Your Capital gains tax computation working sheet images are available in this site. Capital gains tax computation working sheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Capital gains tax computation working sheet files here. Download all royalty-free images.

If you’re looking for capital gains tax computation working sheet pictures information related to the capital gains tax computation working sheet topic, you have come to the right blog. Our website always gives you hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

Capital Gains Tax Computation Working Sheet. Fill in all the boxes on the form that apply to you. If you use a capital gains computation worksheet to work out the gain or loss on the disposal of an asset the worksheet will be attached automatically to your return. How much these gains are taxed depends a lot on how long you held the asset before selling. This means you pay tax on only half the net capital gain on that asset.

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money From marottaonmoney.com

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money From marottaonmoney.com

2020 Tax Computation WorksheetLine 16. Keep for Your Records. A Any kind of property held by an assessee whether or not connected with business or profession of the assesse. Debts and Capital Gains Tax Self Assessment helpsheet HS296 6 April. That allows you to offset your gains with your losses and reduce your total taxable amount. There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more.

A Any kind of property held by an assessee whether or not connected with business or profession of the assesse.

Take Full value of consideration sale price Subtract the following from above. Very simple Fill yellow cells given in the excel sheet below one by one and check the results. Debts and Capital Gains Tax Self Assessment helpsheet HS296 6 April. 2020 Tax Computation WorksheetLine 16. You show the type of CGT asset or CGT event that resulted in the capital gain or capital loss and if a capital gain was made you calculate it using the indexation method. And 2 you have not sold or exchanged another home during the two years.

Source: cours-gratuit.com

Source: cours-gratuit.com

Calculation of tax on long-term capital gains is a slightly trickier business. _____ Revenue District Office No. CGT can be extremely complex but it can also be extremely simple. Take Full value of consideration sale price Subtract the following from above. Calculation of tax on short-term capital gains is simpler than that on long-term gains.

Source: educba.com

Source: educba.com

From HMRC Online Tax Return Help. When it comes time to calculate your capital gains tax liability youll add together all of the numbers in the gainloss column of your worksheet. Capital Gains and Losses and Built-in Gains 2021 12092021 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2021 01072022 Form 2438. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. _____ Revenue District Office No.

Source: bitcourier.co.uk

Source: bitcourier.co.uk

I was inherited a property purchased by My father I am only son which he brought for Rs20000- in the year 1970 Now I wanted to sell this property the market value of the property is around Rs18500000- please let me know the exact amount of capital gain. Less any discount you are entitled to on your gains. Zonal Value ZV Revenue Region No. How to Calculate Capital Gains. Work out the gain for each asset or your share of an asset if its jointly owned.

Source: unovest.co

Source: unovest.co

That allows you to offset your gains with your losses and reduce your total taxable amount. CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSETS TAXABLE AND EXEMPT Tax Form. You must send us your computations valuations specified claim forms and any working sheets with the Capital Gains summary pages of your tax return. Keep for Your Records. Do not cross through any boxes or write see.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

How to Calculate Capital Gains. Do not cross through any boxes or write see. GST Plus Track everything in GST. CCI Jobs FindPost your vacancy. Calculation of tax on long-term capital gains is a slightly trickier business.

Source: teachoo.com

Source: teachoo.com

I was inherited a property purchased by My father I am only son which he brought for Rs20000- in the year 1970 Now I wanted to sell this property the market value of the property is around Rs18500000- please let me know the exact amount of capital gain. A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. If you use a capital gains computation worksheet to work out the gain or loss on the disposal of an asset the worksheet will be attached automatically to your return. Debts and Capital Gains Tax Self Assessment helpsheet HS296 6 April. You show the type of CGT asset or CGT event that resulted in the capital gain or capital loss and if a capital gain was made you calculate it using the indexation method.

