Your How does a 1099 work images are ready. How does a 1099 work are a topic that is being searched for and liked by netizens today. You can Get the How does a 1099 work files here. Get all royalty-free vectors.

If you’re searching for how does a 1099 work pictures information connected with to the how does a 1099 work keyword, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

How Does A 1099 Work. Therefore you might find double reporting of. The 1099 form is a record that someone another entity or person who is not your employer - sent or gave you money. The 1099 tax form is one of the many income reporting forms that you can get from the IRS. Contractors often work with various clients and they only get.

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Student Information From pinterest.com

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Student Information From pinterest.com

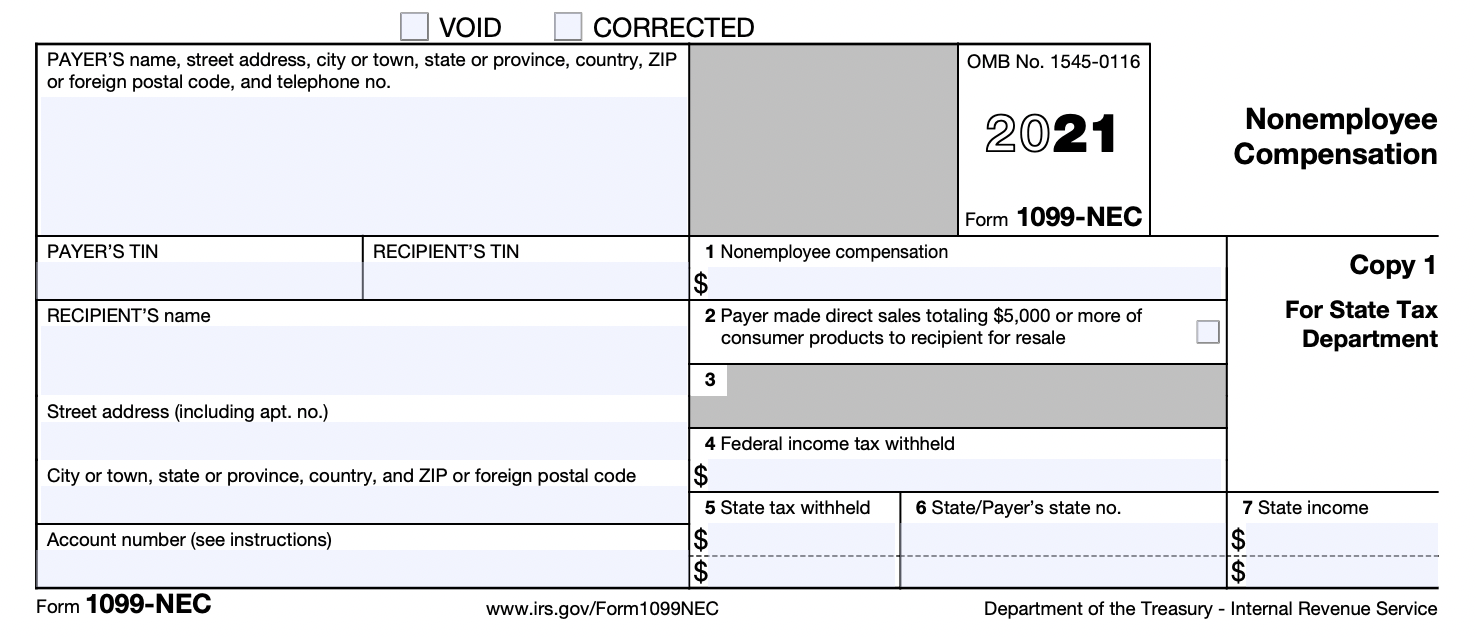

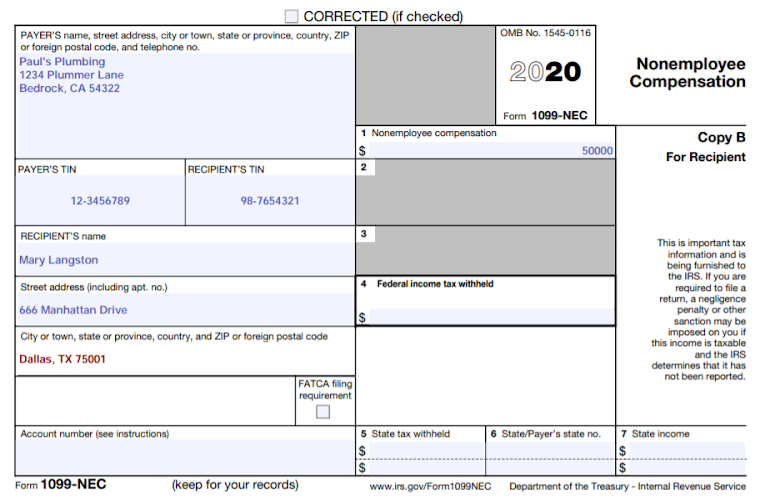

Files are processed faster and with fewer errors. You may simply perform services as a non-employee. Any worker who is eligible for 1099 is actually an Independent Contractor and never an employee. A 1099-NEC lists how much money an independent contractor earned so they can pay taxes on that income. So at the end of the year youll send them a 1099-NEC tax form. How Does a 1099 Work.

Independent contractors are 1099 employees.

Utilizing a spreadsheet file to complete multiple forms. A 1099 employee doesnt receive benefits or have taxes deducted from their paycheck. Any worker who is eligible for 1099 is actually an Independent Contractor and never an employee. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. You can enter data manually or upload a spreadsheet file to complete a form.

