Your How do convertible notes work images are available. How do convertible notes work are a topic that is being searched for and liked by netizens today. You can Download the How do convertible notes work files here. Download all free images.

If you’re looking for how do convertible notes work pictures information linked to the how do convertible notes work keyword, you have visit the ideal blog. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

How Do Convertible Notes Work. They have however some common clauses that are key to determining the equity situation of. In other words investors loan money to a startup as its first round of funding. A valuation cap can act as an anchor on your Series A pre-money valuation. Were explaining what convertible notes are how they work and well define the terms you need to know.

Pin On Visual Madness From pinterest.com

Pin On Visual Madness From pinterest.com

Created specifically for startup funding they almost always mature at. At the time of the investment the funds are allocated as debt on the companys balance sheet. In other words investors loan money to a startup as its first round of funding. Think of it as a kind of startup IOU. Ultimately the note serves to defer and delay valuing the worth of the startup in the early. And then rather than get their money back with interest the investors receive shares of preferred stock as part of the startups initial preferred stock financing based on the terms of the note.

An investor will provide a startup company with a loan and repayment terms ie the note The convertible note will include a due date when the note matures and the balance is due along with any interest that the loan accrued during that time.

A convertible note is a short-term debt that converts into equity. When an issuer and investor sign a convertible note the investor loans a sum of money with an agreed-upon interest rate to the note issuer. Within venture capital financing a convertible note is a type of short-term debt financing thats used in early-stage capital raises. How would that change if there was an MBA on the team. And then rather than get their money back with interest the investors receive shares of preferred stock as part of the startups initial preferred stock financing based on the terms of the note. As the name suggests a convertible note is a type of short-term debt that converts to equity after a conversion event occurs usually when the startup raises a.

A Convertible Note has three components. How Do Convertible Notes Work. A convertible note is a short-term debt that converts into equity. Convertible notes often come with a discount rate that represents the discount on share price that. Convertible notes are often used for seed rounds the first investment money taken by a startup because they delay the difficult task of deciding how much the company is worth to a later point in time when it is easier to do so.

Source: zegal.com

Source: zegal.com

For example when a startup raises a certain amount in its next fundraising round or another milestone in its lifecycle. How Do Convertible Notes Work. Convertible notes often come with a discount rate that represents the discount on share price that. How does a convertible note work. The interest is not meant to be paid out monthly or quarterly like a.

Source: youtube.com

Source: youtube.com

Convertible notes will typically convert based on either the discount rate or valuation cap it depends on which of the two gives the investor the higher price. If your startup is negotiating your first convertible note try and avoid having a valuation cap. Its important to know when and why companies would issue convertible notes. A convertible note is primarily a short term debt instrument which can be converted into equity at a future date typically when a new financing round occurs. Though these notes earn interest most of the returns are earned by converting the debt into stock usually preferred.

Source: pinterest.com

Source: pinterest.com

A convertible note is primarily a short term debt instrument which can be converted into equity at a future date typically when a new financing round occurs. In other words investors loan money to a startup as its first round of funding. A convertible note is a form of short-term debt that converts into equity typically in conjunction with a future financing round. Equity Debt Convertible Notes Straight equity the investors receive shares directly in the company Investors receive a monthly payment and they are the first ones paid in case of bankruptcy Hybrid instrument in which debt is converted into Equity at a trigger event The Trigger Event The trigger event triggers the conversion of the debt. A convertible note is.

Source: carta.com

Source: carta.com

Its important to know when and why companies would issue convertible notes. The interest rate discount rate and cap rate. Find the formats youre looking for How Do Convertible Notes Work here. A financial instrument used for investments in early stage companies A short-term debt that converts into equity at a trigger eventA short-term debt that converts into equity at a trigger event Frequently used in bridge financing Suitable for. How would that change if there was an MBA on the team.

Source: investopedia.com

Source: investopedia.com

Ultimately the note serves to defer and delay valuing the worth of the startup in the early. What are convertible notes. At that point the company will have some operating history to determine a fair price and your loan converts into shares at a discounted price to reward you for the additional risk you took on by investing. A convertible note is a short-term debt that converts into equity. A valuation cap can act as an anchor on your Series A pre-money valuation.

Source: investopedia.com

Source: investopedia.com

For example when a startup raises a certain amount in its next fundraising round or another milestone in its lifecycle. A valuation cap can act as an anchor on your Series A pre-money valuation. They have however some common clauses that are key to determining the equity situation of. In the simplest of terms a convertible note is a debt thatat some predefined future time converts to equity. A Convertible Note has three components.

Source: investopedia.com

Source: investopedia.com

Ultimately the note serves to defer and delay valuing the worth of the startup in the early. Convertible notes are quite simple when understood. How much would you say that 2 software engineers and a prototype is worth. How Do Convertible Notes Work. Within venture capital financing a convertible note is a type of short-term debt financing thats used in early-stage capital raises.

Source: pinterest.com

Source: pinterest.com

Convertible notes are often used for seed rounds the first investment money taken by a startup because they delay the difficult task of deciding how much the company is worth to a later point in time when it is easier to do so. How Do Convertible Notes Work. An investor will provide a startup company with a loan and repayment terms ie the note The convertible note will include a due date when the note matures and the balance is due along with any interest that the loan accrued during that time. A convertible note is an investment structure that allows a company to take on funding in exchange for equity at a later date. How Do Convertible Notes Work.

