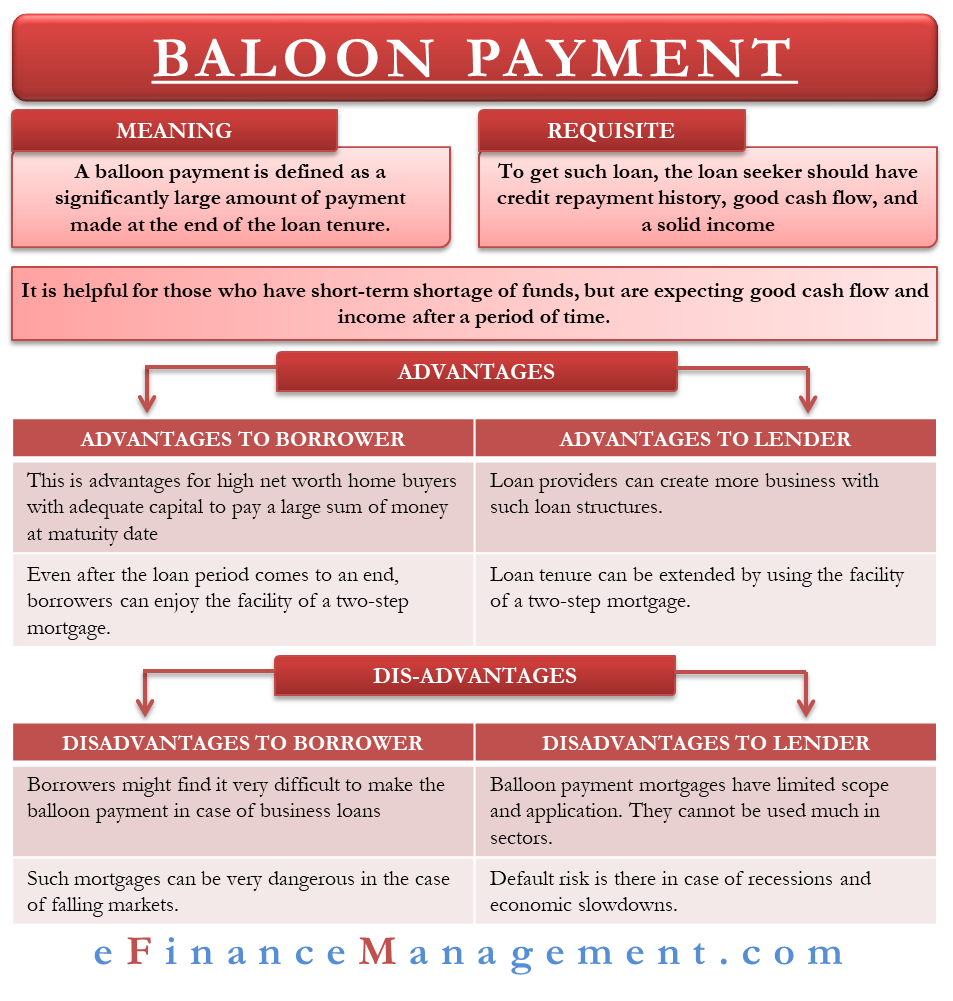

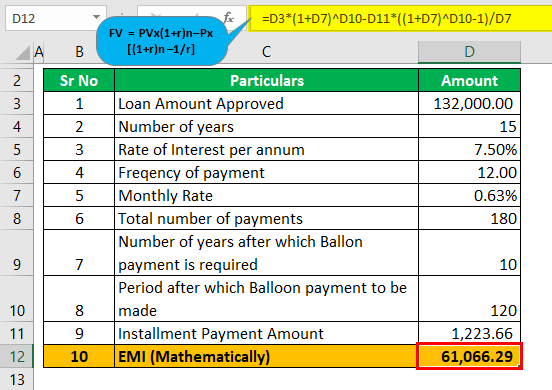

Based on a 30-year amortization or similar But differs in that the loan is due in full in just a fraction of the time. The borrower will make payments over a set period of time usually five or seven years at the end of which the entire remaining loan balance will be due at once. A balloon loan allows you to finance a car with monthly payments that are usually lower than the payments youd make with a traditional auto loan. A balloon payment is a payoff option on a loan that allows you to make a lump sum payment at the end of the loans term that is much larger than the preceding payments. Balloon payment loans are a complex financial product and should only be used by income-stable borrowers. For example this type of loan would be a good choice for the investor who wishes to minimise short term loan costs to free up capital.

How does a balloon car loan work.