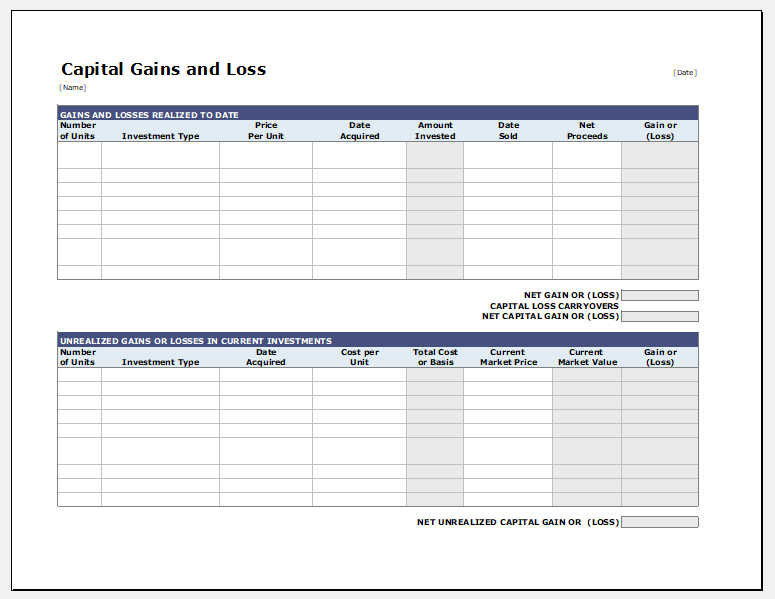

Source: xltemplates.org

Source: xltemplates.org

A Any kind of property held by an assessee whether or not connected with business or profession of the assesse. CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSETS TAXABLE AND EXEMPT Tax Form. Qualified Dividends and Capital Gain Tax WorksheetLine 11a. I was inherited a property purchased by My father I am only son which he brought for Rs20000- in the year 1970 Now I wanted to sell this property the market value of the property is around Rs18500000- please let me know the exact amount of capital gain. How to Calculate Capital Gains.

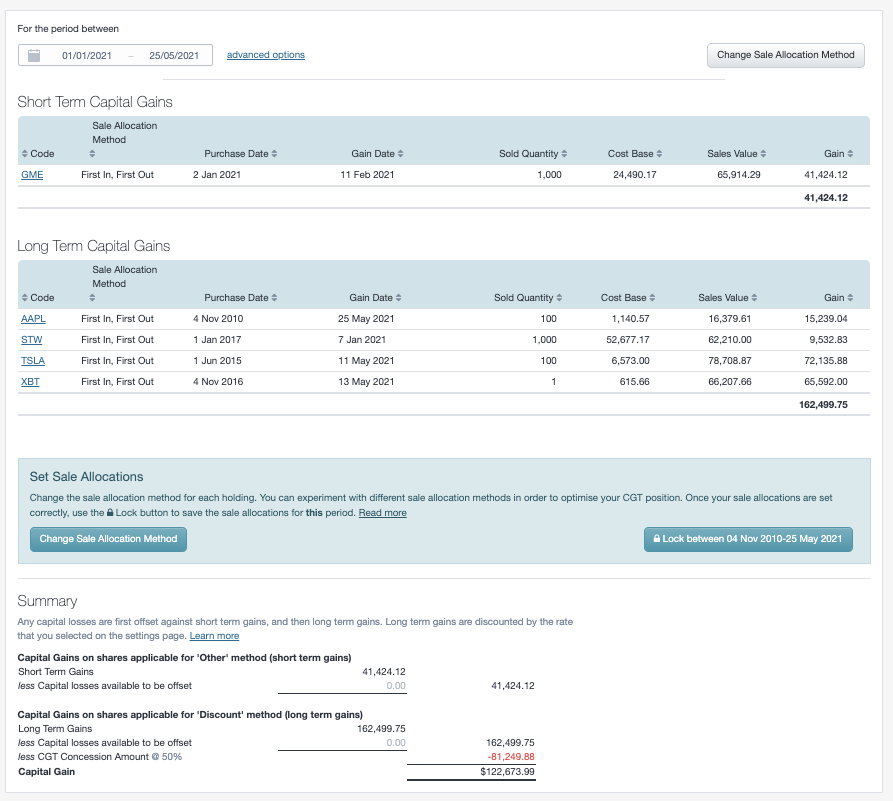

Source: sharesight.com

Source: sharesight.com

Capital Gains and Losses and Built-in Gains 2021 12092021 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2021 01072022 Form 2438. Zonal Value ZV Revenue Region No. Undistributed Capital Gains Tax Return 1220 11302020 Form 2439. How to Calculate Capital Gains. However to get to the right answer.

