Your How do accumulation funds work images are available in this site. How do accumulation funds work are a topic that is being searched for and liked by netizens now. You can Get the How do accumulation funds work files here. Get all free photos.

If you’re looking for how do accumulation funds work pictures information related to the how do accumulation funds work topic, you have come to the ideal site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

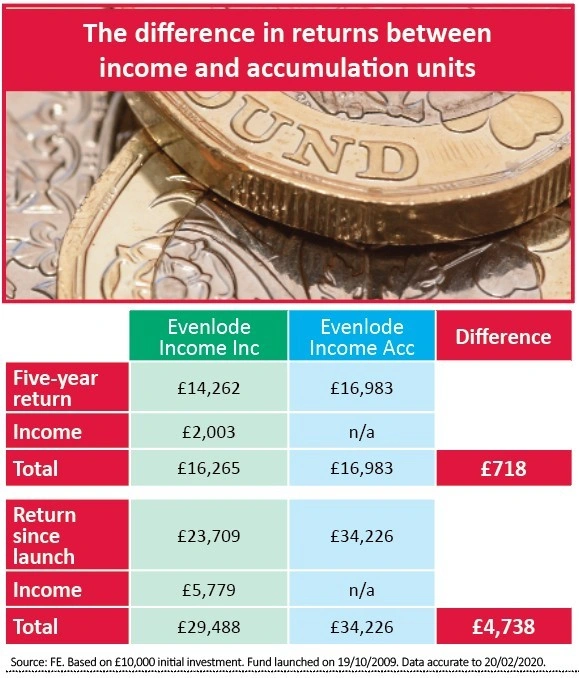

How Do Accumulation Funds Work. How do accumulation funds work. The magic of capitalization. Each fund receives income throughout the year on its underlying holdings be it dividends from shares coupons from bonds or rent from property. This can vary from monthly to quarterly to yearly - depends on the fund.

Halte Es Einfach Diese Beiden Etfs Reichen Fur Deinen Sparplan Fur Geldanlage Vermogensaufbau Und Altersvorsorge Keep Finanzen Sparplan Geldsparplan From pinterest.com

Halte Es Einfach Diese Beiden Etfs Reichen Fur Deinen Sparplan Fur Geldanlage Vermogensaufbau Und Altersvorsorge Keep Finanzen Sparplan Geldsparplan From pinterest.com

Leveraged ETFs which generally contain options or futures are the ETFs where you can lose a lot of money in a hurry and with no particular prospect for recovery. The magic of capitalization. A small number of platformsproviders may charge for reinvestment - most dont. Some funds offer both income and accumulation units some mainly income funds strangely enough offer only income units whilst others mainly growth funds where there is little income offer accumulation units only. Jan 21 2018 3 Does anyone. For example Fundsmith Equity does not whereas Vanguard FTSE all share does.

Accumulating ETFs are the best choice as they automatically reinvest your income back into the fund at no extra expense.

The ongoing policy charges are paid for by cashing-in units. Jan 21 2018 1 0. When policyholders withdraw money from the fund they sell their units back to the company. In summary accumulation funds reinvest all income generated by the funds assets while income funds pay out the income to investors on a regular basis. The magic of capitalization. For example Fundsmith Equity does not whereas Vanguard FTSE all share does.

Source: ii.co.uk

Source: ii.co.uk

May 18 2014. Not all funds operate an equalisation regime. Can you lose all your money in ETF. Your profits are automatically reinvested to buy more shares in the fund. Are designed to generate growth rather than income.

Source: pinterest.com

Source: pinterest.com

An accumulation fund does not pay out any proceeds coupons dividends capital gains from the purchase and sale of the funds securities because the management company automatically reinvests them in the fund itself in technical jargon it is said that the proceeds are capitalized. Some of our policies have two types of units Accumulation Typically accumulation units are purchased for regular contributions from year two or three onward and for all one-off lump sum payments. For example Fundsmith Equity does not whereas Vanguard FTSE all share does. Do you pay tax on accumulation funds. Working three jobs 247 gifts from every member of your extended family inheritance from your second cousins uncle.

Source: superguy.com.au

Source: superguy.com.au

Investors buy shares in a fund Their money is pooled together The fund uses its pooled capital to invest in specific assets Investors are rewarded based on the funds overall performance What is the difference between the investment and accumulation funds. How do accumulation funds work. Can you lose all your money in ETF. Accumulation funds automatically reinvestdividends for you. When policyholders withdraw money from the fund they sell their units back to the company.

Source: sharesmagazine.co.uk

Source: sharesmagazine.co.uk

An accumulation fund does not pay out any proceeds coupons dividends capital gains from the purchase and sale of the funds securities because the management company automatically reinvests them in the fund itself in technical jargon it is said that the proceeds are capitalized. Accumulation units still generate an income and are taxed accordingly but the income is not paid out but retained in the fund and the unit price increased pro-rata. Just write an explanation HOW you got the money you declare. The fund price bumps up as the dividends are ingested but it often seems like an inconsequential burp when prices are in the red. The magic of capitalization.