A balloon loan is a type of loan that does not fully amortize over its term. How Do Balloon Mortgages Work. What Is a Balloon Mortgage. What type of loan requires a balloon payment. Most borrowers make this payment at the end of the loan term. How does a balloon car loan work.

Source: financial-calculators.com

Source: financial-calculators.com

This can in turn lower your earlier payments. The combined total of all monthly bills paid on a Balloon loan will not equal the total amount due on the loan by the end of the term a scenario called Negative Amortization. Can you pay off a balloon loan early. The loan agreement may include penalty payments if the balloon is paid off early. A balloon payment is a lump sum owed to the lender at the end of a loan term after all regular monthly repayments have been made.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

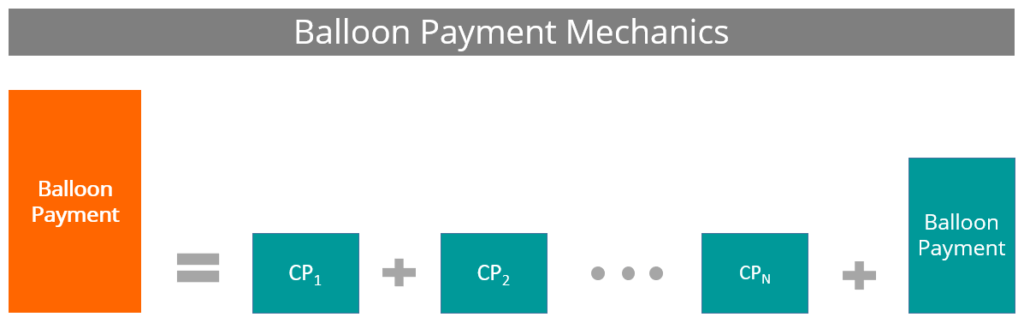

By making one large lump sum payment balloon loans allow borrowers to lower their monthly loan repayment costs in the initial stages of paying back a loan. Balloon payment can be used for everything from mortgage loans to auto loans though most commonly theyre used for business loans. Balloon loans usually have shorter terms than traditional installment loans with the large payment typically due after a few months or years. Or a lump-sum payment. Balloon loans work by letting people pay the majority of their loans along with interest at the end of the period.

Source: youtube.com

Source: youtube.com

Balloon payment can be used for everything from mortgage loans to auto loans though most commonly theyre used for business loans. Generally a balloon note will have fixed payments for a particular period followed by a balloon payment. However the payments are lower than those for a traditional loan. During your loan term you make standard monthly payments that include principal and interest. Since it is not fully amortized a balloon payment is required at.

Source: efinancemanagement.com

Source: efinancemanagement.com

Balloon loans are loans that only require borrowers to pay interest for the first few years. In that you make principal and interest payments each month. Some balloon mortgage lenders may allow you to only pay off accrued. A balloon mortgage refers to any mortgage that doesnt fully amortize over the loan term. In other words unlike with a traditional loan where youre paying partly interest and partly principal the money you borrowed every month with a balloon loan youd pay only the interest thats accrued on the loan.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

But an auto balloon loan also comes with risks. A balloon payment is a payoff option on a loan that allows you to make a lump sum payment at the end of the loans term that is much larger than the preceding payments. How does a balloon loan work. Or a lump-sum payment. How Balloon Loans Work A balloon loan is a loan that you pay off with a large single final payment.

Source: financeformulas.net

Source: financeformulas.net

Usually balloon loans are associated with mortgages. In the case of a balloon loan for a car the lender lays out a schedule of smaller monthly payments leading up to the balloon payment also called the lump sum payment. A balloon mortgage refers to any mortgage that doesnt fully amortize over the loan term. A balloon loan comes with a big one-time payment at the end of the term. The terms of your balloon loan may have you paying only the interest on the loan.

Source: financial-calculators.com

Source: financial-calculators.com

How does a balloon loan work. Paying the balloon off early eliminates the interest the lender would have earned if you kept making the payments. Some balloon mortgage lenders may allow you to only pay off accrued. But an auto balloon loan also comes with risks. A balloon mortgage is a type of mortgage that starts with little or no monthly payments at the beginning.

Source: vertex42.com

Source: vertex42.com

A balloon mortgage is a home loan that does not fully amortize over the life of the loan leaving a large balance at the end of the shortened term. Balloon loans work by letting people pay the majority of their loans along with interest at the end of the period. Since it is not fully amortized a balloon payment is required at. What Is a Balloon Mortgage. During your loan term you make standard monthly payments that include principal and interest.

