Your Aasb work in progress images are available. Aasb work in progress are a topic that is being searched for and liked by netizens today. You can Download the Aasb work in progress files here. Get all royalty-free photos.

If you’re searching for aasb work in progress images information connected with to the aasb work in progress topic, you have come to the right blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Aasb Work In Progress. Hi there sorry for the late response. In respect of land under roads the notes to the financial statements must disclose in addition to the disclosures applicable to the entire land class. For non-specialised assets measured at fair value or an amount that approximates fair value impairment would only arise in rare circumstances such as. Service concession arrangements by public sector grantors.

Inventories also encompass finished goods produced or work in progress being produced by the entity and include materials and supplies awaiting use in the production process. Open for comment work-in-progress documents are proposal documents of various types for which the open-for-comment period either has not yet closed or has recently closed. Selling prices of finished goods less the sum. AASB 111 Construction Contracts under section 334 of the Corporations Act 2001 on 15 July 2004. For non-specialised assets measured at fair value or an amount that approximates fair value impairment would only arise in rare circumstances such as. To all other non-specialised assets including work-in-progress and assets held for generating cash flows in the rare circumstances cash-generating assets are held by not-for-profit agencies under AASB 116 and AASB 138.

One of the topics listed.

The cost of constructing these assets was initially recognised as part of the work in progress assets in Sydney Metros financial statements. Cleaning minor repairs and grounds maintenance is expenditure that should be expensed. That includes billable work performed up to and including the balance sheet date that has not been invoiced plus an element of the expected profit on the. Construction Work in Progress represents the cost of work performed in the construction or development of a non-current asset. Plant and equipment and work in progress must be carried at cost. Without using this method each reported profit would be heavily dependent on the timing of invoicing both the issuing of invoices to clients and the receipt of invoices from suppliers and contractors.

Source: slidetodoc.com

Source: slidetodoc.com

Plant and equipment and work in progress must be carried at cost. HttpwwwaasbgovauWork-In-ProgressOpen-for-commentaspxid1886 Australian Accounting Standards Board Exposure Draft - ED 265 Updating References to the Conceptual Framework Proposed amendments to AASB 2 AASB 3 AASB 4 AASB 6 AASB 101 AASB 108 AASB 134 Interpretation 127 and Interpretation 132 - June 2015 - Open for comment. The cost of constructing these assets was initially recognised as part of the work in progress assets in Sydney Metros financial statements. The loss of control over the. Inventories also encompass finished goods produced or work in progress being produced by the entity and include materials and supplies awaiting use in the production process.

Source: bdo.com.au

Source: bdo.com.au

The treatment of costs capitalised as work-in-progress WIP under previous standards will depend on how revenue is recognised under the new revenue standard. That includes billable work performed up to and including the balance sheet date that has not been invoiced plus an element of the expected profit on the. AASB 2021-7 Amendments to Australian Accounting Standards Effective Date of Amendments to AASB 10 and AASB 128 and Editorial Corrections. Recognition of Construction Work in Progress Construction or development costs are to be recognised as Construction Work in Progress where they meet the asset recognition and capitalisation criteria. The treatment of costs capitalised as work-in-progress WIP under previous standards will depend on how revenue is recognised under the new revenue standard.

Source: slidetodoc.com

Source: slidetodoc.com

The treatment of costs capitalised as work-in-progress WIP under previous standards will depend on how revenue is recognised under the new revenue standard. Work in progress accounting is a technical accounting method used to represent a fairtrue profit position in each respective reporting period. A reasonable profit allowance for the completing and selling effort based on profit for similar finished goods. This includes service concession work in progress WIP2 AASB í ì ñ õB ñ states Zfor property plant and equipment and intangible. Within each group the documents are presented in issue date order.