Source: pinterest.com

Source: pinterest.com

Even when there is no crisis or market crash you could lose half or all of your money in a week. Contrast that with the feedback you get from distributing funds which pay out dividend cash straight into your brokerage account. If you had one Inc unit worth 1 paying a 2 dividend after the dividend was paid youd still. Can you lose all your money in ETF. An ETF is just a big box of securities.

Source: money.co.uk

Source: money.co.uk

Units at the outset. The ETFs net valueNAV increases when the underlying companies distribute dividends to. Jan 21 2018 1 0. Accumulation funds dont payout an income to you. If you are unsure whether these are suitable for you please speak to a financial adviser.

Source: businesseducation.ie

Source: businesseducation.ie

The ongoing policy charges are paid for by cashing-in units. Dividends affect the ETFs net value. Units at the outset. They all work on the same broad principles. The income you would have received is automatically reinvested into the.

Source: pinterest.com

Source: pinterest.com

You either purchase income or accum. Accumulation funds dont payout an income to you. Working three jobs 247 gifts from every member of your extended family inheritance from your second cousins uncle. Jan 21 2018 1 0. If you invest in the accumulation shares your part of this income will be automatically reinvested and this will be reflected in the value of your holding.

Source: nl.pinterest.com

Source: nl.pinterest.com

Past performance is not a reliable indicator of future returns. They all work on the same broad principles. Your stake in the fund grows as should your profits if the fund performs well. Net assets in nonprofit. What are net assets in a non-profit.

Source: pinterest.com

Source: pinterest.com

The decision whether to buy income or accumulation units will depend on your goals. An ETF is just a big box of securities. What are net assets in a non-profit. Some of our policies have two types of units Accumulation Typically accumulation units are purchased for regular contributions from year two or three onward and for all one-off lump sum payments. In summary accumulation funds reinvest all income generated by the funds assets while income funds pay out the income to investors on a regular basis.

Source: investopedia.com

Source: investopedia.com

Just write an explanation HOW you got the money you declare. Even when there is no crisis or market crash you could lose half or all of your money in a week. Past performance is not a reliable indicator of future returns. Accumulation units are not added on to your holding. In summary accumulation funds reinvest all income generated by the funds assets while income funds pay out the income to investors on a regular basis.

Source: vanguardinvestor.co.uk

Source: vanguardinvestor.co.uk

So if you buy an ETFshare just before its ex. For an accumulation fund your taxable dividend in this first year is decreased by this amount but the cost basis is unaffected. If you are unsure whether these are suitable for you please speak to a financial adviser. What are net assets in a non-profit. Jan 21 2018 3 Does anyone.

Source: investopedia.com

Source: investopedia.com

If you invest in the accumulation shares your part of this income will be automatically reinvested and this will be reflected in the value of your holding. If you had one Inc unit worth 1 paying a 2 dividend after the dividend was paid youd still. Its important to make the right decision as income is a vital part of any investment strategy whether you need it now or can save it for later. This compounds your returns saves you time and spares you dealing fees. If you are unsure whether these are suitable for you please speak to a financial adviser.

Source: pinterest.com

Source: pinterest.com

How an Accumulation Unit Works An accumulation unit can refer to one of two things. A mutual fund investor is usually given the choice between receiving income distributions in cash from the fund or reinvesting the income. This could provide the investor with an income stream or the cash could be reinvested to buy additional units. Contrast that with the feedback you get from distributing funds which pay out dividend cash straight into your brokerage account. The income you would have received is automatically reinvested into the.

Source: pinterest.com

Source: pinterest.com

Accumulation of Funds. Some funds offer both income and accumulation units some mainly income funds strangely enough offer only income units whilst others mainly growth funds where there is little income offer accumulation units only. Jan 21 2018 1 0. Working three jobs 247 gifts from every member of your extended family inheritance from your second cousins uncle. Even when there is no crisis or market crash you could lose half or all of your money in a week.

Source: investopedia.com

Source: investopedia.com

For example Fundsmith Equity does not whereas Vanguard FTSE all share does. Some of our policies have two types of units Accumulation Typically accumulation units are purchased for regular contributions from year two or three onward and for all one-off lump sum payments. Do you need the income now or do you want to wait giving. When policyholders withdraw money from the fund they sell their units back to the company. Can you lose all your money in ETF.

Source: pinterest.com

Source: pinterest.com

This could provide the investor with an income stream or the cash could be reinvested to buy additional units. The basic explanation is that mutual funds receive dividends from the companies in which they invest. Even when there is no crisis or market crash you could lose half or all of your money in a week. An ETF is just a big box of securities. The decision whether to buy income or accumulation units will depend on your goals.

Source:

Source:

Are designed to generate growth rather than income. The ongoing policy charges are paid for by cashing-in units. The dividend is accumulated into the Acc units price. They all work on the same broad principles. How an Accumulation Unit Works An accumulation unit can refer to one of two things.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how do accumulation funds work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.