Source: help.justworks.com

Source: help.justworks.com

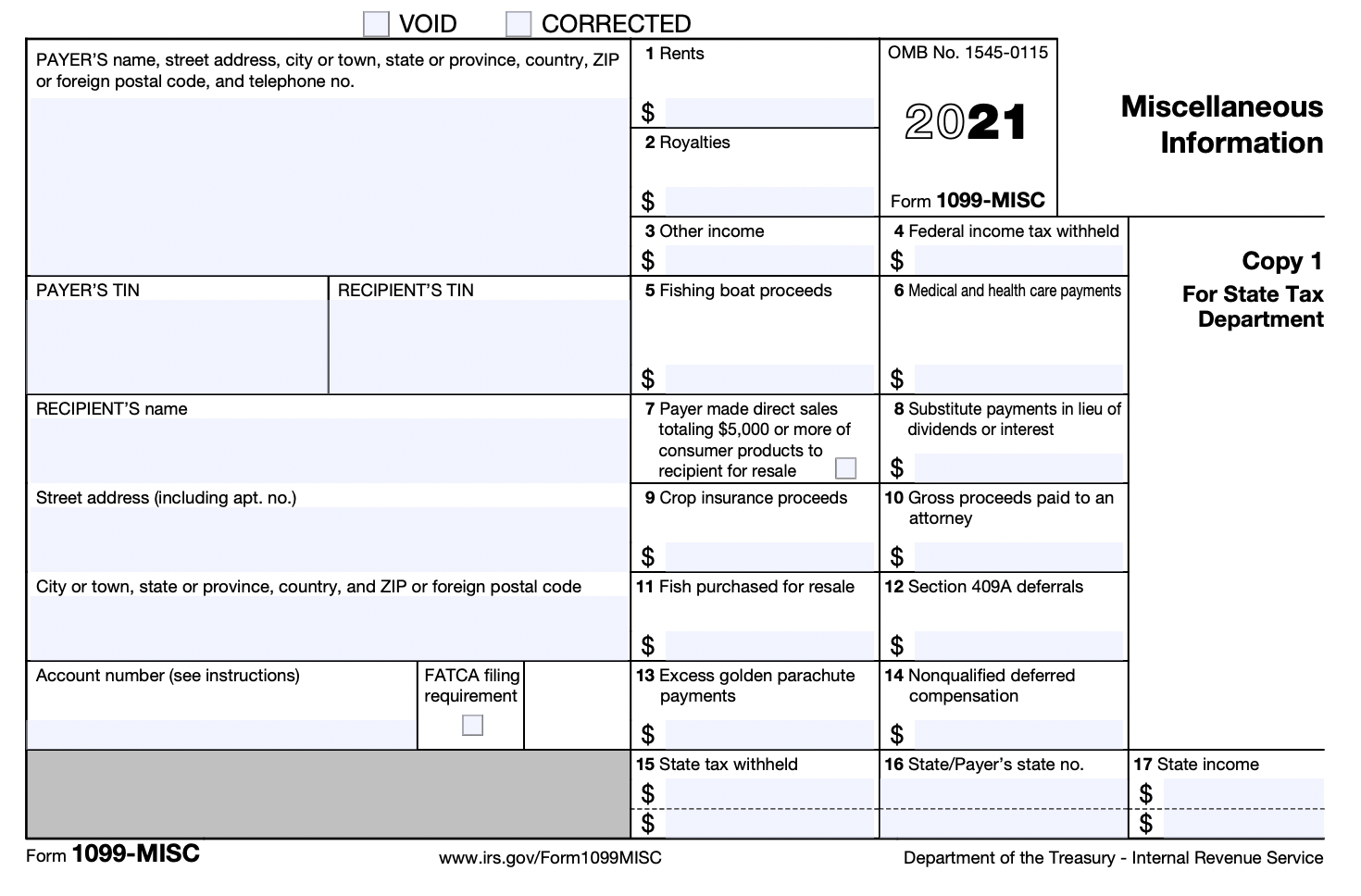

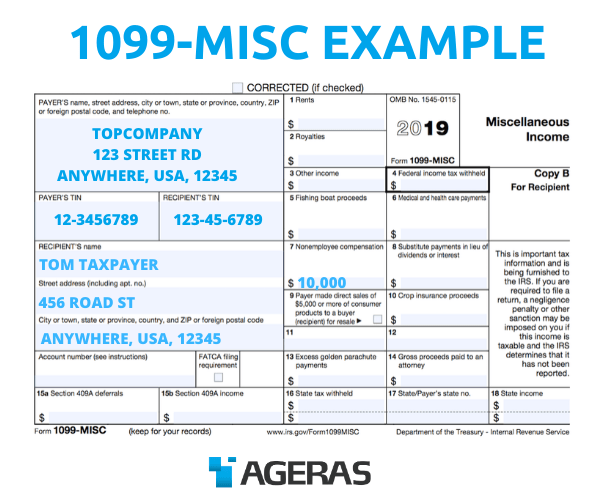

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. The Form 1099-MISC is the contractors version of the W-2 that employees receive every year to detail their wages earned and taxes paid. What is a 1099 Employee. How does a 1099-K work. This system can help employers file and report 1099 forms with several advantages.

Source: forbes.com

Source: forbes.com

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. With eFile360 you can file 1099 1098 W2 and Affordable Care Act forms in three steps. Choose your form type and enter or upload your form details. Form 1099-K is a form the IRS requires payment-settlement entities to use to report certain payments received through reportable payment card transactions andor settlement of third-party payment network transactions. The term 1099 refers to certain forms that an individual must complete in order to classify their work and current standing with the company as an independent contractor.

Source: fool.com

Source: fool.com

There are different types and sources of the 1099 form. The term 1099 refers to certain forms that an individual must complete in order to classify their work and current standing with the company as an independent contractor. What is a 1099 tax form. Its the contractors responsibility to report their income and pay their taxes. RTAA is a federal program that provides extra money to make up the.

Source:

Source:

So if you received any of these kinds of payments during the tax year you may receive Form 1099-K. You can enter data manually or upload a spreadsheet file to complete a form. Well save you some time googling it. Files are processed faster and with fewer errors. What is a 1099 Employee.

Source: help.justworks.com

Source: help.justworks.com

FIRE an acronym for Filing Information Returns Electronically is the fastest most accurate way to file any form with the IRS. Otherwise called an independent contractor. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. You can enter data manually or upload a spreadsheet file to complete a form. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes.

Source: pinterest.com

Source: pinterest.com

How does a 1099-K work. Instead of having a permanent worker that takes direction from the company your business would use an independent contractor who works under their own guidance. Going forward third-party payment companies will issue you a 1099-K tax form each year if you earn 600 or more annually in income for goods or services. FIRE an acronym for Filing Information Returns Electronically is the fastest most accurate way to file any form with the IRS. Choose your form type and enter or upload your form details.

Source: hrblock.com

Source: hrblock.com

The payer fills out the 1099 form and sends copies to you and the IRS. But youll typically lose out on employee benefits like compensated time off overtime and unemployment benefits not to mention the responsibility of filing your own taxes throughout or. The 1099-NEC shows nonemployee compensation without specifying the payment method. FIRE an acronym for Filing Information Returns Electronically is the fastest most accurate way to file any form with the IRS. A 1099-G lists unemployment compensation state or local income tax refunds reemployment trade adjustment assistance RTAA payments taxable grants and agricultural payments.