Source: learn.angellist.com

Source: learn.angellist.com

A convertible note acts as a form of short term debt that converts into an investors equity after a conversion event occurs known as a conversion trigger. Convertible notes often convert to preferred stock which can give investors additional protections. How much would you say that 2 software engineers and a prototype is worth. If your startup is negotiating your first convertible note try and avoid having a valuation cap. Created specifically for startup funding they almost always mature at.

Source: pinterest.com

Source: pinterest.com

An investor will provide a startup company with a loan and repayment terms ie the note The convertible note will include a due date when the note matures and the balance is due along with any interest that the loan accrued during that time. A convertible note is. Convertible notes often convert to preferred stock which can give investors additional protections. The interest rate determines the annual interest that will accrue. The interest rate discount rate and cap rate.

Source: pinterest.com

Source: pinterest.com

Convertible notes allow investors to provide funds to a company and receive promissory notes which convert to equity based on the valuation at a future date. If your startup is negotiating your first convertible note try and avoid having a valuation cap. When an issuer and investor sign a convertible note the investor loans a sum of money with an agreed-upon interest rate to the note issuer. A convertible note is an investment structure that allows a company to take on funding in exchange for equity at a later date. A valuation cap can act as an anchor on your Series A pre-money valuation.

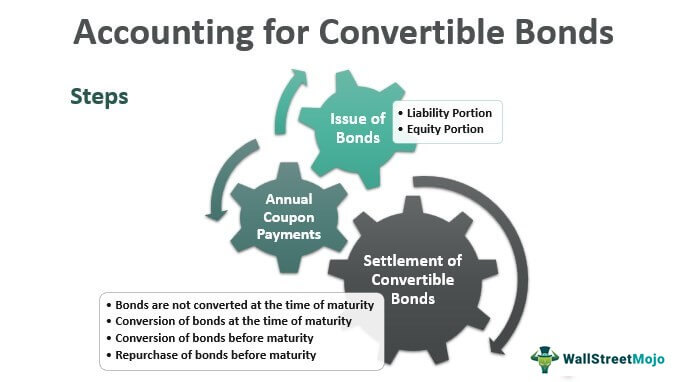

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The interest rate discount rate and cap rate. As the name suggests a convertible note is a type of short-term debt that converts to equity after a conversion event occurs usually when the startup raises a. Created specifically for startup funding they almost always mature at. Its important to know when and why companies would issue convertible notes. It allows small businesses or startup entrepreneurs to offer a kind of delayed equity to potential investors instead of offering them a direct share of the company immediately.

Source: youtube.com

Source: youtube.com

The usual situation is that the company may not be ready for a financing round yet but may be in need of additional operating capital. Equity Debt Convertible Notes Straight equity the investors receive shares directly in the company Investors receive a monthly payment and they are the first ones paid in case of bankruptcy Hybrid instrument in which debt is converted into Equity at a trigger event The Trigger Event The trigger event triggers the conversion of the debt. How does a convertible note work. If your startup is negotiating your first convertible note try and avoid having a valuation cap. A convertible note is primarily a short term debt instrument which can be converted into equity at a future date typically when a new financing round occurs.

Source: ar.pinterest.com

Source: ar.pinterest.com

Think of it as a kind of startup IOU. Convertible notes often come with a discount rate that represents the discount on share price that. In other words convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due. When you invest through a convertible note the startup receives the money right away but the number of shares you are entitled to is determined during its next round of financing. The interest is not meant to be paid out monthly or quarterly like a.

Source: fundersclub.com

Source: fundersclub.com

A Convertible Note has three components. Ultimately the note serves to defer and delay valuing the worth of the startup in the early. They have however some common clauses that are key to determining the equity situation of. When an issuer and investor sign a convertible note the investor loans a sum of money with an agreed-upon interest rate to the note issuer. A convertible note is a type of short-term debt financing.

Source: es.pinterest.com

Source: es.pinterest.com

How would that change if there was an MBA on the team. A SAFE Simple Agreement For Future Equity is the second main type of funding used by early stage startups to secure early venture capital. And then rather than get their money back with interest the investors receive shares of preferred stock as part of the startups initial preferred stock financing based on the terms of the note. For example when a startup raises a certain amount in its next fundraising round or another milestone in its lifecycle. In effect the investor would be loaning money to a startup and instead of a return in the form of principal plus interest the investor would receive equity in the company.

Source: pinterest.com

Source: pinterest.com

Convertible notes are quite simple when understood. Convertible notes allow investors to provide funds to a company and receive promissory notes which convert to equity based on the valuation at a future date. And then rather than get their money back with interest the investors receive shares of preferred stock as part of the startups initial preferred stock financing based on the terms of the note. A financial instrument used for investments in early stage companies A short-term debt that converts into equity at a trigger eventA short-term debt that converts into equity at a trigger event Frequently used in bridge financing Suitable for. In effect the investor would be loaning money to a startup and instead of a return in the form of principal plus interest the investor would receive equity in the company.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how do convertible notes work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.