Source: blog.udemy.com

Source: blog.udemy.com

These balloon mortgages have short terms between five and seven years. How Balloon Loans Work A balloon loan is a loan that you pay off with a large single final payment. You could end up taking on more debt. Balloon loans usually have shorter terms than traditional installment loans with the large payment typically due after a few months or years. These balloon mortgages have short terms between five and seven years.

Source: youtube.com

Source: youtube.com

However the payments are lower than those for a traditional loan. A balloon payment is a payoff option on a loan that allows you to make a lump sum payment at the end of the loans term that is much larger than the preceding payments. Usually balloon loans are associated with mortgages. Instead they are calculated as if the loan is a 30-year mortgage. Balloon payment loans are a complex financial product and should only be used by income-stable borrowers.

Source: thebalance.com

Source: thebalance.com

Most balloon mortgages have very short terms usually 5 10 years. However the borrower is expected to pay a lump sum of the loan amount during the course of the loan. The borrower will make payments over a set period of time usually five or seven years at the end of which the entire remaining loan balance will be due at once. The terms of your balloon loan may have you paying only the interest on the loan. During this time you make payments on the loan.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

It is different from a fully amortized loan where a loan is paid. Based on a 30-year amortization or similar But differs in that the loan is due in full in just a fraction of the time. But an auto balloon loan also comes with risks. Its like a standard home loan. Balloon payment structures are most commonly used for.

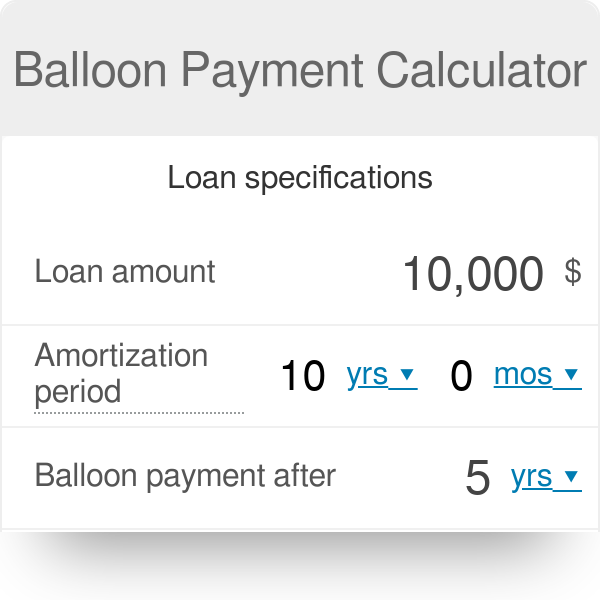

Source: omnicalculator.com

Source: omnicalculator.com

A balloon mortgage refers to any mortgage that doesnt fully amortize over the loan term. During this time you make payments on the loan. How Balloon Loans Work A balloon loan is a loan that you pay off with a large single final payment. Some balloon mortgage lenders may allow you to only pay off accrued. Can you pay off a balloon loan early.

Source: investopedia.com

Source: investopedia.com

How Balloon Loans Work A balloon loan is a loan that you pay off with a large single final payment. The Balloon mortgage is another type of loan program available to real estate buyers which has contract features that can be attractive to borrowers but also dangerous. A balloon loan comes with a big one-time payment at the end of the term. A balloon loan is a type of loan that does not fully amortize over its term. Instead they are calculated as if the loan is a 30-year mortgage.

Source: youtube.com

Source: youtube.com

How does a balloon car loan work. A balloon mortgage is written to cover a shorter period of time than a typical home loan. A balloon loan is a type of loan that does not fully amortize over its term. What type of loan requires a balloon payment. For businesses balloon payment loans can be used by companies who have immediate financing needs and predictable future.

Source: financial-calculators.com

Source: financial-calculators.com

It is different from a fully amortized loan where a loan is paid. How Do Balloon Mortgages Work. Based on a 30-year amortization or similar But differs in that the loan is due in full in just a fraction of the time. You could end up taking on more debt. For businesses balloon payment loans can be used by companies who have immediate financing needs and predictable future.

Source: financeformulas.net

Source: financeformulas.net

If you have any missed payments you can pay them all at once at the end of the forbearance period. Usually balloon loans are associated with mortgages. A balloon mortgage refers to any mortgage that doesnt fully amortize over the loan term. However at the end of the. A balloon payment is a payoff option on a loan that allows you to make a lump sum payment at the end of the loans term that is much larger than the preceding payments.

Source: savings.com.au

Source: savings.com.au

It is different from a fully amortized loan where a loan is paid. Monthly payments can be divided into two types. What Is a Balloon Mortgage. A balloon loan is a type of loan that does not fully amortize over its term. The specific terms of a balloon mortgage depend on the lender and the loan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does a balloon loan work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.