Source: pinterest.com

Source: pinterest.com

Proposed Agenda Decisions Exposure Drafts Draft Interpretations Invitations to Comment and Discussion Papers. Proposed Agenda Decisions Exposure Drafts Draft Interpretations Invitations to Comment and Discussion Papers. At a point-in-time costs will be capitalised probably as inventory until control transfers. For non-specialised assets measured at fair value or an amount that approximates fair value impairment would only arise in rare circumstances such as. Costs of disposal and.

Source: pinterest.com

Source: pinterest.com

AASB and standard setting. AASB 111 Construction Contracts under section 334 of the Corporations Act 2001 on 15 July 2004. Under paragraph 12 of AASB 116 the day-to-day servicing of an asset eg. Service concession arrangements by public sector grantors. The documents retain the open for comment status until.

Source: slidetodoc.com

Source: slidetodoc.com

AASB and standard setting. The documents may be Proposed Agenda Decisions Exposure Drafts Draft Interpretations Invitations to Comment or Discussion Papers. Under AASB 1059 service concession assets are initially measured at current replacement cost CRC1. Plant and equipment and work in progress must be carried at cost. The cost of constructing these assets was initially recognised as part of the work in progress assets in Sydney Metros financial statements.

The following decision tree outlines the three criteria to be. AASB 2021-7 Amendments to Australian Accounting Standards Effective Date of Amendments to AASB 10 and AASB 128 and Editorial Corrections. Without using this method each reported profit would be heavily dependent on the timing of invoicing both the issuing of invoices to clients and the receipt of invoices from suppliers and contractors. Under paragraph 12 of AASB 116 the day-to-day servicing of an asset eg. Costs of disposal and.

Source: bdo.com.au

Source: bdo.com.au

93 rows Archived Work In Progress Documents. Work in progress accounting is a technical accounting method used to represent a fairtrue profit position in each respective reporting period. Proposed Agenda Decisions Exposure Drafts Draft Interpretations Invitations to Comment and Discussion Papers. Selling prices of finished goods less the sum. That includes billable work performed up to and including the balance sheet date that has not been invoiced plus an element of the expected profit on the.

Source: slidetodoc.com

Source: slidetodoc.com

The treatment of costs capitalised as work-in-progress WIP under previous standards will depend on how revenue is recognised under the new revenue standard. Without using this method each reported profit would be heavily dependent on the timing of invoicing both the issuing of invoices to clients and the receipt of invoices from suppliers and contractors. Recognition of Construction Work in Progress Construction or development costs are to be recognised as Construction Work in Progress where they meet the asset recognition and capitalisation criteria. Under paragraph 12 of AASB 116 the day-to-day servicing of an asset eg. It all depends on the point of delivery.

Source: bdo.com.au

Source: bdo.com.au

Recognition of Construction Work in Progress Construction or development costs are to be recognised as Construction Work in Progress where they meet the asset recognition and capitalisation criteria. This includes service concession work in progress WIP2 AASB í ì ñ õB ñ states Zfor property plant and equipment and intangible. Service concession arrangements by public sector grantors. The calculation of work in progress is the outcome of a construction contract that can be estimated reliably with contract revenue and contract costs to be recognised by applying the stage of completion method. AASB 2021-7 Amendments to Australian Accounting Standards Effective Date of Amendments to AASB 10 and AASB 128 and Editorial Corrections.

Pending work-in-progress documents are proposal documents of various types that are no longer open for comment. A reasonable profit allowance for the completing and selling effort based on profit for similar finished goods. Work in progress accounting is a technical accounting method used to represent a fairtrue profit position in each respective reporting period. The documents may be Proposed Agenda Decisions Exposure Drafts Draft Interpretations Invitations to Comment or Discussion Papers. Construction Work in Progress represents the cost of work performed in the construction or development of a non-current asset.

Source: expertassignmenthelp.com

Source: expertassignmenthelp.com

Plant and equipment and work in progress must be carried at cost. Where revenue is recognised. AASB 2021-7 again defers to 1 January 2025 the amendments to AASB 10 and AASB 128 relating to the sale or contribution of assets between an investor and its associate or joint venture. Hi there sorry for the late response. Under paragraph 12 of AASB 116 the day-to-day servicing of an asset eg.