Source: eloquens.com

Source: eloquens.com

We have prepared a online Capital gain tax calculator which will not only helps you in calculating the Capital gain tax but also suggests you how you can save the capital gain by using the exemption as per section 5454B54EC and 54F. B Any securities held by a FII which has invested in such securities in accordance with the regulations made under the SEBI Act 1992. ONETT COMPUTATION SHEET CAPITAL GAINS TAX CGT and DOCUMENTARY STAMP TAX DST Tax Base ZVFMVSP whichever is higher Selling Price SP FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSET BOTH TAXABLE AND EXEMPT DUE DATE DST. CCI Online Learning Learn CA CS CMA. Very simple Fill yellow cells given in the excel sheet below one by one and check the results.

Source: marottaonmoney.com

Source: marottaonmoney.com

Calculation of tax on short-term capital gains is simpler than that on long-term gains. You must fill in the SA108 Capital Gains Summary pages and attach your computations if in the tax year. 2020 Tax Computation WorksheetLine 16. Before completing this worksheet complete Form 1040 through line 10. Undistributed Capital Gains Tax Return 1220 11302020 Form 2439.

Source: teachoo.com

Source: teachoo.com

Capital Gains Tax relief on gifts and similar transactions Self Assessment helpsheet HS295 6 April 2021. You show the type of CGT asset or CGT event that resulted in the capital gain or capital loss and if a capital gain was made you calculate it using the indexation method. ONETT COMPUTATION SHEET CAPITAL GAINS TAX CGT and DOCUMENTARY STAMP TAX DST Tax Base ZVFMVSP whichever is higher Selling Price SP FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSET BOTH TAXABLE AND EXEMPT DUE DATE DST. For the latest information on this subject. If you dont have to file Schedule D and you received capital gain distributions be sure you checked the box on line 13 of.

Source: investopedia.com

Source: investopedia.com

However to get to the right answer. CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSETS TAXABLE AND EXEMPT Tax Form. Work out the gain for each asset or your share of an asset if its jointly owned. If you do not use a worksheet you will be able to attach your own computation or include it in additional information at. Capital Gains Tax relief on gifts and similar transactions Self Assessment helpsheet HS295 6 April 2021.

Source: michaelkummer.com

Source: michaelkummer.com

CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSETS TAXABLE AND EXEMPT Tax Form. How to Calculate Capital Gains. Calculation of tax on long-term capital gains is a slightly trickier business. Qualified Dividends and Capital Gain Tax WorksheetLine 11a. Youll need a separate computation or working sheet for simple calculations for each asset or type of asset you sold or disposed of.

Source: novelinvestor.com

Source: novelinvestor.com

And 2 you have not sold or exchanged another home during the two years. 26th Jul 2015 1218. Completing the tax calculation working sheet The working sheet is made up of 12 main sections but you will not have to complete every box in every section. Take Full value of consideration sale price Subtract the following from above. See the instructions for line 16 to see if you must use the worksheet below to figure your tax.

Source: taxguru.in

Source: taxguru.in

However to get to the right answer. CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF REAL PROPERTY CLASSIFIED AS CAPITAL ASSETS TAXABLE AND EXEMPT Tax Form. We have prepared a online Capital gain tax calculator which will not only helps you in calculating the Capital gain tax but also suggests you how you can save the capital gain by using the exemption as per section 5454B54EC and 54F. Capital Gains Tax relief on gifts and similar transactions Self Assessment helpsheet HS295 6 April 2021. B Any securities held by a FII which has invested in such securities in accordance with the regulations made under the SEBI Act 1992.

Source: investopedia.com

Source: investopedia.com

Calculation of tax on short-term capital gains is simpler than that on long-term gains. Capital Gains and Losses and Built-in Gains 2021 12092021 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2021 01072022 Form 2438. CGT can be extremely complex but it can also be extremely simple. Keep for Your Records. Calculation of tax is dependent upon the type of capital gain.

Source: pinterest.com

Source: pinterest.com

You disposed of chargeable assets which were worth more than 49200 or Losses are deducted from your chargeable gains and your chargeable gains before losses and taper relief are more than 12300 or. CGT can be extremely complex but it can also be extremely simple. Charged to tax under the head Capital Gains. This means you pay tax on only half the net capital gain on that asset. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form.

Source: financialcontrol.in

Source: financialcontrol.in

CGT can be extremely complex but it can also be extremely simple. Your total capital gains. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. You pay tax on your net capital gains. You must send us your computations valuations specified claim forms and any working sheets with the Capital Gains summary pages of your tax return.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital gains tax computation working sheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.