Source: pinterest.com

Source: pinterest.com

Although they are usually managing a small business that doesnt have to be the case. There are a few types of 1099 forms that each report different sources of income. What is a 1099 tax form. 9 Most of that seems pretty clear but what in the world is RTAA. What is a 1099 Employee.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

This form lets the IRS know that you need to report non-salary income on your taxes. This is in line with the contractors independent status and reflects his obligation to pay taxes on income himself. This tax form might include taxable and. Well save you some time googling it. The term 1099 refers to certain forms that an individual must complete in order to classify their work and current standing with the company as an independent contractor.

Source: pinterest.com

Source: pinterest.com

The term 1099 refers to certain forms that an individual must complete in order to classify their work and current standing with the company as an independent contractor. A 1099 worker typically offers particular services as delineated by a written agreement. But youll typically lose out on employee benefits like compensated time off overtime and unemployment benefits not to mention the responsibility of filing your own taxes throughout or. Reporting income from your Upwork 1099 Form 1099 is how the IRS tracks all your income that is classified as independent contractor earnings. A 1099 form is a record that an entity or person other than your employer gave or paid you money.

Source: pinterest.com

Source: pinterest.com

You may simply perform services as a non-employee. You can enter data manually or upload a spreadsheet file to complete a form. There are then several different versions of the form but the most popular is the 1099-MISC. It can come from the bank informing you about your savings interest or from your client reflecting the money they paid for your services. Sign up for a free eFile360 account.

Source: ro.pinterest.com

Source: ro.pinterest.com

When hiring a 1099 employee companies often negotiate a contract outlining the projects terms and payment for completing the assignment. You can enter data manually or upload a spreadsheet file to complete a form. Choose your form type and enter or upload your form details. Independent contractors are 1099 employees. 9 Most of that seems pretty clear but what in the world is RTAA.

Source: pinterest.com

Source: pinterest.com

Any worker who is eligible for 1099 is actually an Independent Contractor and never an employee. But youll typically lose out on employee benefits like compensated time off overtime and unemployment benefits not to mention the responsibility of filing your own taxes throughout or. A 1099 form enables the IRS to catch income from sources other than traditional employment wages. There are 20 variants of 1099s but the most popular is the 1099-NEC. With eFile360 you can file 1099 1098 W2 and Affordable Care Act forms in three steps.

Source: pinterest.com

Source: pinterest.com

A 1099 worker typically offers particular services as delineated by a written agreement. What is a 1099 tax form. But youll typically lose out on employee benefits like compensated time off overtime and unemployment benefits not to mention the responsibility of filing your own taxes throughout or. A 1099-G lists unemployment compensation state or local income tax refunds reemployment trade adjustment assistance RTAA payments taxable grants and agricultural payments. A 1099 form is a record that an entity or person other than your employer gave or paid you money.

Source: ageras.com

Source: ageras.com

1099 FIRE is the system the IRS uses for electronic filing. Independent contractors are 1099 employees. Choose your form type and enter or upload your form details. A 1099-G lists unemployment compensation state or local income tax refunds reemployment trade adjustment assistance RTAA payments taxable grants and agricultural payments. A 1099 form is a record that an entity or person other than your employer gave or paid you money.

Source: pinterest.com

Source: pinterest.com

This tax form might include taxable and. Independent contractors are 1099 employees. A 1099 is an information filing form used to report non-salary income to the IRS for federal tax purposes. You can enter data manually or upload a spreadsheet file to complete a form. What is a 1099 tax form.

Source: pinterest.com

Source: pinterest.com

But youll typically lose out on employee benefits like compensated time off overtime and unemployment benefits not to mention the responsibility of filing your own taxes throughout or. There are a few types of 1099 forms that each report different sources of income. Who Uses the 1099. Reporting income from your Upwork 1099 Form 1099 is how the IRS tracks all your income that is classified as independent contractor earnings. This form lets the IRS know that you need to report non-salary income on your taxes.

Source: pinterest.com

Source: pinterest.com

If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. The payer fills out the 1099 form and sends copies to you and the IRS. There are different types and sources of the 1099 form. Utilizing a spreadsheet file to complete multiple forms. The Form 1099-MISC is the contractors version of the W-2 that employees receive every year to detail their wages earned and taxes paid.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does a 1099 work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.