Construction Work in Progress represents the cost of work performed in the construction or development of a non-current asset. Construction Work in Progress represents the cost of work performed in the construction or development of a non-current asset. Costs incurred to fulfil a contract with a customer that do not give rise to inventories or assets within the scope of another Standard are accounted for in accordance with AASB 15 Revenue from Contracts. Pending work-in-progress documents are proposal documents of various types that are no longer open for comment. If a performance obligation is deemed to be satisfied over time under AASB 15 then an entity is able to use the percentage of completion method to measure its progress in recognising revenue.

Source: slideplayer.com

Source: slideplayer.com

For example work in progress that is controlled by the customer as work progresses The vendors performance creates an asset which does not have an alternative use to the vendor and the vendor has an enforceable right to be paid for work completed to date. Management reviewed its capital works in progress at 30 June 2020 and identified 100 million of capital works constructed on behalf of third parties over which control was transferred in 201819. The following decision tree outlines the three criteria to be. A reasonable profit allowance for the completing and selling effort based on profit for similar finished goods. Construction Work in Progress represents the cost of work performed in the construction or development of a non-current asset.

Costs of disposal and. For non-specialised assets measured at fair value or an amount that approximates fair value impairment would only arise in rare circumstances such as. The calculation of work in progress is the outcome of a construction contract that can be estimated reliably with contract revenue and contract costs to be recognised by applying the stage of completion method. A reasonable profit allowance for the completing and selling effort based on profit for similar finished goods. Open for comment work-in-progress documents are proposal documents of various types for which the open-for-comment period either has not yet closed or has recently closed.

Source: pinterest.com

Source: pinterest.com

AASB 2021-7 Amendments to Australian Accounting Standards Effective Date of Amendments to AASB 10 and AASB 128 and Editorial Corrections. Within each group the documents are presented in issue date order. The AASB as part of its work program offers comment on documents such as proposed agenda decisions exposure drafts draft exposure drafts invitations to comment and discussion papers. The cost of constructing these assets was initially recognised as part of the work in progress assets in Sydney Metros financial statements. D1 Contracts in progress.

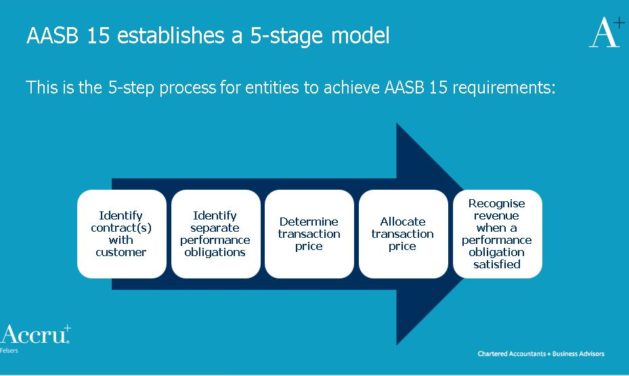

Source: accru.com

Source: accru.com

Under AASB 1059 service concession assets are initially measured at current replacement cost CRC1. If the partial delivery occurs you can put the expense as capital work in progress. Within each group the documents are presented in issue date order. For example work in progress that is controlled by the customer as work progresses The vendors performance creates an asset which does not have an alternative use to the vendor and the vendor has an enforceable right to be paid for work completed to date. Costs of disposal and.

The documents retain the open for comment status until. Inventories also encompass finished goods produced or work in progress being produced by the entity and include materials and supplies awaiting use in the production process. The treatment of costs capitalised as work-in-progress WIP under previous standards will depend on how revenue is recognised under the new revenue standard. It all depends on the point of delivery. AASB 2021-7 Amendments to Australian Accounting Standards Effective Date of Amendments to AASB 10 and AASB 128 and Editorial Corrections.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aasb work in progress by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.